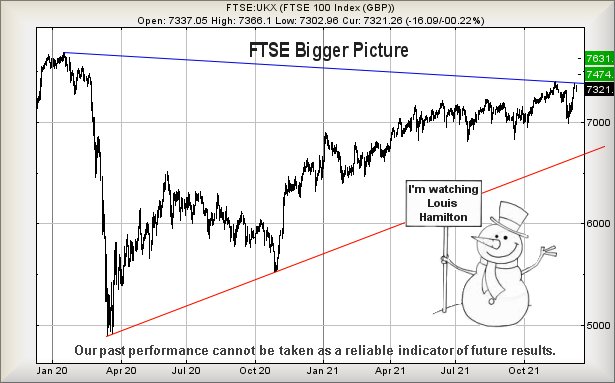

#FTSE #Genedrive With the countdown to Xmas, as usual there’s the seasonal speculation for the possibility of a forthcoming “Santa Rally” in the marketplace. To be fair on the FTSE, presently trading around 7,320 points, the index only need exceed 7,405 points to provide a pretty solid expectation for coming growth of around 4.2% from current, potentially to around 7,631 points.

Almost laughably, this would return the index to a level last seen at Christmas 2019, when the market closed on Xmas eve at 7,632 points. Numbers can be a strange thing, yet as clearly exhibited by Genedrive in our report for the 9th December (yesterda), the share price indeed exceeded our 68p trigger and exactly hit our 81p initial target 44 minutes later. We also note our initial target was not exceeded, running the risk of the price messing around for a while.

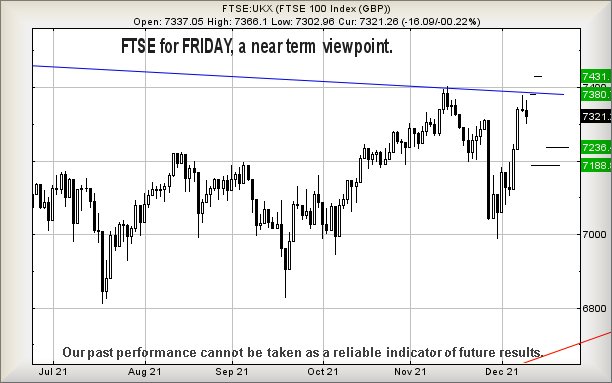

From a near term perspective, the FTSE now requires exceed 7,366 to suggest coming movement to an initial 7,380 points. If bettered, we can calculate a secondary at 7,431 points, quite cheerfully above the trigger level which is supposed to trigger a mythical “Santa Rally”. Then again, as we live in an age where politicians frown on all frivolity and ensure their behaviour meets the lowest standards expected in public office, perhaps politics shall conspire to derail any optimism.

However, should the dream come true in the days ahead, the Big Picture tells us above 7,405 is supposed to provoke FTSE a recovery cycle to an initial 7,474 with secondary, if bettered, at our 7,631 points.

Should things intend for pear shaped, below 7,287 looks capable of triggering reversal to an almost certain 7,236 points. If broken, we can calculate a secondary at 7,188 points and hopefully some sort of real bounce.

Have a good weekend, hopefully one which shall see a UK driver lift the F1 World Drivers championship for the 8th time.

Huge thanks to those who discover interesting adverts on this page. The tiny amount of income literally buys us our daily coffee!

Thanks again.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:10:03PM | BRENT | 73.91 | 73.7 | 73.08 | 74.93 | 75.54 | 76.13 | 74.45 | ‘cess | ||

| 10:12:01PM | GOLD | 1775.56 | 1773 | 1769 | 1783 | 1787 | 1790 | 1779 | ‘cess | ||

| 10:13:50PM | FTSE | 7314.03 | 7297 | 7283 | 7335 | 7335 | 7341 | 7303 | ‘cess | ||

| 10:15:48PM | FRANCE | 6997.8 | 6982 | 6972 | 7014 | 7042 | 7047 | 7007 | ‘cess | ||

| 10:18:24PM | GERMANY | 15620 | 15583 | 15553 | 15697 | 15725 | 15762 | 15667 | ‘cess | ||

| 10:23:06PM | US500 | 4671.57 | 4663 | 4652 | 4681 | 4684 | 4690 | 4670 | ‘cess | ||

| 10:26:45PM | DOW | 35759.1 | 35577 | 35468 | 35804 | 35863 | 35969 | 35606 | |||

| 10:29:44PM | NASDAQ | 16162 | 16120 | 16090 | 16220 | 16202 | 16265 | 16147 | ‘cess | ||

| 10:32:19PM | JAPAN | 28614 | 28562 | 28420 | 28751 | 28790 | 28854 | 28593 |

9/12/2021 FTSE Closed at 7321 points. Change of -0.22%. Total value traded through LSE was: £ 5,443,441,871 a change of -11.44%

