#Free_Futures #Bitcoin

Thursday was a day with numbers everywhere. From a personal perspective, the only ones which mattered were the results of some blood tests. For a year, I’ve been enjoying low dosage chemotherapy daily, designed to keep my non-fatal-if-treated leukaemia under control. Today, we reviewed the entire year. While ‘flatline’ usually has some negative connotations from a medical stance, in my own case the various nasty blood indicators have remained flat and boring for 12 months.

It’s all quite exciting, not cured but under control and no longer braced for a surprise bout of aggressive chemo, along with the usual unpleasantness. Instead, I get to continue daily chemotherapy pills dealing with the illness quite unobtrusively. About the only bad thing; damage caused by aggressive chemotherapy a couple of years ago remains, unlikely to repair itself, and my immune system will always be weak. All in all, it was a good news day, now only needing visit the hospital every 3 months rather than monthly.

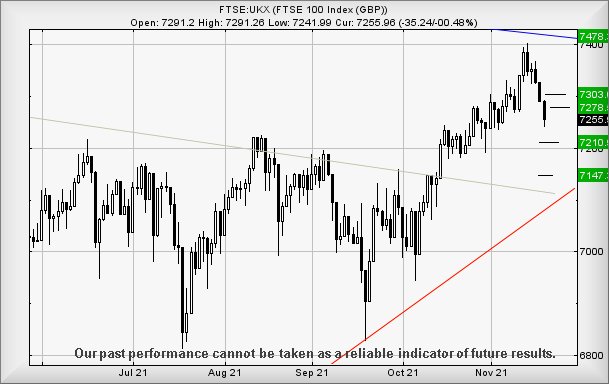

In the hospital waiting room, watching the FTSE slither off a cliff on my tablet at 3pm was frustrating, a clear sign something perceived as bad was happening. The Dow Jones also reacted negatively, while the S&P and the Nasdaq somehow or other discovered some strength. It was one of these occasions which invented the need for multiple monitors, a 14 inch table screen utterly failing to provide sufficient information on real time chaos.

With the markets now closed, along with the luxury of time to think, we’re not happy at the level the FTSE closed the day at. The immediate situation suggests weakness below 7240 risks ongoing reversal to an initial 7210 points. If broken, our secondary calculates at 7147 points. If triggered, the tightest stop looks like 7282 points. As usual, we advocate caution if the movement triggers in the opening seconds of Friday as it’s liable to prove “fake”. To judge by the chart, should our initial drop target of 7210 make an appearance, the index should bounce a bit.

On the basis such a spike down movement occurs, it was prove interesting if any subsequent bounce manages above 7263 points as continued traffic in the direction of a fairly limp 7278 points. If bettered, our secondary calculates at 7303 points.

Bitcoin (COIN:BTCUSD) With some surprise volatility, Bitcoin has managed to launch itself into fairly dangerous territory. The price remains absurd, of course, but there appears some reversal around the corner. Weakness next below $56,600 calculates with a drop potential at an initial 52,953 dollars. If broken, our secondary works out at 47,291, a level at which we’re not convinced to expect a rebound. Instead, if this secondary target level breaks, there’s a strong argument favouring an eventual bounce down at 38,909 dollars. Or so!

An important caveat with Bitcoin is worth remembering. Unless the crypto currency manages to actually close a session below our secondary target level, it remains trading in a region where we’re supposed to regard a long term 76,881 as a strong ambition, a level at which some volatility can be anticipated. Given past behaviour, along with surprising underlying strength, we shall not be surprised if it goes down a bit, only to recover and once again paint a new high.

Our thanks to the kind folk who find adverts on this page worth a visit. We appreciate the daily coffee a click buys!

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:45:40PM | BRENT | 80.5 | 79.5 | 78.8 | 80.8 | 80.75 | 81.435 | 79.52 | |||

| 9:47:17PM | GOLD | 1861.04 | 1855 | 1850 | 1867 | 1867 | 1872 | 1857 | |||

| 9:48:53PM | FTSE | 7267.98 | 7253 | 7238 | 7278 | 7284 | 7297 | 7254 | ‘cess | ||

| 9:50:56PM | FRANCE | 7147.5 | 7139 | 7130 | 7161 | 7181 | 7191 | 7151 | ‘cess | ||

| 9:52:40PM | GERMANY | 16254.49 | 16191 | 16168 | 16255 | 16291 | 16309 | 16221 | ‘cess | ||

| 10:00:17PM | US500 | 4710.32 | 4671 | 4660 | 4705 | 4711 | 4719 | 4683 | ‘cess | ||

| 10:02:34PM | DOW | 35884 | 35820 | 35718 | 35926 | 36019 | 36055 | 35877 | Success | ||

| 10:05:12PM | NASDAQ | 16509 | 16388 | 16357 | 16454 | 16510 | 16582 | 16310 | ‘cess | ||

| 10:07:35PM | JAPAN | 29597 | 29507 | 29429 | 29610 | 29713 | 29829 | 29507 | ‘cess |

