#Gold #SP500 As we live through the final days of a failed political career, it’s easy to imagine the abrupt downward surge on the FTSE was a direct result of the UK’s “Strong and Stable (aka, Weak and Shoogly)” governance. We’re fairly confident drops experienced on Thursday had nothing to do with the Prime Minister.

It all goes back to a market movement, worldwide, on Wednesday. Sharp eyed readers viewing our evening UK Futures noted we used the word “Shambles” to describe the previous days results. Our preference, obviously, is to use “Success” or ” ‘cess”, denoting whether one or two targets were achieved. We only employ “Shambles” when market behaviour makes absolutely no sense. Only once the day was over and tempers calmed did we start to suspect what had happened.

At 13:26 on Wednesday, a whole bunch of indices both in Europe and the USA dropped, for a couple of seconds, below levels we’d designed as key trigger levels to open SHORT positions. Once these short positions triggered, the indices immediately reversed direction, spending the following 90 minutes climbing above logical Stop Loss levels for each and every one of the SHORT positions.

Thus, the trades would be cancelled and traders left out of pocket. A co-ordinated effort, internationally, reminded us sharply why we avoid comment on Forex unless from a Big Picture perspective. This sort of market behaviour, in our opinion, is rather lacking in ethics. The following private note was included on Wednesday evening for our clients;

“With shares, I tend regard this as a clear warning signal for a coming drop with the market opting to trigger a bunch of trades with attractive stop loss levels. This essentially clears out the folk who were poised to take advantage of coming reversals.”

Markets dropped sharply on Thursday, as feared. But behaviour on Wednesday was clearly designed to wipe out SHORT positions, prior to the drop!

Our tantrum over, what’s next?

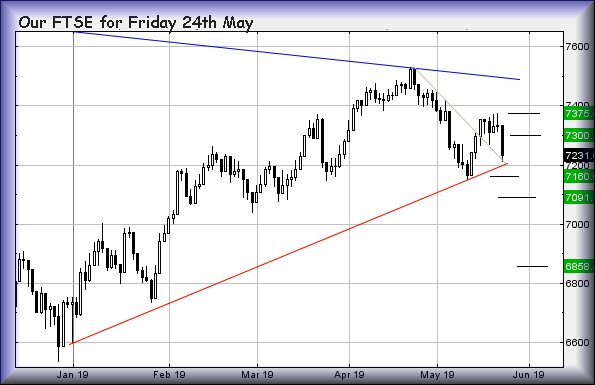

The FTSE actually dropped further than we’d like. It closed Thursday at 7230 points and now lurks with the threat of weakness below 7210 bringing travel down to 7160 points next. Our secondary, should 7156 break, calculates at 7091 points.

If triggered, the tightest stop level looks like 7270 points. But given market behaviour as listed previously, we’d prefer wider still at 7301 points.

We’ve an obvious disparity between a drop target 7160 and trigger level of 7156. This is fairly simple, due to the FTSE being manipulated (gapped) downward by 14 points at the open on Thursday morning. Essentially, this nonsense confuses our software.

What happens if the FTSE exceeds 7270 points? Initially we’re looking for 7300 points. Our secondary, if such a point exceeded, calculates at 7375 points. If triggered, the tightest stop is at 7210 points.

Perhaps it is also worth mentioning the index (somehow) remains above the 2019 Red uptrend on the chart below. We’re far from comfortable this state of affairs shall continue.

On a brighter note, it’s the Monaco GP this weekend, possibly the most boring race on the F1 calendar yet one which makes compulsive viewing in the hope something happens. Have a good weekend.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:25:51PM |

BRENT |

67.02 |

Success | ||||||||

|

10:28:00PM |

GOLD |

1284 |

1272.82 |

1270.5 |

1265 |

1279 |

1287.25 |

1291 |

1298 |

1279 |

Success |

|

10:31:18PM |

FTSE |

7233.72 |

Success | ||||||||

|

10:33:56PM |

FRANCE |

5284.7 |

Success | ||||||||

|

10:37:14PM |

GERMANY |

11948 |

‘cess | ||||||||

|

10:39:15PM |

US500 |

2821.12 |

2810 |

2800.5 |

2770 |

2835 |

2845 |

2850.5 |

2866 |

2822 |

Success |

|

10:43:26PM |

DOW |

25485.8 |

Success | ||||||||

|

10:45:47PM |

NASDAQ |

7308.12 |

Success | ||||||||

|

10:48:17PM |

JAPAN |

20874 |

Success |