#FreeFTSE #FridayFutures We reviewed Argo Blockchain as recently as April, asking the question ‘Is Argo Blochchain sinking’. It appears we know the answer with the price attaining a low of 86p, closing the session around 87p. This is not good, thanks to our prior report published on Interactive Investor giving a secondary drop target of 92p and hopefully a bounce. By breaking below our 92p and closing below such a level, from our standpoint, any bounce becomes less probable.

The situation now for ARB has a few tweaks implemented, due to price movements over the last few months. Next below 86p introduces the possibility of weakness to an initial 73p. If broken, our “ultimate bottom” remains at 63p, presenting a level by which the price almost must bounce. This is due to a single salient detail. We cannot calculate anything below 63p!

To escape this mess, the share price needs exceed 110p to tick a pretty major box for any recovery to prove genuine. Such a movement should allow recovery to an initial 127 with secondary, if bettered, calculating at an eventual 170p. For now, as mentioned in our original article; ‘For the cautious, perhaps worth keeping a weather eye on it, just in case 63p makes a guest appearance in the weeks ahead.’

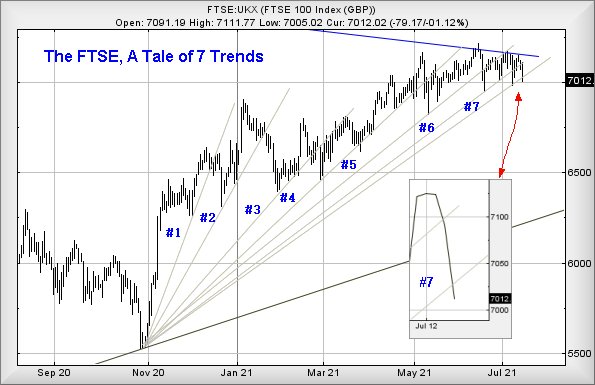

FTSE for FRIDAY We remain somewhat pleased at the number of folk, internationally, who ‘tune in’ every Friday for this report. Given the state of the UK market since June, we fear there’s an expectation of us coming up with magic words to signal the point at which the FTSE actually does something sane. The FTSE opened June at 7022 points. It closed Thursday 15th July at 7018 points! Despite the index making a few attempts upward, some sort of gravity has ensured the market returns to the 7000 level on 8, out of 31 trading days. This sort of glass ceiling behaviour, when witnessed against shares, often indicates a hiatus prior to positive news being announced. Thereafter, any surge upward will tend prove interesting and sharp.

Unfortunately, this is the FTSE, an index which rarely boldly goes anywhere. The market now has broken 7 uptrends since November last year, without actually crashing. The most recent trend breaks provide slight cause for worry, due to the index also failing to exceed prior highs. An argument can be made for weakness settling into place, despite the UK nervously hopping from foot to foot as we count down the seconds to Freedom Day on Monday. Equally nervously, we note the media carefully mentioning Covid-19 infections reaching new highs and we wonder if the UK Govt intends press the brakes on the supposed concept of imminent freedoms.

It’s funny how, using the UK criteria to define what exactly a “Red Zone” country is, the UK would already completely ban any travel to the UK! Perhaps this is where the hesitancy across the FTSE 100 comes as there are a few quite contradictory signals evident. The market has now closed below its 7th uptrend.

The immediate prospect for the FTSE is fairly straightforward. We should anticipate the worst is coming, were it not for the markets serial behaviour of breaking uptrends, bouncing from the 7,000 point level. If things are about to become serious, the index needs drop below 6993 to convince us as this risks imminent reversal to an initial 6963 points. If broken, our secondary works out at 6890 points, taking the index into a truly nasty area where it’s difficult to ignore the potential of 6500 making an appearance eventually.

Of course, there’s always the visual promise the FTSE shall, once again, rebound from the 7000 level. We shall not be inclined to trust any bounce unless the market exceeds 7030 points as this calculates as capable of triggering movement to an initial 7044 points. If bettered, our secondary works out at 7073 points. We’re not immune from noticing both “rebound” targets are pretty lame, the FTSE really needing above 7100 to convince a true attempt to escape the gutter is upon us.

Hopefully the UK can make it to Monday without political action, and a day when some optimism may finally rear its ugly head.

