#Brent #Dax_Futures It’s always quite pleasing when the market chooses to confirm a theory. We often bang on about the importance of a share price closing above (or below) specific levels as a method of confirming whether a trend line is bogus. One such scenario involves up-trends, along with the point of a trend break.

Natwest, in recent weeks, demonstrate exactly what we’re talking about.

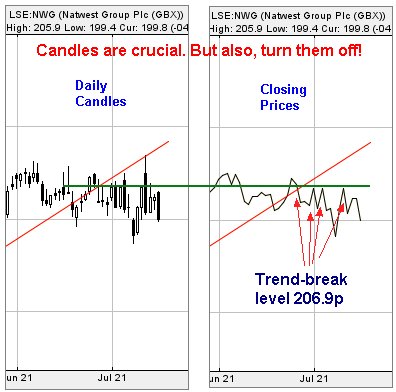

The two chart extracts below highlight an interesting stance by the market. The Red uptrend since September 2020 looks pretty important and it appears the market shares this viewpoints. In the period since the market broke this uptrend at the end of last month, considerable care has been taken to ensure NWG’s share price has failed to close a session above the point of trend break. To us, this is a pretty big deal, confirming this historical uptrend was indeed valid and worse, suggesting the break of the trend should be viewed as a precursor to some coming reversals.

For three quite different reasons, this is a bit of a surprise, thanks to us taking time to read the financial press.

Firstly, the constraints on Dividend Payments came off last week, the UK big three expected to introduce 5%+ payments within a year or so.

Second, we’re approaching another Earnings Season for the banks and it appears we should anticipate them doing better than expected. Apparently losses due to the Pandemic were nothing like expected.

Thirdly is a bit left field. The ex-CEO of Barclays has called for an end to the requirement for banks to ring fence capital, joining a growing clamour to enable the institutions to explore more exotic ways of earning money. It must be admitted, there’s a strong chance the level of regulation inflicted on the industry has become over-regulation to the point of actually causing harm.

Collectively, the three arguments above should produce a picture of a share price desperate to go up but instead, we’re now a little flummoxed, starting to suspect some reversal make be on the cards.

Near term, below just 199p for Natwest suggests imminent weakness to an initial 188p with secondary, if broken, at 178p. In the event the 178p level breaks, all that’s left is a real hope for a rebound before a third level calculation of 164p.

Our alternate scenario demands the share price trade above 210p to introduce the potential of a gain to 215p. At this level, it all becomes a story of whether the share closes a session above the Blue downtrend, due to some spectacular movement becoming possible. Closure above Blue shall allow us to confidently mention 253p and beyond as ambitions for the future.

For now, our suspicion is the share price risks being a little bit stuffed but we’d suspect if 164p (ish) makes a guest appearance, a future bounce is liable to prove interesting.

As always, our thanks to the folk who find adverts on this page fascinating. Keeps the ‘Taylors Lazy Sunday’ coffee beans coming. <not kidding, our favourite>

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:01:56AM | BRENT | 72.9 | 72.5 | 71.895 | 70.41 | 73.67 | 73.73 | 74.36 | 75.15 | 72.67 | ‘cess |

| 9:05:40AM | GOLD | 1812.61 | Success | ||||||||

| 9:29:35AM | FTSE | 7011.82 | |||||||||

| 9:31:50AM | FRANCE | 6443 | ‘cess | ||||||||

| 12:50:25PM | GERMANY | 15500 | 15473 | 15407 | 15362 | 15623 | 15704 | 15733 | 15819 | 15591 | ‘cess |

| 1:36:32PM | US500 | 4326 | Success | ||||||||

| 1:39:39PM | DOW | 34686 | ‘cess | ||||||||

| 1:41:59PM | NASDAQ | 14679 | ‘cess | ||||||||

| 1:52:39PM | JAPAN | 27741 | ‘cess |

16/07/2021 FTSE Closed at 7008 points. Change of -0.06%. Total value traded through LSE was: £ 5,019,385,780 a change of -1.58%

15/07/2021 FTSE Closed at 7012 points. Change of -1.11%. Total value traded through LSE was: £ 5,099,995,306 a change of 13.98%

14/07/2021 FTSE Closed at 7091 points. Change of -0.46%. Total value traded through LSE was: £ 4,474,388,413 a change of 6.25%

13/07/2021 FTSE Closed at 7124 points. Change of -0.01%. Total value traded through LSE was: £ 4,211,106,808 a change of 2.19%

12/07/2021 FTSE Closed at 7125 points. Change of 0.06%. Total value traded through LSE was: £ 4,120,988,724 a change of -9.74%

9/07/2021 FTSE Closed at 7121 points. Change of 1.29%. Total value traded through LSE was: £ 4,565,910,390 a change of -14.66%

