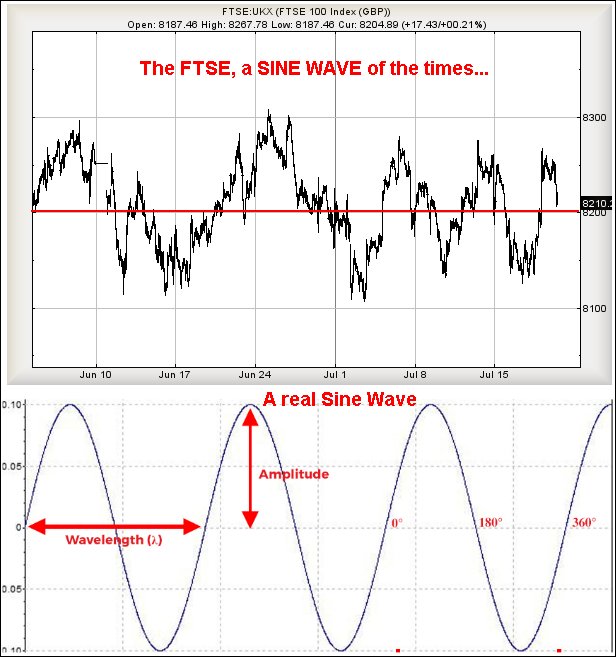

#FTSE #Broccoli A lot can happen in a week. Unless it’s to do with the FTSE as, last week, we discussed the ridiculous Sine Wave which the market has been describing since June of this year. The FTSE managed to ignore last weekend Grand Prix being interesting yet again, and the USA finding itself with a President who claims he will be unfit to run the country for the next 4 years, yet can work reliably until the November election. Of course, there was the unmissable grilling of the head of the US Secret Service by an angry senate (watch the Forbes channel on YouTube) which made anything dished out by our UK politicians to a corrupt Post Office management sound akin to a 6 year old telling off a 5 year old. Needless to say, the head of the US SS eventually resigned.

Until Thursday, the FTSE doddled along like a Just Stop Oil protestor (used) to do. If these people would start a campaign to ‘Just Stop Broccoli and Asparagus’, the nation might get behind them. But everything may have changed on Thursday as the FTSE broken the sin of the Sine cycle. Unfortunately it was with movement within the opening 90 minutes of trade, so we really distrust the drop as it all felt very manufactured and artificial, just like Lando Norris’ team mate victory last weekend in Hungary.

Essentially, we suspect the plunge at the open on Thursday shall prove to be a “fake”, a movement designed to commit traders to short positions as there was no doubt the market had broken trend. However, by Thursday afternoon, the market change direction, climbing remorselessly from 8057 points to close the day at 8185 points, a very unusual 128 point gain.

Should this positive flow of energy continue, we shall not be surprised if movement above the Green 8200 point median of the imaginary Sine Wave triggers recovery. We can calculate an initial 8224 points with our secondary, if bettered working out at 8280 points. If triggered, the tightest stop is fairly wide at 8120 points though we suspect 8150 shall probably suffice.

As always, there’s a fly in the ointment and it comes from how Futures are currently trading. Despite the FTSE closing the session at 8185 points, Futures are sprinkling pixy dust everywhere, running at 8222 at time of writing. In the very likely event the market is spiked upward to our initial target level of 8224, we would expect some relaxation toward the 8200 level within the first hour before a surprise climb sets in. Or so we hope. Of course, beware if the FTSE is actually “gapped” up to our target level at the open as this will make reversal less likely.

So many numbers, so little time…

As usual, we can present a converse scenario and it kicks in, should the index make it below 8150 points. Movement such as this risks promoting reversal to an initial 8121 with our secondary, if broken, at 8084 points.

