Barclays, #Brent, #DAX Our previous review of Barclays (link here) had a pretty miserable expectation, should the share price break below our drop target. Unfortunately, this has now happened and there’s the slimmest of margins inhibiting it opening the gates of gloom. The problem number is currently 148.82p.

Absolutely nothing to do with Barclays. Google News algorithms can be odd!

In the event Barclays closes a session below 148.823p, we’re looking for traffic down to an initial 136p. To be blunt, if it even trades below 147p, it shall be viewed as entering this reversal cycle. Our secondary, if 136p breaks, calculates at 114p. It’s rather worrying to note, we’ve two quite distinct arguments suggesting Barclays share price intends take a visit down to the 114p level eventually. About the only encouraging signal left is fairly simple. The share has NOT yet closed below the RED uptrend since 2009, hence our fascination with 148.823p. However, the share price has broken below this trend during the last two sessions, so we’d be far from confident the trend line shall hold.

There’s obviously the risk of the somewhat confused series of political results from the EU election entering the fray, if any of the mainstream politicians actually can decide what they stand for. At present, Barclays requires exceed 165p to convince us it has exited the drop zone to 136p eventually. Visually, there’s quite a strong suggestion the price will head to 136p, execute some sort of short lived bounce, then eventually wander downward to 114p.

It needs exceed 166p to signal our misery is misplaced, allowing recovery to an initial 174p. If bettered, secondary is at 191p.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:10:58PM |

BRENT |

68.85 |

67.27 |

66.57 |

65.76 |

68.7 |

69.05 |

69.335 |

70.38 |

67.4 | |

|

10:12:57PM |

GOLD |

1285.53 | |||||||||

|

10:29:38PM |

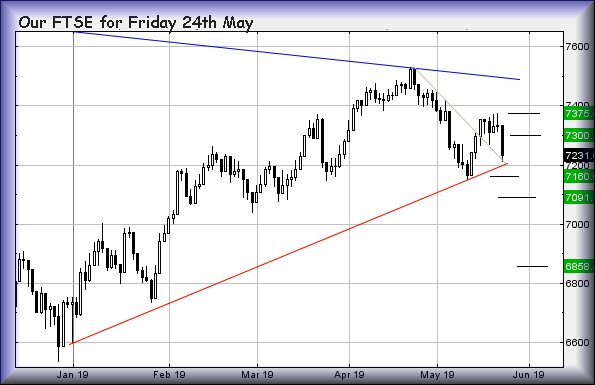

FTSE |

7287.92 | |||||||||

|

10:31:37PM |

FRANCE |

5338 | |||||||||

|

10:38:08PM |

GERMANY |

12067.52 |

12014 |

11974.5 |

11925 |

12088 |

12123 |

12162.5 |

12242 |

12024 | |

|

10:40:32PM |

US500 |

2830.47 | |||||||||

|

10:46:12PM |

DOW |

25648 | |||||||||

|

10:51:32PM |

NASDAQ |

7311.49 | |||||||||

|

10:53:37PM |

JAPAN |

21212 |