Finally, have a good weekend and remember to cross your fingers for Louis Hamilton remembering how to drive again… It is “our” home Grand Prix after all.

Also, our thanks to those who find adverts on this page sufficiently interesting to check out.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:40:28PM | BRENT | 72.97 | 72.8 | 72.115 | 74.1 | 74.25 | 74.6 | 73.1 | |||

| 10:42:28PM | GOLD | 1829.86 | 1819 | 1816 | 1828 | 1834 | 1837 | 1824 | ‘cess | ||

| 10:45:52PM | FTSE | 7014.9 | 6997 | 6977 | 7049 | 7068 | 7078.5 | 7014 | Success | ||

| 10:52:32PM | FRANCE | 6492.5 | 6466 | 6429 | 6506 | 6506 | 6515.5 | 6477 | Success | ||

| 10:54:30PM | GERMANY | 15619 | 15587 | 15543.5 | 15663 | 15777 | 15792 | 15654 | Success | ||

| 10:56:33PM | US500 | 4354.97 | 4351 | 4339 | 4366 | 4377 | 4384 | 4356 | ‘cess | ||

| 10:58:30PM | DOW | 34953 | 34704 | 34600.5 | 34890 | 34990 | 35079 | 34830 | ‘cess | ||

| 11:00:59PM | NASDAQ | 14782 | 14739 | 14700 | 14839 | 14974 | 15020 | 14870 | Shambles | ||

| 11:03:11PM | JAPAN | 28024 | 27980 | 27923 | 28180 | 28286 | 28334 | 28102 | Success |

15/07/2021 FTSE Closed at 7012 points. Change of -1.11%. Total value traded through LSE was: £ 5,099,995,306 a change of 13.98%

14/07/2021 FTSE Closed at 7091 points. Change of -0.46%. Total value traded through LSE was: £ 4,474,388,413 a change of 6.25%

13/07/2021 FTSE Closed at 7124 points. Change of -0.01%. Total value traded through LSE was: £ 4,211,106,808 a change of 2.19%

12/07/2021 FTSE Closed at 7125 points. Change of 0.06%. Total value traded through LSE was: £ 4,120,988,724 a change of -9.74%

9/07/2021 FTSE Closed at 7121 points. Change of 1.29%. Total value traded through LSE was: £ 4,565,910,390 a change of -14.66%

8/07/2021 FTSE Closed at 7030 points. Change of -1.69%. Total value traded through LSE was: £ 5,350,338,695 a change of -5.7%

7/07/2021 FTSE Closed at 7151 points. Change of 0.72%. Total value traded through LSE was: £ 5,673,997,934 a change of 23.9%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:ASC Asos** **LSE:AV. Aviva** **LSE:BLVN Bowleven** **LSE:BP. BP PLC** **LSE:CCL Carnival** **LSE:CPI Capita** **LSE:DDDD 4D Pharma** **LSE:DGE Diageo** **LSE:EXPN Experian** **LSE:EZJ EasyJet** **LSE:IAG British Airways** **LSE:MKS Marks and Spencer** **LSE:QFI Quadrise** **LSE:RMG Royal Mail** **LSE:SPX Spirax** **LSE:STAN Standard Chartered** **LSE:TW. Taylor Wimpey** **LSE:VOD Vodafone** **

********

Updated charts published on : AFC Energy, Asos, Aviva, Bowleven, BP PLC, Carnival, Capita, 4D Pharma, Diageo, Experian, EasyJet, British Airways, Marks and Spencer, Quadrise, Royal Mail, Spirax, Standard Chartered, Taylor Wimpey, Vodafone,

LSE:AFC AFC Energy Close Mid-Price: 53.7 Percentage Change: -6.77% Day High: 58 Day Low: 52.6

If AFC Energy experiences continued weakness below 52.6, it will invariab ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:ASC Asos Close Mid-Price: 3854 Percentage Change: -18.12% Day High: 4451 Day Low: 3809

Target met. In the event Asos experiences weakness below 3809 it calculat ……..

</p

View Previous Asos & Big Picture ***

LSE:AV. Aviva Close Mid-Price: 393.1 Percentage Change: -0.96% Day High: 399.2 Day Low: 391.5

Target met. Weakness on Aviva below 391.5 will invariably lead to 388 wit ……..

