#Gold #Nasdaq The last 18 months has seen us gradually lose fascination with drug companies. The root cause, obviously, Covid-19 and an almost distressing number of companies jumping on the “look at me” bandwagon, the general tell tale being dominant usage of “Pandemic” and “Covid-19” on a pharmaceuticals front page. Perhaps it has proven a wise ploy, perhaps not, as the fortunes of rather a few companies appear to have waxed and waned quite vividly.

Sareum Holdings Plc are certainly not a new kid on the block. Founded 17 years ago, their listing on the AIM has shown the usual fits and starts with the share price currently looking a bit “interesting”. Obviously, the company have a finger in the Covid-19 pie but our own interest is driven by personal experience of treatment for a type of leukaemia. Historically, receiving what’s described as aggressive chemotherapy should be more fairly thought of as dodging attempts to murder the patient in the hope the drugs only kills the nasty cancer cells. Thankfully, companies such as Sareum are developing more targeted treatments, easier on the patient and substantially less likely to cause longer term issues.

Again, from personal experience, I remain with damaging effects (sod all immune system, etc) from chemotherapy in 2012 and again, during 2018.

One particular treatment being developed by Sareum is a type of chemo which is a “one a day” pill, aimed at stabilising the patient. Again, from personal experience since 2020, this regime has proven revolutionary as once blood counts retreated to normal human levels, the strength of the drug was vastly reduced with hospital visits becoming substantially less. Hopefully, products of this type become the norm with chemotherapy as the fun of being plumbed into a chair in a treatment room wears off fairly quickly.

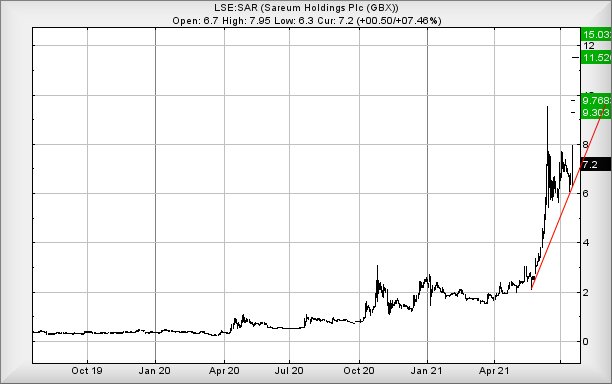

Currently trading around 7.2p, trades on Sareum above 8p should prove capable of an attempt at 9.3p. If bettered, our secondary calculation works out at 9.75p and while this isn’t particularly exciting, will place the share price potentially in game changing territory.

The thing is, our software demands LSE:SAR close a session above 9.45p as the share price shall enter a brave new world for the longer term. While our calculations are necessarily vague, share price closure above 9.45 currently provides the potential of a longer term movement to 11.5 with secondary, if bettered, at 15p. While we cannot calculate above 15p currently, this does not mean a price cannot go higher.

Many thanks to those who find adverts on this page sufficiently interesting to visit. It’s like getting a daily coffee from a chum!

Perhaps, of course, our enthusiasm is biased by the type of cancer drug this company focus on. We feel it the future for chemo and while Covid-19 may prove to be less intrusive in peoples lives, cancers look here to stay.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:02:35PM | BRENT | 68.38 | Success | ||||||||

| 10:22:25PM | GOLD | 1812.98 | 1804 | 1796.5 | 1784 | 1814 | 1818 | 1825 | 1835 | 1804 | Success |

| 10:26:03PM | FTSE | 6867.33 | Success | ||||||||

| 10:33:46PM | FRANCE | 6293 | All | ||||||||

| 10:40:18PM | GERMANY | 15145 | Drop | ||||||||

| 10:43:20PM | US500 | 4269 | Targets | ||||||||

| 10:46:30PM | DOW | 34040 | Were | ||||||||

| 10:50:21PM | NASDAQ | 14604 | 14446 | 14322 | 14095 | 14582 | 14642 | 14656 | 14726 | 14509 | Hit |

| 10:53:07PM | JAPAN | 27286 | Fast! |

19/07/2021 FTSE Closed at 6844 points. Change of -2.34%. Total value traded through LSE was: £ 4,660,799,780 a change of -7.14%

