#Nasdaq #DOW Our weekly review of the #FTSE continues to generate surprising visitor sources. Argentina is now our 3rd most popular feed for reasons which remain unknown, providing more visitors than France, Spain, India, or Canada. The UK & US remain dominant at the top of our Friday listings.

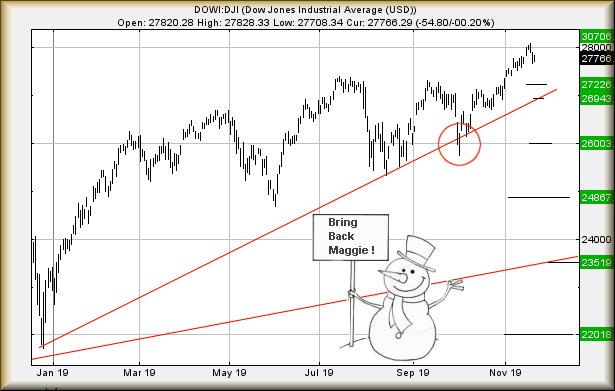

Whether it’s US vs China, the UK’s woes, or whatever, markets are not doing particularly well at present with early signs of the DOW coming “off the boil”. We’re quite far from pressing any sort of panic button but should the US primary index manage below 27,600, it shall be regarded as entering a cycle down to 27,250 points and hopefully some sort of rebound. If broken, our secondary calculates at 26,950, a point where it almost must bounce. The US market requires exceed 27,900 to escape this immediate prophecy of doom. Any reason for the US to find itself below 26,950 will prove pretty alarming, thanks to the risk of a further 1,000 point freefall!

The FTSE, closing Thursday at 7,231, risks some immediate trouble if it wanders below 7,180 points. Such a trigger risks kickstarting a mantra threatening a visit to 7,164 points initially. If broken, secondary is at 7,083 points and hopefully some sort of real bounce.

To get out of trouble, the UK market requires better 7,294 points as this should prove capable of 7,320 points. If bettered, secondary is at 7,356 along with a strong chance of some hesitation. As always, we’ve a major however…

On Tuesday, the UK market did something we really dislike. Between 10:45 and 2:30pm on the 19th, the market painted a very slow, very deliberate, downtrend. It was almost like some “grown up” had decided ‘This is the new trend and any rise cannot be taken seriously unless the index betters this downtrend!’ As a result, we’re pretty far from confident about any long position scenario.***

At present, this unpleasant stain is at 7,311 points. If past experience proves reliable, the market shall now struggle to exceed this strange Blue line until such point a material change in circumstances emerge. As a result, we strongly suspect the current reversal cycle intends 7,083 points. We’ve shown the start of this deliberate trend on a chart inset, to try and explain why the main chart has a Blue downtrend simply hanging in the air. This sort of contrived trend generally highlights, quite firmly, a coming period of reversals.

***This movement was on the FTSE. Curiously, FTSE Futures did not display quite as vivid price movements and suggest Futures only require exceed 7265 presently to better this strange trend. We’re inclined to pay more attention to the FTSE itself as it was “real”.

Have a good weekend.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:54:36PM |

BRENT |

62.89 |

61.22 |

61.07 |

63.26 |

63.43 |

‘cess | ||||

|

10:59:27PM |

GOLD |

1465 |

1462 |

1460 |

1474 |

1476.5 |

‘cess | ||||

|

11:04:05PM |

FTSE |

7249.78 |

7194 |

7155 |

7255 |

7266 | |||||

|

11:09:39PM |

FRANCE |

5891 |

5833 |

5824.5 |

5897 |

5903.5 |

‘cess | ||||

|

11:12:09PM |

GERMANY |

13169.37 |

13079 |

13012 |

13180 |

13193.5 |

‘cess | ||||

|

11:14:39PM |

US500 |

3104.42 |

3093 |

3087 |

3115 |

3118 |

Sorry | ||||

|

11:21:36PM |

DOW |

27777 |

27670 |

27626 |

27902 |

27971.5 | |||||

|

11:27:11PM |

NASDAQ |

8274.5 |

8240 |

8221.5 |

8300 |

8316.5 | |||||

|

11:30:03PM |

JAPAN |

23071 |

22717 |

22529 |

23155 |

23285.5 |

Success |