Have a good weekend. Hopefully the Belgian Grand Prix supplies its usual quota of trouble on track! And that will be it for a month as they all go to Butlins.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 11:24:58PM | BRENT | 8137.8 | 8039 | 7902 | 8158 | 8156 | 8185 | 8103 | |||

| 11:27:24PM | GOLD | 2364.05 | 2353 | 2328 | 2383 | 2383 | 2395 | 2365 | Success | ||

| 11:30:09PM | FTSE | 8203.7 | 8056 | 8019 | 8119 | 8222 | 8233 | 8196 | Success | ||

| 11:34:37PM | STOX50 | 4811.8 | 4801 | 4766 | 4835 | 4843 | 4867 | 4817 | Success | ||

| 11:37:30PM | GERMANY | 18294 | 18095 | 18006 | 18180 | 18372 | 18458 | 18280 | Success | ||

| 11:39:43PM | US500 | 5410.8 | 5391 | 5352 | 5435 | 5454 | 5476 | 5422 | ‘cess | ||

| 12:28:08AM | DOW | 40025.5 | 39811 | 39534 | 39994 | 40355 | 40417 | 40054 | Success | ||

| 12:31:44AM | NASDAQ | 18865 | 18725 | 18530 | 18893 | 19084 | 19196 | 18949 | Shambles | ||

| 12:34:14AM | JAPAN | 37793 | 37342 | 36964 | 37647 | 38144 | 38310 | 37854 |

25/07/2024 FTSE Closed at 8186 points. Change of 0.4%. Total value traded through LSE was: £ 5,356,362,048 a change of 4.45%

24/07/2024 FTSE Closed at 8153 points. Change of -0.17%. Total value traded through LSE was: £ 5,128,130,189 a change of -2.6%

23/07/2024 FTSE Closed at 8167 points. Change of -0.38%. Total value traded through LSE was: £ 5,265,250,514 a change of 15.55%

22/07/2024 FTSE Closed at 8198 points. Change of 0.53%. Total value traded through LSE was: £ 4,556,598,316 a change of 4.43%

19/07/2024 FTSE Closed at 8155 points. Change of -0.6%. Total value traded through LSE was: £ 4,363,233,367 a change of 1.99%

18/07/2024 FTSE Closed at 8204 points. Change of 0.21%. Total value traded through LSE was: £ 4,278,080,573 a change of -5.62%

17/07/2024 FTSE Closed at 8187 points. Change of 0.28%. Total value traded through LSE was: £ 4,532,847,996 a change of 7.45%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CAR Carclo** **LSE:IDS International Distribution** **LSE:IGG IG Group** **LSE:JET Just Eat** **LSE:LLOY Lloyds Grp.** **LSE:SCLP Scancell** **

********

Updated charts published on : Carclo, International Distribution, IG Group, Just Eat, Lloyds Grp., Scancell,

LSE:CAR Carclo. Close Mid-Price: 32.6 Percentage Change: + 10.88% Day High: 33.6 Day Low: 31

Target met. Further movement against Carclo ABOVE 33.6 should improve acc ……..

</p

View Previous Carclo & Big Picture ***

LSE:IDS International Distribution Close Mid-Price: 343.8 Percentage Change: -0.06% Day High: 344.4 Day Low: 341

Further movement against International Distribution ABOVE 344.4 should im ……..

</p

View Previous International Distribution & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 901.5 Percentage Change: + 6.69% Day High: 897 Day Low: 823.5

Target met. All IG Group needs are mid-price trades ABOVE 897 to improve ……..

</p

View Previous IG Group & Big Picture ***

LSE:JET Just Eat Close Mid-Price: 913 Percentage Change: -0.22% Day High: 919 Day Low: 890

Target met. In the event Just Eat experiences weakness below 890 it calcu ……..

</p

View Previous Just Eat & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 60.64 Percentage Change: + 1.64% Day High: 60.8 Day Low: 57

Target met. In the event of Lloyds Grp. enjoying further trades beyond 61 ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:SCLP Scancell. Close Mid-Price: 14.5 Percentage Change: + 0.00% Day High: 14.85 Day Low: 13.75

Target met. In the event of Scancell enjoying further trades beyond 15p, ……..

</p

View Previous Scancell & Big Picture ***