8/07/2021 FTSE Closed at 7030 points. Change of -1.69%. Total value traded through LSE was: £ 5,350,338,695 a change of -5.7%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:BARC Barclays** **LSE:BP. BP PLC** **LSE:CAR Carclo** **LSE:CCL Carnival** **LSE:FGP Firstgroup** **LSE:GENL Genel** **LSE:HSBA HSBC** **LSE:IQE IQE** **LSE:MKS Marks and Spencer** **LSE:POG Petrop etc** **LSE:QFI Quadrise** **LSE:RMG Royal Mail** **LSE:SPX Spirax** **LSE:STAN Standard Chartered** **LSE:TW. Taylor Wimpey** **LSE:VOG VICTORIA** **

********

Updated charts published on : Aviva, Barclays, BP PLC, Carclo, Carnival, Firstgroup, Genel, IQE, Marks and Spencer, Petrop etc, Quadrise, Royal Mail, Spirax, Standard Chartered, Taylor Wimpey, VICTORIA,

LSE:AV. Aviva Close Mid-Price: 391.4 Percentage Change: -0.43% Day High: 397.8 Day Low: 389.8

Continued weakness against AV. taking the price below 389.8 calculates as ……..

</p

View Previous Aviva & Big Picture ***

LSE:BARC Barclays Close Mid-Price: 165.42 Percentage Change: -2.19% Day High: 170.82 Day Low: 164.24

If Barclays experiences continued weakness below 164.24, it will invariab ……..

</p

View Previous Barclays & Big Picture ***

LSE:BP. BP PLC Close Mid-Price: 292.25 Percentage Change: -1.28% Day High: 300.6 Day Low: 290.25

Weakness on BP PLC below 290.25 will invariably lead to 286 with secondar ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CAR Carclo Close Mid-Price: 41.4 Percentage Change: -7.17% Day High: 45.9 Day Low: 39.9

Target met. Continued weakness against CAR taking the price below 39.9 ca ……..

</p

View Previous Carclo & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 1414.2 Percentage Change: -0.79% Day High: 1451.6 Day Low: 1404

In the event Carnival experiences weakness below 1404 it calculates with ……..

</p

View Previous Carnival & Big Picture ***

LSE:FGP Firstgroup Close Mid-Price: 77.6 Percentage Change: -3.18% Day High: 83 Day Low: 77

If Firstgroup experiences continued weakness below 77, it will invariably ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:GENL Genel Close Mid-Price: 144.8 Percentage Change: -3.08% Day High: 149.6 Day Low: 143

In the event Genel experiences weakness below 143 it calculates with a dr ……..

</p

View Previous Genel & Big Picture ***

LSE:HSBA HSBC Close Mid-Price: 403.25 Percentage Change: -1.35% Day High: 411.65 Day Low: 401.75

Weakness on HSBC below 401.75 will invariably lead to 395 with secondary, ……..

</p

View Previous HSBC & Big Picture ***

LSE:IQE IQE Close Mid-Price: 45.8 Percentage Change: -3.27% Day High: 47.8 Day Low: 44.95

Continued weakness against IQE taking the price below 44.95 calculates as ……..

</p

View Previous IQE & Big Picture ***

LSE:MKS Marks and Spencer. Close Mid-Price: 138.3 Percentage Change: + 0.58% Day High: 141.15 Day Low: 137.65

Weakness on Marks and Spencer below 137.65 will invariably lead to 131p. ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:POG Petrop etc Close Mid-Price: 22.3 Percentage Change: -2.19% Day High: 23.58 Day Low: 22.32

In the event Petrop etc experiences weakness below 22.32 it calculates wi ……..

</p

View Previous Petrop etc & Big Picture ***

LSE:QFI Quadrise. Close Mid-Price: 3.98 Percentage Change: + 20.61% Day High: 3.4 Day Low: 3.19

Something positive is finally happening as movement above 4p should bring ……..

</p

View Previous Quadrise & Big Picture ***

LSE:RMG Royal Mail Close Mid-Price: 547 Percentage Change: -1.23% Day High: 557.4 Day Low: 547.2

If Royal Mail experiences continued weakness below 547.2, it will invaria ……..

</p

View Previous Royal Mail & Big Picture ***

LSE:SPX Spirax Close Mid-Price: 14170 Percentage Change: -1.87% Day High: 14600 Day Low: 14070

Target met. In the event of Spirax enjoying further trades beyond 14600, ……..

</p

View Previous Spirax & Big Picture ***

LSE:STAN Standard Chartered Close Mid-Price: 434.7 Percentage Change: -1.32% Day High: 443.7 Day Low: 433.1

If Standard Chartered experiences continued weakness below 433.1, it will ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 155.45 Percentage Change: -0.77% Day High: 158.8 Day Low: 154.9

In the event Taylor Wimpey experiences weakness below 154.9 it calculates ……..

</p

View Previous Taylor Wimpey & Big Picture ***

LSE:VOG VICTORIA Close Mid-Price: 4.03 Percentage Change: -2.42% Day High: 4.12 Day Low: 3.88

Target met. If VICTORIA experiences continued weakness below 3.88, it wil ……..

</p

View Previous VICTORIA & Big Picture ***