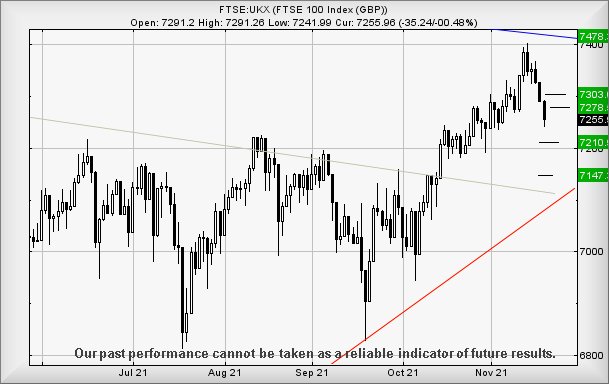

#NK225 #DAX As the American markets close for Thanksgiving, their final holiday before Xmas, we can only rue the state of a holiday parsimonious UK, our last trading holiday being in August. Traditionally, Thanksgiving Thursday witnesses very little happening with European markets while the US is closed, the day inevitably ending pretty flat. Perhaps this year shall be different, thanks to markets recently tending to do their own thing. Wednesday saw Wall St close slightly down, whereas the Nasdaq and S&P both managed slightly up.

Long story short, we’re NOT currently expecting fireworks from the FTSE, despite low level indications pointing at gains for Thursday.

As for Glencore, the share has proven tediously slow this year. We reviewed the price back in February, giving a trigger level of 295 which was to provoke gains toward 408p. The pace of movement has been such, the price took until last month, just to reach 400p. We’re not convinced this glacial movement is wrong, just painfully slow, and suspect our target level can now be refined slightly. Price gains now bettering 400p suggest gains coming to an initial 416p with secondary, if bettered, a pretty confident looking 463p.

We do suspect some hesitation shall take place, should 463p make an appearance within living memory!

Something pretty important is worth consideration from a Big Picture perspective. In the event Glencore manages to close a session above 416p, the share exceeds the highs of three years ago and shall now be regarded as entering a cycle toward a longer term 578p.

One thing about Glencore surprised us. We’d known of the companies metal & mineral mining business, always assuming copper etc was their mainstay. It was therefore a surprise to discover they also mine thermal coal for the energy market, a source which somehow or other received a blessing of sorts from the recent Climate conference. Perhaps their stance as the market leader is recycling of copper earned them brownie points from the green folks. In addition, the company also market the products they mine, handling the international transport from sale to delivery.

To summarise, we feel Glencore enjoy many positives, perhaps just needing favourable market conditions for their share price to flourish properly. As the chart below shows, there’s an obvious glass ceiling at the 400p level and should this finally break, the pace of acceleration may improve somewhat. To cause concern, the share would need reverse below Blue, presently 340p. as a cycle to 188 becomes possible.

Our thanks, as ever, to those who discover a fascinating advert on this page and visit it. It buys us a welcome coffee.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:48:28PM | BRENT | 81.15 | 80.94 | ‘cess | |||||||

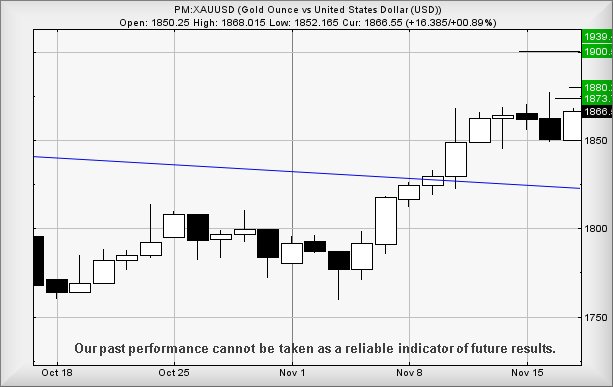

| 9:52:30PM | GOLD | 1788.29 | 1785 | ||||||||

| 9:54:04PM | FTSE | 7302 | 7278 | ‘cess | |||||||

| 9:59:14PM | FRANCE | 7047 | 7023 | Success | |||||||

| 10:04:17PM | GERMANY | 15913.2 | 15866 | 15815 | 15674 | 15960 | 15932 | 15976 | 16010 | 15865 | Success |

| 10:05:55PM | US500 | 4704.82 | |||||||||

| 10:21:30PM | DOW | 35837 | |||||||||

| 10:23:13PM | NASDAQ | 16361 | ‘cess | ||||||||

| 10:25:14PM | JAPAN | 29445 | 29190 | 29087 | 28967 | 29344 | 29454 | 29520 | 29630 | 29290 | Success |

24/11/2021 FTSE Closed at 7286 points. Change of 0.28%. Total value traded through LSE was: £ 5,389,556,678 a change of 0.75%