</p

View Previous Aviva & Big Picture ***

LSE:BLVN Bowleven Close Mid-Price: 4 Percentage Change: -11.11% Day High: 4.25 Day Low: 3.5

If Bowleven experiences continued weakness below 3.5, it will invariably ……..

</p

View Previous Bowleven & Big Picture ***

LSE:BP. BP PLC Close Mid-Price: 296.05 Percentage Change: -2.85% Day High: 301.7 Day Low: 293.95

In the event BP PLC experiences weakness below 293.95 it calculates with ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 1425.4 Percentage Change: -2.80% Day High: 1456.2 Day Low: 1424.4

If Carnival experiences continued weakness below 1424.4, it will invariab ……..

</p

View Previous Carnival & Big Picture ***

LSE:CPI Capita Close Mid-Price: 34.02 Percentage Change: -2.13% Day High: 35.24 Day Low: 33.67

Continued weakness against CPI taking the price below 33.67 calculates as ……..

</p

View Previous Capita & Big Picture ***

LSE:DDDD 4D Pharma Close Mid-Price: 88.4 Percentage Change: -1.56% Day High: 90.9 Day Low: 86.7

If 4D Pharma experiences continued weakness below 86.7, it will invariabl ……..

</p

View Previous 4D Pharma & Big Picture ***

LSE:DGE Diageo Close Mid-Price: 3477.5 Percentage Change: -0.27% Day High: 3552.5 Day Low: 3473.5

In the event of Diageo enjoying further trades beyond 3552.5, the share s ……..

</p

View Previous Diageo & Big Picture ***

LSE:EXPN Experian. Close Mid-Price: 3050 Percentage Change: + 2.45% Day High: 3157 Day Low: 3026

Target met. Continued trades against EXPN with a mid-price ABOVE 3157 sho ……..

</p

View Previous Experian & Big Picture ***

LSE:EZJ EasyJet Close Mid-Price: 822.6 Percentage Change: -2.02% Day High: 835.6 Day Low: 807.8

If EasyJet experiences continued weakness below 807.8, it will invariably ……..

</p

View Previous EasyJet & Big Picture ***

LSE:IAG British Airways Close Mid-Price: 165.36 Percentage Change: -3.25% Day High: 171 Day Low: 164.86

Continued weakness against IAG taking the price below 164.86 calculates a ……..

</p

View Previous British Airways & Big Picture ***

LSE:MKS Marks and Spencer Close Mid-Price: 137.5 Percentage Change: -5.24% Day High: 145 Day Low: 138.05

In the event Marks and Spencer experiences weakness below 138.05 it calcu ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:QFI Quadrise Close Mid-Price: 3.3 Percentage Change: -6.78% Day High: 3.52 Day Low: 3.3

If Quadrise experiences continued weakness below 3.3, it will invariably ……..

</p

View Previous Quadrise & Big Picture ***

LSE:RMG Royal Mail Close Mid-Price: 553.8 Percentage Change: -2.19% Day High: 567.4 Day Low: 551.6

Continued weakness against RMG taking the price below 551.6 calculates as ……..

</p

View Previous Royal Mail & Big Picture ***

LSE:SPX Spirax. Close Mid-Price: 14440 Percentage Change: + 1.30% Day High: 14460 Day Low: 14255

Target met. Continued trades against SPX with a mid-price ABOVE 14460 sho ……..

</p

View Previous Spirax & Big Picture ***

LSE:STAN Standard Chartered Close Mid-Price: 440.5 Percentage Change: -1.28% Day High: 448.5 Day Low: 439.7

Continued weakness against STAN taking the price below 439.7 calculates a ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 156.65 Percentage Change: -3.60% Day High: 162 Day Low: 156.65

Continued weakness against TW. taking the price below 156.65 calculates a ……..

</p

View Previous Taylor Wimpey & Big Picture ***

LSE:VOD Vodafone Close Mid-Price: 115.3 Percentage Change: -1.86% Day High: 117.64 Day Low: 114.6

If Vodafone experiences continued weakness below 114.6, it will invariabl ……..

</p

View Previous Vodafone & Big Picture ***