16/07/2021 FTSE Closed at 7008 points. Change of -0.06%. Total value traded through LSE was: £ 5,019,385,780 a change of -1.58%

15/07/2021 FTSE Closed at 7012 points. Change of -1.11%. Total value traded through LSE was: £ 5,099,995,306 a change of 13.98%

14/07/2021 FTSE Closed at 7091 points. Change of -0.46%. Total value traded through LSE was: £ 4,474,388,413 a change of 6.25%

13/07/2021 FTSE Closed at 7124 points. Change of -0.01%. Total value traded through LSE was: £ 4,211,106,808 a change of 2.19%

12/07/2021 FTSE Closed at 7125 points. Change of 0.06%. Total value traded through LSE was: £ 4,120,988,724 a change of -9.74%

9/07/2021 FTSE Closed at 7121 points. Change of 1.29%. Total value traded through LSE was: £ 4,565,910,390 a change of -14.66%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:AML Aston Martin** **LSE:ASC Asos** **LSE:AV. Aviva** **LSE:BARC Barclays** **LSE:BDEV Barrett Devs** **LSE:BP. BP PLC** **LSE:BT.A British Telecom** **LSE:CAR Carclo** **LSE:CCL Carnival** **LSE:CNA Centrica** **LSE:CPI Capita** **LSE:DDDD 4D Pharma** **LSE:EZJ EasyJet** **LSE:FGP Firstgroup** **LSE:FOXT Foxtons** **LSE:FRES Fresnillo** **LSE:GENL Genel** **LSE:HIK Hikma** **LSE:HSBA HSBC** **LSE:IAG British Airways** **LSE:IGG IG Group** **LSE:IHG Intercontinental Hotels Group** **LSE:IQE IQE** **LSE:ITV ITV** **LSE:LLOY Lloyds Grp.** **LSE:MKS Marks and Spencer** **LSE:OPG OPG Power Ventures** **LSE:POG Petrop etc** **LSE:RMG Royal Mail** **LSE:RR. Rolls Royce** **LSE:STAN Standard Chartered** **LSE:TLW Tullow** **LSE:TW. Taylor Wimpey** **LSE:VOD Vodafone** **

********

Updated charts published on : AFC Energy, Aston Martin, Asos, Aviva, Barclays, Barrett Devs, BP PLC, British Telecom, Carclo, Carnival, Centrica, Capita, 4D Pharma, EasyJet, Firstgroup, Foxtons, Fresnillo, Genel, Hikma, HSBC, British Airways, IG Group, Intercontinental Hotels Group, IQE, ITV, Lloyds Grp., Marks and Spencer, OPG Power Ventures, Petrop etc, Royal Mail, Rolls Royce, Standard Chartered, Tullow, Taylor Wimpey, Vodafone,

LSE:AFC AFC Energy Close Mid-Price: 51.7 Percentage Change: -5.48% Day High: 54.9 Day Low: 51

Weakness on AFC Energy below 51 will invariably lead to 48.5 with seconda ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:AML Aston Martin Close Mid-Price: 1724.5 Percentage Change: -7.09% Day High: 1853 Day Low: 1694.5

Target met. Continued weakness against AML taking the price below 1694.5 ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:ASC Asos Close Mid-Price: 3820 Percentage Change: -3.05% Day High: 3916 Day Low: 3774

If Asos experiences continued weakness below 3774, it will invariably lea ……..

</p

View Previous Asos & Big Picture ***

LSE:AV. Aviva Close Mid-Price: 376.8 Percentage Change: -3.73% Day High: 388 Day Low: 375.2

Target met. In the event Aviva experiences weakness below 375.2 it calcul ……..

