#Brent #DAX The price of GOLD appears on the verge of becoming properly interesting again. Of course, this has only occurred since we started to speculate whether Bitcoin was becoming the new ‘contrary’ indicator for the markets, overall. But now, something quite useful seems to be awakening Gold from its recent slumbers.

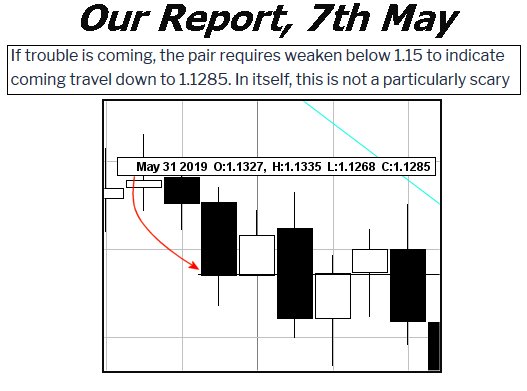

Perhaps we’re being churlish, describing the metal stuck in a 300 dollar range since 2014 as a “slumber” but a glance at the chart below illustrates, despite it going up and down a bit, we’d need be generous to attribute any link to Gold behaviour with, for instance, Dow Jones behaviour. However, all this appears to be on the point of changing but with an important caveat. If the metal actually CLOSES a day above 1350 dollars – or trades beyond 1357 dollars – there is a very reasonable excuse to speculate on some coming reasonable growth.

Visually there’s a historical issue at the 1350 level, thanks to a glass ceiling being in place since June 2014. If we forget arithmetic and simply use common sense, once the shiny stuff is seen solidly exceeding this Glass Ceiling (or Flat Trend), a majority of traders will assume, correctly we suspect, Gold is heading skyward. Thus far, we’ve only one reservation regarding its prospects and we’ve circled it on the chart.

The price broke the BLUE downtrend at 1288 dollars. Since the point of trend break, the metal has closed a couple of sessions below the point of trend break. This sort of thing tends dampen enthusiasm for the future, along with fouling our calculations.

For now, we can calculate trades above 1357 should bring an initial 1385 within range. If such a level is bettered, our secondary calculates at 1401 dollars though, to be honest, it could easily continue acceleration toward 1537, a level where some hesitation seems essential.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

11:56:11AM |

BRENT |

61.56 |

60.3 |

59.475 |

58.56 |

61.67 |

61.95 |

62.19 |

62.82 |

60.95 | |

|

11:58:15AM |

GOLD |

1342.32 |

Success | ||||||||

|

12:00:47PM |

FTSE |

7373 |

Shambles | ||||||||

|

12:02:55PM |

FRANCE |

5372.5 | |||||||||

|

12:04:48PM |

GERMANY |

12126 |

12046 |

12014 |

11951 |

12111 |

12136 |

12148 |

12182 |

12076 | |

|

12:07:48PM |

US500 |

2890.92 | |||||||||

|

12:13:04PM |

DOW |

26118.2 | |||||||||

|

12:17:07PM |

NASDAQ |

7479.75 | |||||||||

|

12:19:18PM |

JAPAN |

21040 |