8/12/2021 FTSE Closed at 7337 points. Change of -0.04%. Total value traded through LSE was: £ 6,146,296,986 a change of 1.35%

7/12/2021 FTSE Closed at 7340 points. Change of 1.49%. Total value traded through LSE was: £ 6,064,412,188 a change of 23.32%

6/12/2021 FTSE Closed at 7232 points. Change of 1.54%. Total value traded through LSE was: £ 4,917,455,192 a change of -4.51%

3/12/2021 FTSE Closed at 7122 points. Change of -0.1%. Total value traded through LSE was: £ 5,149,568,407 a change of -8.34%

2/12/2021 FTSE Closed at 7129 points. Change of -0.54%. Total value traded through LSE was: £ 5,618,064,136 a change of -12.19%

1/12/2021 FTSE Closed at 7168 points. Change of 1.54%. Total value traded through LSE was: £ 6,397,928,527 a change of -42.03%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AGM Applied Graphene** **LSE:BT.A British Telecom** **LSE:CASP Caspian** **LSE:CEY Centamin** **LSE:DARK Darktrace Plc** **LSE:IGAS Igas Energy** **LSE:ITRK Intertek** **LSE:NG. National Glib** **LSE:QFI Quadrise** **LSE:RBD Reabold Resources PLC** **LSE:RKH Rockhopper** **

********

Updated charts published on : Applied Graphene, British Telecom, Caspian, Centamin, Darktrace Plc, Igas Energy, Intertek, National Glib, Quadrise, Reabold Resources PLC, Rockhopper,

LSE:AGM Applied Graphene Close Mid-Price: 24.5 Percentage Change: -2.00% Day High: 25.5 Day Low: 24

This is suddenly looking dodgy as below 24 looks capable of reversal to 20 ……..

</p

View Previous Applied Graphene & Big Picture ***

LSE:BT.A British Telecom. Close Mid-Price: 176.65 Percentage Change: + 2.79% Day High: 177.2 Day Low: 172.25

Target met. In the event of British Telecom enjoying further trades beyon ……..

</p

View Previous British Telecom & Big Picture ***

LSE:CASP Caspian Close Mid-Price: 3.9 Percentage Change: -3.70% Day High: 4.05 Day Low: 3.9

In the event Caspian experiences weakness below 3.9 it calculates with a ……..

</p

View Previous Caspian & Big Picture ***

LSE:CEY Centamin Close Mid-Price: 87.62 Percentage Change: -4.11% Day High: 91.72 Day Low: 87.46

If Centamin experiences continued weakness below 87.46, it will invariabl ……..

</p

View Previous Centamin & Big Picture ***

LSE:DARK Darktrace Plc. Close Mid-Price: 414.4 Percentage Change: + 1.12% Day High: 430.2 Day Low: 402.4

If Darktrace Plc experiences continued weakness below 402.4, it will inva ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:IGAS Igas Energy Close Mid-Price: 13.75 Percentage Change: -2.31% Day High: 14 Day Low: 13.3

Weakness on Igas Energy below 13.3 will invariably lead to 12.3 next with ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:ITRK Intertek. Close Mid-Price: 5742 Percentage Change: + 1.70% Day High: 5804 Day Low: 5678

Continued trades against ITRK with a mid-price ABOVE 5804 should improve ……..

</p

View Previous Intertek & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1049 Percentage Change: + 1.06% Day High: 1050.6 Day Low: 1041.4

In the event of National Glib enjoying further trades beyond 1050.6, the ……..

</p

View Previous National Glib & Big Picture ***

LSE:QFI Quadrise. Close Mid-Price: 2.31 Percentage Change: + 2.44% Day High: 2.24 Day Low: 2.2

Continued weakness against QFI taking the price below 2.2 calculates as l ……..

</p

View Previous Quadrise & Big Picture ***

LSE:RBD Reabold Resources PLC Close Mid-Price: 0.12 Percentage Change: -7.41% Day High: 0.14 Day Low: 0.12

Target met. In the event Reabold Resources PLC experiences weakness below ……..

</p

View Previous Reabold Resources PLC & Big Picture ***

LSE:RKH Rockhopper. Close Mid-Price: 7 Percentage Change: + 12.80% Day High: 7.49 Day Low: 5.7

Target met. All Rockhopper needs are mid-price trades ABOVE 7.49 to impro ……..

</p

View Previous Rockhopper & Big Picture ***