</p

View Previous Aviva & Big Picture ***

LSE:BARC Barclays Close Mid-Price: 159.32 Percentage Change: -3.69% Day High: 163.98 Day Low: 156.92

Target met. Continued weakness against BARC taking the price below 156.92 ……..

</p

View Previous Barclays & Big Picture ***

LSE:BDEV Barrett Devs Close Mid-Price: 670.2 Percentage Change: -2.50% Day High: 679.2 Day Low: 661.2

Target met. In the event Barrett Devs experiences weakness below 661.2 it ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:BP. BP PLC Close Mid-Price: 278.45 Percentage Change: -4.72% Day High: 289.2 Day Low: 276.3

Target met. Continued weakness against BP. taking the price below 276.3 c ……..

</p

View Previous BP PLC & Big Picture ***

LSE:BT.A British Telecom Close Mid-Price: 178.15 Percentage Change: -4.61% Day High: 185.2 Day Low: 177.15

Target met. In the event British Telecom experiences weakness below 177.1 ……..

</p

View Previous British Telecom & Big Picture ***

LSE:CAR Carclo Close Mid-Price: 35.2 Percentage Change: -14.98% Day High: 39.1 Day Low: 32.8

Target met. If Carclo experiences continued weakness below 32.8, it will ……..

</p

View Previous Carclo & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 1290.8 Percentage Change: -8.73% Day High: 1365 Day Low: 1259

Target met. Weakness on Carnival below 1259 will invariably lead to 1252 ……..

</p

View Previous Carnival & Big Picture ***

LSE:CNA Centrica Close Mid-Price: 49.67 Percentage Change: -2.99% Day High: 51.2 Day Low: 48.28

Target met. If Centrica experiences continued weakness below 48.28, it wi ……..

</p

View Previous Centrica & Big Picture ***

LSE:CPI Capita Close Mid-Price: 32.29 Percentage Change: -4.95% Day High: 33.45 Day Low: 31.87

In the event Capita experiences weakness below 31.87 it calculates with a ……..

</p

View Previous Capita & Big Picture ***

LSE:DDDD 4D Pharma Close Mid-Price: 87 Percentage Change: -1.81% Day High: 88.2 Day Low: 83.8

Weakness on 4D Pharma below 83.8 will invariably lead to 82 with secondar ……..

</p

View Previous 4D Pharma & Big Picture ***

LSE:EZJ EasyJet Close Mid-Price: 768.6 Percentage Change: -6.75% Day High: 811.4 Day Low: 753

Target met. Continued weakness against EZJ taking the price below 753 cal ……..

</p

View Previous EasyJet & Big Picture ***

LSE:FGP Firstgroup Close Mid-Price: 73.85 Percentage Change: -4.83% Day High: 77 Day Low: 73

Weakness on Firstgroup below 73 will invariably lead to 65p with secondar ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:FOXT Foxtons Close Mid-Price: 47 Percentage Change: -7.84% Day High: 51.9 Day Low: 47

Target met. Continued weakness against FOXT taking the price below 47 cal ……..

</p

View Previous Foxtons & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 791.6 Percentage Change: -0.40% Day High: 811 Day Low: 777.6

Continued weakness against FRES taking the price below 777.6 calculates a ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:GENL Genel Close Mid-Price: 139.6 Percentage Change: -3.59% Day High: 144.4 Day Low: 138

If Genel experiences continued weakness below 138, it will invariably lea ……..

</p

View Previous Genel & Big Picture ***

LSE:HIK Hikma. Close Mid-Price: 2633 Percentage Change: + 0.11% Day High: 2644 Day Low: 2606

All Hikma needs are mid-price trades ABOVE 2644 to improve acceleration t ……..