23/11/2021 FTSE Closed at 7266 points. Change of 0.15%. Total value traded through LSE was: £ 5,349,222,584 a change of 8.04%

22/11/2021 FTSE Closed at 7255 points. Change of 0.44%. Total value traded through LSE was: £ 4,951,055,285 a change of -23.97%

19/11/2021 FTSE Closed at 7223 points. Change of -0.44%. Total value traded through LSE was: £ 6,512,253,332 a change of 26.1%

18/11/2021 FTSE Closed at 7255 points. Change of -0.49%. Total value traded through LSE was: £ 5,164,170,076 a change of -21.09%

17/11/2021 FTSE Closed at 7291 points. Change of -0.48%. Total value traded through LSE was: £ 6,544,197,629 a change of 2.92%

16/11/2021 FTSE Closed at 7326 points. Change of -0.34%. Total value traded through LSE was: £ 6,358,395,076 a change of 26.19%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:BDEV Barrett Devs** **LSE:CCL Carnival** **LSE:DARK Darktrace Plc** **LSE:HUR Hurrican Energy** **LSE:IQE IQE** **LSE:ITRK Intertek** **LSE:NG. National Glib** **LSE:ODX Omega Diags** **LSE:PPC President Energy** **LSE:QFI Quadrise** **LSE:RKH Rockhopper** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : Aston Martin, Barrett Devs, Carnival, Darktrace Plc, Hurrican Energy, IQE, Intertek, National Glib, Omega Diags, President Energy, Quadrise, Rockhopper, Taylor Wimpey,

LSE:AML Aston Martin Close Mid-Price: 1541 Percentage Change: -1.44% Day High: 1594 Day Low: 1520

Continued weakness against AML taking the price below 1520 calculates as ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:BDEV Barrett Devs. Close Mid-Price: 709.2 Percentage Change: + 1.00% Day High: 718.8 Day Low: 700.4

Continued trades against BDEV with a mid-price ABOVE 718.8 should improve ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 1386 Percentage Change: + 0.57% Day High: 1402.6 Day Low: 1349.2

If Carnival experiences continued weakness below 1349.2, it will invariab ……..

</p

View Previous Carnival & Big Picture ***

LSE:DARK Darktrace Plc Close Mid-Price: 489 Percentage Change: -1.96% Day High: 505 Day Low: 475.4

Target Met. In the event Darktrace Plc experiences weakness below 475.4 ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:HUR Hurrican Energy. Close Mid-Price: 4.25 Percentage Change: + 1.19% Day High: 4.25 Day Low: 4.09

Huricanes failure to launch is a bother and now, it feels like weakness be ……..

</p

View Previous Hurrican Energy & Big Picture ***

LSE:IQE IQE Close Mid-Price: 38.1 Percentage Change: -24.40% Day High: 44.2 Day Low: 36.65

Target met. If IQE experiences continued weakness below 36.65, it will in ……..

</p

View Previous IQE & Big Picture ***

LSE:ITRK Intertek. Close Mid-Price: 5470 Percentage Change: + 6.01% Day High: 5548 Day Low: 5210

Target met. Continued trades against ITRK with a mid-price ABOVE 5548 sho ……..

</p

View Previous Intertek & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 998.3 Percentage Change: + 0.59% Day High: 1001 Day Low: 986.1

Further movement against National Glib ABOVE 1001 should improve accelera ……..

</p

View Previous National Glib & Big Picture ***

LSE:ODX Omega Diags Close Mid-Price: 40 Percentage Change: -4.76% Day High: 42 Day Low: 39.25

Continued weakness against ODX taking the price below 39.25 calculates as ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:PPC President Energy. Close Mid-Price: 2.4 Percentage Change: + 4.35% Day High: 2.55 Day Low: 2.27

Further movement against President Energy ABOVE 2.55 should improve accel ……..

</p

View Previous President Energy & Big Picture ***

LSE:QFI Quadrise Close Mid-Price: 2.94 Percentage Change: -4.07% Day High: 2.95 Day Low: 2.76

Weakness on Quadrise below 2.76 will invariably lead to 2.5 with secondar ……..

</p

View Previous Quadrise & Big Picture ***

LSE:RKH Rockhopper. Close Mid-Price: 5.7 Percentage Change: + 9.40% Day High: 5.58 Day Low: 5.3

It starts to feel like the penguin is dead but no-one has informed the bod ……..

</p

View Previous Rockhopper & Big Picture ***

LSE:TW. Taylor Wimpey. Close Mid-Price: 160.65 Percentage Change: + 1.81% Day High: 162 Day Low: 157.5

Continued trades against TW. with a mid-price ABOVE 162 should improve th ……..

</p

View Previous Taylor Wimpey & Big Picture ***