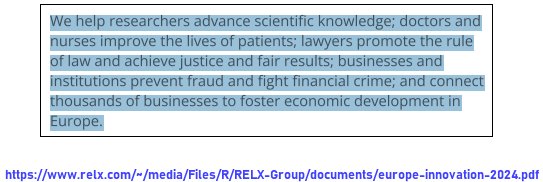

#FTSE #GOLD We’re at a peculiar time of year we like, from a chart perspective. One of the more comfortable ways of viewing price movements is in minute-by-minute mode with such precise data generally available for almost 3 months. Don’t get us wrong, the most important indicator is almost always the Closing Price for a session but it’s handy to zoom in and view the minutiae of the last 80 days of price twitches, sometimes an intraday wobble giving a clear idea the market may have a cunning plan. Just not one it intends enact on that particular day. Thursday provided one such example of collywobbles, the FTSE managing to wander up to 10,277 before data from the USA was used to create what we suspect was an artificial fall. The elegance with which the minute-by-minute chart cuddled the immediate Red uptrend for the final 30 minutes of the UK market made us wonder.

Logically, below 10,154 expected a drizzle down to a tame 10,145 points, a potential short lived bounce, then further traffic down to a hopeful bottom at 10,102 points. In terms of points collected, it’s not the most spectacular of scenario but a stop can be emplaced around 10,173 points.

Unfortunately. the FTSE also has a solid argument favouring upward pressure, thanks to the shambolic Covid-19 drop back in March 2000. Allegedly, the Covid drop damage has not yet been undone, the FTSE needing exceed 10,394 points before recovery becomes official and the UK market can be seen to be following actual growth, rather than recovery from “actual manipulation” as we still regard the Covid drop to be entirely false. But Wall Street undid the Covid damage in 2024 when it exceeded 40k points. The period since has seen the US index grow by over 20%. The Nasdaq undid the Covid damage during 2020, reaching 12k points and is now more than double the level. Similarly, the S&P unwound itself from Covid by the end of 2021, exceeding 4,500 points and now flirts with the 7k level.

What this means is we shall not be inclined to regard the FTSE reaching 10,394 as potentially hitting a reversal point. Quite the opposite, thanks to the behaviour of other international indices.

At this point in time, we shall regard movement above 10,228 as potentially triggering gains to an initial 10,323 points with our secondary, if beaten, at a longer term 10,419 points. This secondary ambition, by exceeding our “Covid Undone” target level, shall suggest the FTSE intends to finally join respectable markets.

Maybe next week, on 5th February, the BoE shall do something ethical again with UK interest rates, justifying the FTSE making another upward surge.

Have a good weekend, hopefully drier and warmer than it looks like here in Argyll.

FUTURES

FUTURES

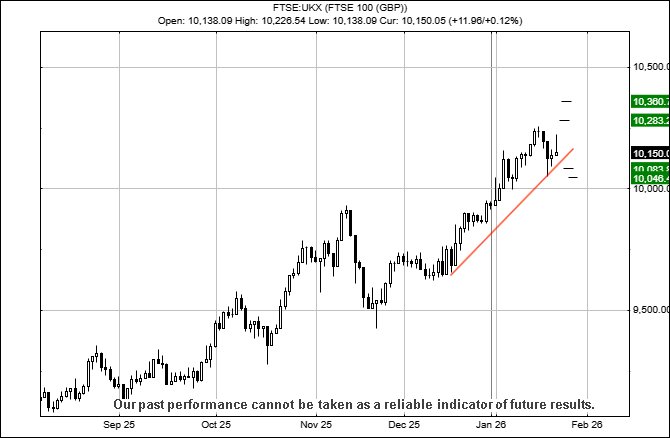

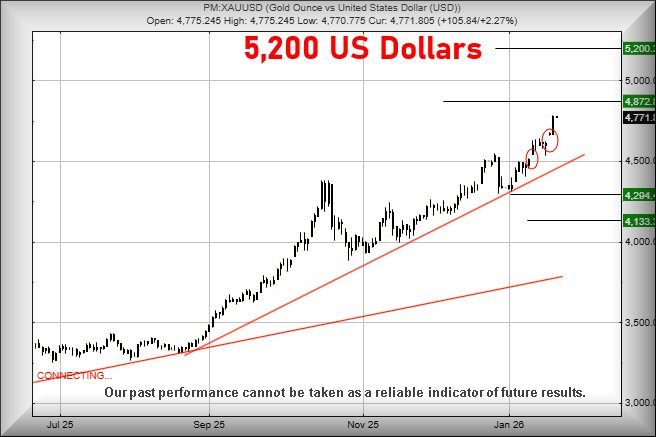

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:41:24PM | BRENT | 6952.1 | 6769 | 6691 | 6881 | 7058 | 7149 | 6659 | Success | ||

| 10:44:48PM | GOLD | 5376.96 | 5164 | 5087 | 5315 | 5600 | 5754 | 5473 | Success | ||

| 10:58:57PM | FTSE | 10207.3 | 10154 | 10103 | 10204 | 10259 | 10289 | 10222 | ‘cess | ||

| 11:12:53PM | STOX50 | 5933.8 | 5878 | 5826 | 5935 | 5972 | 6010 | 5940 | ‘cess | ||

| 11:16:19PM | GERMANY | 24440.5 | 24260 | 24215 | 24474 | 24640 | 24798 | 24505 | Success | ||

| 11:19:17PM | US500 | 6947.6 | 6871 | 6840 | 6942 | 6975 | 7011 | 6933 | Success | ||

| 11:24:55PM | DOW | 48921.5 | 48592 | 48511 | 48908 | 49140 | 49317 | 48990 | ‘cess | ||

| 11:28:34PM | NASDAQ | 25841.7 | 25631 | 25502 | 25774 | 26107 | 26381 | 25958 | Success | ||

| 11:33:57PM | JAPAN | 53231 | 53000 | 52694 | 53196 | 53558 | 54027 | 53218 | Success |

