#DAX #Nasdaq We wonder if someone, somewhere, has a betting pool open on just when will France match the FTSE, point for point. The indices are drawer ever closer, France closing the 17th November at 7156 points and the FTSE at 7291 points. Obviously, aside from the points value, there is no similarity between the pair. Even market performance since the Covid-19 low last year highlights the dismal movement of the FTSE.

As can be seen, with the FTSE performance overlaid on a chart for the French market, the difference in performance is quite a worry, especially as France commenced from a lower level in 2020. In an exercise (otherwise known as ‘grasping at straws’), we’d liked to suspect European markets were slowing down, while the FTSE made an effort to catch up. It’s certainly becoming difficult to stoke the fires of optimism for the UK. Perhaps Santa shall appear, wearing a Superman cloak, and produce a super-Santa rally. (Clue: not going to happen)

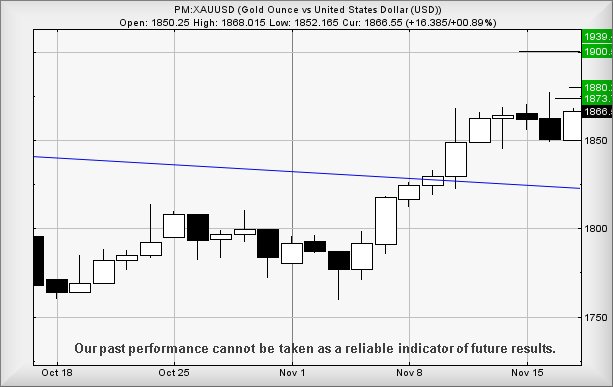

GOLD (PM:XAUUSD) We’ve received a few emails, asking for a further update on Gold, despite it being covered last week. The reason for the flurry is fairly simple; we’d given a trigger level at $1,873 and the metal achieved a high of 1,877 on Tuesday before retreating to close the day at 1,850 dollars. This sort of thing is always a worry, hence our often repeated demand a market actually CLOSE a session above a target level to give a belt and braces signal which confirms movement potentials. Instead, for the present, about the best we can hope is our 1,873 level shall prove valid until such time the market stops circling below the trigger level and once again, breaks the surface.

For now, we can announce CLOSURE above 1873 or intraday traffic above 1,878 should make a visit to an initial 1,900 almost inevitable. Our longer term secondary currently recalculates at $1,939.

From a very immediate perspective, given the stuff is trading at 1,865 at time of writing, above 1,868 is supposed to bring a trip to 1,873. A near term secondary, should this level be exceeded, calculates at 1,880 points and just another nudge higher. This is why being fussy about a closing price level becomes important. There’s certainly a good chance achieving our secondary target shall permit the product to actually close a session above the trigger level. Visually, we’re inclined toward optimism for the price of Gold.

Our thanks to those folk who find adverts on this page worthy of a visit. It keeps us in rocket fuel (coffee)

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:49:22PM | BRENT | 79.46 | Success | ||||||||

| 9:51:56PM | GOLD | 1867.09 | |||||||||

| 9:57:46PM | FTSE | 7287.5 | Success | ||||||||

| 10:02:37PM | FRANCE | 7158 | |||||||||

| 10:04:27PM | GERMANY | 16255 | 16208 | 16180 | 16146 | 16238 | 16274 | 16286 | 16312 | 16243 | |

| 10:11:51PM | US500 | 4690 | 4678 | 4672 | 4661 | 4701 | 4705 | 4710 | 4719 | 4685 | |

| 10:14:39PM | DOW | 35900 | Success | ||||||||

| 10:17:01PM | NASDAQ | 16329 | Success | ||||||||

| 10:20:23PM | JAPAN | 29549 | Success |

17/11/2021 FTSE Closed at 7291 points. Change of -0.48%. Total value traded through LSE was: £ 6,544,197,629 a change of 2.92%

16/11/2021 FTSE Closed at 7326 points. Change of -0.34%. Total value traded through LSE was: £ 6,358,395,076 a change of 26.19%

15/11/2021 FTSE Closed at 7351 points. Change of 0.05%. Total value traded through LSE was: £ 5,038,681,465 a change of -24.12%

12/11/2021 FTSE Closed at 7347 points. Change of -0.5%. Total value traded through LSE was: £ 6,640,483,437 a change of 17%

11/11/2021 FTSE Closed at 7384 points. Change of 0.6%. Total value traded through LSE was: £ 5,675,393,557 a change of -10.05%

10/11/2021 FTSE Closed at 7340 points. Change of 0.91%. Total value traded through LSE was: £ 6,309,453,625 a change of -1.99%

9/11/2021 FTSE Closed at 7274 points. Change of -0.36%. Total value traded through LSE was: £ 6,437,458,851 a change of 17.56%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BBY BALFOUR BEATTY** **LSE:DARK Darktrace Plc** **LSE:DGE Diageo** **LSE:EZJ EasyJet** **LSE:IGG IG Group** **LSE:ITRK Intertek** **LSE:NWG Natwest** **LSE:ODX Omega Diags** **LSE:PHP Primary Health** **LSE:SRP Serco** **

********

Updated charts published on : BALFOUR BEATTY, Darktrace Plc, Diageo, EasyJet, IG Group, Intertek, Natwest, Omega Diags, Primary Health, Serco,

LSE:BBY BALFOUR BEATTY Close Mid-Price: 243.4 Percentage Change: -1.62% Day High: 247 Day Low: 243.4

In the event BALFOUR BEATTY experiences weakness below 243.4 it calculate ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:DARK Darktrace Plc. Close Mid-Price: 550 Percentage Change: + 1.10% Day High: 557.5 Day Low: 530.5

Weakness on Darktrace Plc below 530.5 will invariably lead to 511p next w ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:DGE Diageo. Close Mid-Price: 3881.5 Percentage Change: + 0.49% Day High: 3902 Day Low: 3845.5

Continued trades against DGE with a mid-price ABOVE 3902 should improve th ……..

</p

View Previous Diageo & Big Picture ***

LSE:EZJ EasyJet Close Mid-Price: 573.6 Percentage Change: -1.14% Day High: 591 Day Low: 571.4

Weakness on EasyJet below 571.4 will invariably lead to 546 with secondar ……..

</p

View Previous EasyJet & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 773 Percentage Change: -2.28% Day High: 788.5 Day Low: 763.5

If IG Group experiences continued weakness below 763.5, it will invariabl ……..

</p

View Previous IG Group & Big Picture ***

LSE:ITRK Intertek. Close Mid-Price: 5288 Percentage Change: + 0.34% Day High: 5296 Day Low: 5242

In the event of Intertek enjoying further trades beyond 5296, the share s ……..

</p

View Previous Intertek & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 224.3 Percentage Change: + 0.40% Day High: 227.7 Day Low: 223.8

Target met. Further movement against Natwest ABOVE 227.7 should improve a ……..

</p

View Previous Natwest & Big Picture ***

LSE:ODX Omega Diags Close Mid-Price: 40.5 Percentage Change: -1.82% Day High: 42.5 Day Low: 39.5

Target met. In the event Omega Diags experiences weakness below 39.5 it c ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:PHP Primary Health Close Mid-Price: 149.6 Percentage Change: -0.80% Day High: 151.1 Day Low: 149.2

Ongoing movement below 149 now makes travel to 144p pretty certain. While ……..

</p

View Previous Primary Health & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 134.8 Percentage Change: + 0.00% Day High: 135.6 Day Low: 133.9

Above just 140 should now give hope, allowing for an initial 154 with seco ……..

</p

View Previous Serco & Big Picture ***