18/11/2021 FTSE Closed at 7255 points. Change of -0.49%. Total value traded through LSE was: £ 5,164,170,076 a change of -21.09%

17/11/2021 FTSE Closed at 7291 points. Change of -0.48%. Total value traded through LSE was: £ 6,544,197,629 a change of 2.92%

16/11/2021 FTSE Closed at 7326 points. Change of -0.34%. Total value traded through LSE was: £ 6,358,395,076 a change of 26.19%

15/11/2021 FTSE Closed at 7351 points. Change of 0.05%. Total value traded through LSE was: £ 5,038,681,465 a change of -24.12%

12/11/2021 FTSE Closed at 7347 points. Change of -0.5%. Total value traded through LSE was: £ 6,640,483,437 a change of 17%

11/11/2021 FTSE Closed at 7384 points. Change of 0.6%. Total value traded through LSE was: £ 5,675,393,557 a change of -10.05%

10/11/2021 FTSE Closed at 7340 points. Change of 0.91%. Total value traded through LSE was: £ 6,309,453,625 a change of -1.99%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AVCT Avacta** **LSE:CCL Carnival** **LSE:CNA Centrica** **LSE:DARK Darktrace Plc** **LSE:DGE Diageo** **LSE:EZJ EasyJet** **LSE:HIK Hikma** **LSE:ITRK Intertek** **LSE:NG. National Glib** **LSE:RBD Reabold Resources PLC** **LSE:SDY Speedyhire** **

********

Updated charts published on : Avacta, Carnival, Centrica, Darktrace Plc, Diageo, EasyJet, Hikma, Intertek, National Glib, Reabold Resources PLC, Speedyhire,

LSE:AVCT Avacta. Close Mid-Price: 130 Percentage Change: + 11.11% Day High: 137.5 Day Low: 114.5

In the event of Avacta enjoying further trades beyond 137.5, the share sh ……..

</p

View Previous Avacta & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 1425.2 Percentage Change: -0.81% Day High: 1466.4 Day Low: 1401.2

Continued weakness against CCL taking the price below 1401.2 calculates a ……..

</p

View Previous Carnival & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 68.22 Percentage Change: + 0.95% Day High: 68.52 Day Low: 67.26

Further movement against Centrica ABOVE 68.52 should improve acceleration ……..

</p

View Previous Centrica & Big Picture ***

LSE:DARK Darktrace Plc Close Mid-Price: 524.5 Percentage Change: -4.64% Day High: 549 Day Low: 524

In the event Darktrace Plc experiences weakness below 524 it calculates w ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:DGE Diageo. Close Mid-Price: 3892.5 Percentage Change: + 0.28% Day High: 3915.5 Day Low: 3874.5

Further movement against Diageo ABOVE 3915.5 should improve acceleration ……..

</p

View Previous Diageo & Big Picture ***

LSE:EZJ EasyJet Close Mid-Price: 570.6 Percentage Change: -0.52% Day High: 581.6 Day Low: 568.8

If EasyJet experiences continued weakness below 568.8, it will invariably ……..

</p

View Previous EasyJet & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 2287 Percentage Change: -2.35% Day High: 2358 Day Low: 2285

Weakness on Hikma below 2285 will invariably lead to 2242 with secondary, ……..

</p

View Previous Hikma & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 5234 Percentage Change: -1.02% Day High: 5314 Day Low: 5222

All Intertek needs are mid-price trades ABOVE 5314 to improve acceleratio ……..

</p

View Previous Intertek & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 986.5 Percentage Change: + 1.18% Day High: 991.5 Day Low: 972.9

All National Glib needs are mid-price trades ABOVE 991.5 to improve accel ……..

</p

View Previous National Glib & Big Picture ***

LSE:RBD Reabold Resources PLC Close Mid-Price: 0.17 Percentage Change: -5.56% Day High: 0.18 Day Low: 0.16

In exciting news, it now appears below .16 shall provoke an initial 0.12 w ……..

</p

View Previous Reabold Resources PLC & Big Picture ***

LSE:SDY Speedyhire Close Mid-Price: 67.8 Percentage Change: -0.73% Day High: 69.4 Day Low: 67.5

This is a little complex but above 70 now suggests the potential of recove ……..

</p

View Previous Speedyhire & Big Picture ***