</p

View Previous Hikma & Big Picture ***

LSE:HSBA HSBC Close Mid-Price: 392.05 Percentage Change: -2.78% Day High: 401.6 Day Low: 390.25

Target met. In the event HSBC experiences weakness below 390.25 it calcul ……..

</p

View Previous HSBC & Big Picture ***

LSE:IAG British Airways Close Mid-Price: 159.78 Percentage Change: -4.77% Day High: 166.82 Day Low: 156.8

In the event British Airways experiences weakness below 156.8 it calcula ……..

</p

View Previous British Airways & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 824.5 Percentage Change: -2.43% Day High: 842 Day Low: 822.5

Weakness on IG Group below 822.5 will invariably lead to 800p looking cap ……..

</p

View Previous IG Group & Big Picture ***

LSE:IHG Intercontinental Hotels Group Close Mid-Price: 4546 Percentage Change: -3.34% Day High: 4650 Day Low: 4492

If Intercontinental Hotels Group experiences continued weakness below 449 ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:IQE IQE Close Mid-Price: 43.05 Percentage Change: -6.00% Day High: 48.2 Day Low: 42

In the event IQE experiences weakness below 42 it calculates with a drop ……..

</p

View Previous IQE & Big Picture ***

LSE:ITV ITV Close Mid-Price: 113.15 Percentage Change: -6.72% Day High: 120.55 Day Low: 112.5

If ITV experiences continued weakness below 112.5, it will invariably lea ……..

</p

View Previous ITV & Big Picture ***

LSE:LLOY Lloyds Grp. Close Mid-Price: 43.5 Percentage Change: -4.86% Day High: 45.18 Day Low: 43.37

Weakness on Lloyds Grp. below 43.37 will invariably lead to 42.75 with se ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:MKS Marks and Spencer Close Mid-Price: 132.05 Percentage Change: -4.52% Day High: 136.4 Day Low: 131.4

Target met. Continued weakness against MKS taking the price below 131.4 c ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:OPG OPG Power Ventures Close Mid-Price: 12.53 Percentage Change: -1.76% Day High: 12.75 Day Low: 12.53

Target met. If OPG Power Ventures experiences continued weakness below 12 ……..

</p

View Previous OPG Power Ventures & Big Picture ***

LSE:POG Petrop etc Close Mid-Price: 21.64 Percentage Change: -2.96% Day High: 22.26 Day Low: 21.42

Weakness on Petrop etc below 21.42 will invariably lead to 20p and hopefu ……..

</p

View Previous Petrop etc & Big Picture ***

LSE:RMG Royal Mail Close Mid-Price: 525 Percentage Change: -4.02% Day High: 544 Day Low: 521.6

Target met. In the event Royal Mail experiences weakness below 521.6 it c ……..

</p

View Previous Royal Mail & Big Picture ***

LSE:RR. Rolls Royce Close Mid-Price: 87.66 Percentage Change: -5.80% Day High: 92.98 Day Low: 86.69

Target met. Continued weakness against RR. taking the price below 86.69 c ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:STAN Standard Chartered Close Mid-Price: 419.1 Percentage Change: -3.59% Day High: 433.4 Day Low: 417.5

In the event Standard Chartered experiences weakness below 417.5 it calcu ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:TLW Tullow Close Mid-Price: 43.63 Percentage Change: -7.21% Day High: 46.45 Day Low: 43.47

If Tullow experiences continued weakness below 43.47, it will invariably ……..

</p

View Previous Tullow & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 150.65 Percentage Change: -3.09% Day High: 153.45 Day Low: 147.8

Target met. If Taylor Wimpey experiences continued weakness below 147.8, ……..

</p

View Previous Taylor Wimpey & Big Picture ***

LSE:VOD Vodafone Close Mid-Price: 113 Percentage Change: -3.09% Day High: 115.86 Day Low: 112.02

Continued weakness against VOD taking the price below 112.02 calculates a ……..

</p

View Previous Vodafone & Big Picture ***