29/01/2026 FTSE Closed at 10171 points. Change of 0.17%. Total value traded through LSE was: £ 7,910,853,503 a change of 7.47%

28/01/2026 FTSE Closed at 10154 points. Change of -0.52%. Total value traded through LSE was: £ 7,361,268,388 a change of 11.9%

27/01/2026 FTSE Closed at 10207 points. Change of 0.58%. Total value traded through LSE was: £ 6,578,616,321 a change of 11.32%

26/01/2026 FTSE Closed at 10148 points. Change of 0.05%. Total value traded through LSE was: £ 5,909,471,540 a change of -3.4%

23/01/2026 FTSE Closed at 10143 points. Change of -0.07%. Total value traded through LSE was: £ 6,117,563,035 a change of -17.66%

22/01/2026 FTSE Closed at 10150 points. Change of 0.12%. Total value traded through LSE was: £ 7,429,608,745 a change of -10.7%

21/01/2026 FTSE Closed at 10138 points. Change of 0.12%. Total value traded through LSE was: £ 8,319,716,543 a change of -14.69%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AAL Anglo American** **LSE:BME B & M** **LSE:CNA Centrica** **LSE:ECO ECO (Atlantic) O & G** **LSE:EXPN Experian** **LSE:GLEN Glencore Xstra** **LSE:HSBA HSBC** **LSE:IGG IG Group** **LSE:LLOY Lloyds Grp.** **LSE:NG. National Glib** **LSE:QED Quadrise** **LSE:SAGA SAGA Plc** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:STAR Star Energy** **LSE:VOD Vodafone** **

********

Updated charts published on : Anglo American, B & M, Centrica, ECO (Atlantic) O & G, Experian, Glencore Xstra, HSBC, IG Group, Lloyds Grp., National Glib, Quadrise, SAGA Plc, Scottish Mortgage Investment Trust, Star Energy, Vodafone,

LSE:AAL Anglo American. Close Mid-Price: 3500 Percentage Change: + 0.69% Day High: 3662 Day Low: 3473

Target met. Further movement against Anglo American ABOVE 3662 should imp ……..

</p

View Previous Anglo American & Big Picture ***

LSE:BME B & M. Close Mid-Price: 177.9 Percentage Change: + 1.02% Day High: 179.1 Day Low: 174.4

In the event of B & M enjoying further trades beyond 179.1, the share sho ……..

</p

View Previous B & M & Big Picture ***

LSE:CNA Centrica Close Mid-Price: 189.5 Percentage Change: -0.76% Day High: 191.85 Day Low: 189.1

Further movement against Centrica ABOVE 191.85 should improve acceleratio ……..

</p

View Previous Centrica & Big Picture ***

LSE:ECO ECO (Atlantic) O & G. Close Mid-Price: 37 Percentage Change: + 14.20% Day High: 37.5 Day Low: 32

Target met. All ECO (Atlantic) O & G needs are mid-price trades ABOVE 37. ……..

</p

View Previous ECO (Atlantic) O & G & Big Picture ***

LSE:EXPN Experian Close Mid-Price: 2695 Percentage Change: -0.88% Day High: 2734 Day Low: 2663

In the event Experian experiences weakness below 2663 it calculates with ……..

</p

View Previous Experian & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 507.9 Percentage Change: + 0.42% Day High: 533.7 Day Low: 504.5

Target met. Continued trades against GLEN with a mid-price ABOVE 533.7 sh ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 1270 Percentage Change: + 0.91% Day High: 1286.2 Day Low: 1262.6

In the event of HSBC enjoying further trades beyond 1286.2, the share sho ……..

</p

View Previous HSBC & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 1349 Percentage Change: -1.68% Day High: 1381 Day Low: 1345

In the event of IG Group enjoying further trades beyond 1381, the share s ……..

</p

View Previous IG Group & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 105.45 Percentage Change: + 0.91% Day High: 107.1 Day Low: 103.35

Target met. Further movement against Lloyds Grp. ABOVE 107.1 should impro ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 1230 Percentage Change: -0.04% Day High: 1237.5 Day Low: 1215

Continued trades against NG. with a mid-price ABOVE 1237.5 should improve ……..

</p

View Previous National Glib & Big Picture ***

LSE:QED Quadrise Close Mid-Price: 2.18 Percentage Change: -7.63% Day High: 2.22 Day Low: 2.1

Target met. Weakness on Quadrise below 2.1 will invariably lead to 2p wit ……..

</p

View Previous Quadrise & Big Picture ***

LSE:SAGA SAGA Plc. Close Mid-Price: 500 Percentage Change: + 15.21% Day High: 503 Day Low: 450

Target met. Further movement against SAGA Plc ABOVE 503 should improve ac ……..

</p

View Previous SAGA Plc & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 1240 Percentage Change: + 0.36% Day High: 1263 Day Low: 1237.5

Further movement against Scottish Mortgage Investment Trust ABOVE 1263 sh ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***

LSE:STAR Star Energy. Close Mid-Price: 10.5 Percentage Change: + 10.53% Day High: 10.5 Day Low: 9.49

Target met. All Star Energy needs are mid-price trades ABOVE 10.5 to impr ……..

</p

View Previous Star Energy & Big Picture ***

LSE:VOD Vodafone. Close Mid-Price: 106.4 Percentage Change: + 0.09% Day High: 107.65 Day Low: 105.95

Target met. In the event of Vodafone enjoying further trades beyond 108p, ……..

</p

View Previous Vodafone & Big Picture ***