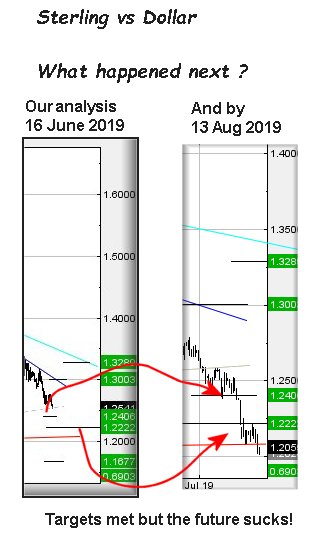

#Gold #DOW #GBPUSD Our previous report (link) proved accurate and now, we’re a little gloomy. Sterling is starting to exhibit similar life expectancy to Epstein’s prison guards. On the other hand, after Brexit, the USA are bound to find UK imports quite competitive. If only the UK still had a reasonable manufacturing industry!

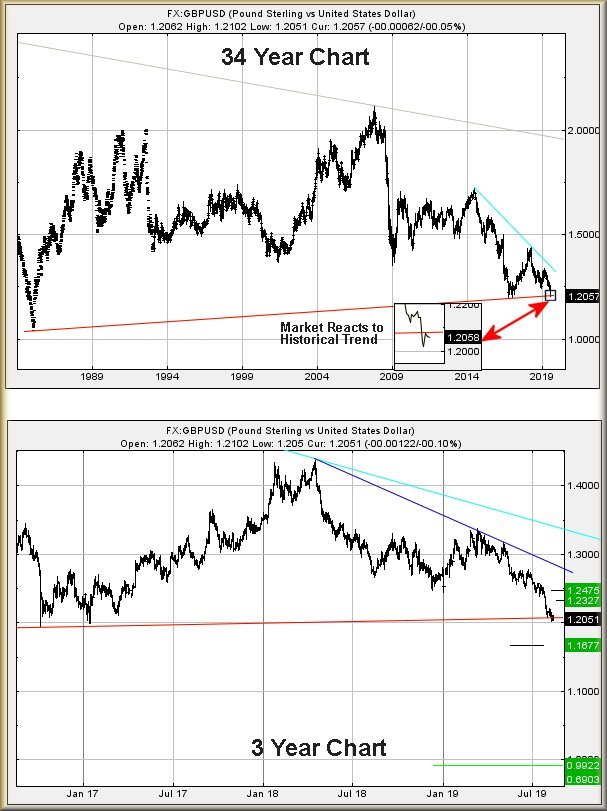

The immediate problem Sterling now faces is an expectation of a “bottom” on the current cycle at 1.1677. Unfortunately, there’s a heck of an argument suggesting things could get worse, substantially worse, as the Big Picture indicates a real bottom should occur at 0.9922 eventually. In addition, there’s the issue of the RED uptrend which ridiculously dates back to 1985.

We’re perfectly aware some readers were not even born when this uptrend commenced 34 years ago but unfortunately the market appears not to care about the age of a faded RED line. The inset on the chart highlights what has happened in the last few days since the trend broke. Visually, there can be little doubt the market is perfectly aware of this line. At time of writing, it is at 1.20807 (roughly) with the currency pairing requiring to CLOSE a session above this to indicate it has all been a dreadful mistake.

Visually, this appears unlikely, thanks to the market acknowledging this historical trend. On the plus side, anyone opening a short and hoping for the best (or worst) can emplace a fairly tight stop at 1.2106, this being the highest achieved since the trend broke. In theory, moves above this level allow for 1.2327 initially with secondary, if bettered, calculating at 1.2475.

When a major trend such as this breaks, we recommend not holding your breath while awaiting recovery!

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:47:56PM |

BRENT |

58.86 |

Success | ||||||||

|

9:49:50PM |

GOLD |

1516.64 |

1499 |

1495.5 |

1486 |

1518 |

1524 |

1528 |

1535 |

1506 |

Success |

|

9:52:10PM |

FTSE |

7102.8 |

‘cess | ||||||||

|

9:54:05PM |

FRANCE |

5228.7 |

Success | ||||||||

|

9:57:05PM |

GERMANY |

11422 |

Success | ||||||||

|

10:02:55PM |

US500 |

2835.07 |

Success | ||||||||

|

10:05:34PM |

DOW |

25422.3 |

25407 |

25319 |

25096 |

25690 |

25745 |

25846.5 |

25993 |

25600 |

Success |

|

10:10:10PM |

NASDAQ |

7468.89 |

Success | ||||||||

|

10:12:23PM |

JAPAN |

20118 |

Success |