#FTSE #DOW A lot has happened in the 4 months since we last reviewed Eurasia, not least today (Tuesday) being woken at 6am by grandchildren arguing. Thanks to forthcoming travel bans, a good idea of bringing Xmas day forward to allow family to visit, cause chaos, eat too much, stay a few days and drive home in time for the UK Govt establishing internal blockades here on ‘Plague Island’ (thanks, NY Times!) ensured we did a “Proper Xmas” 3 days early.

Somehow, the bit I hadn’t factored in was the need to work after dinner. Some other family, somewhere else in the UK, must have (sub 9y/o) girls who’s great idea to allow an escape from the dinner table was something they called a Maths Quiz. This act of arithmetical nastiness proved horrifying, especially after suitable wine consumption during the day. Thankfully, as I write this, the other 3 adults remain trapped at the dining table, doubtless enjoying the gleeful shrieks from the girls as yet another wrong answer is supplied.

There’s something wrong with kids today, if a “Maths Quiz” is regarded a good idea…

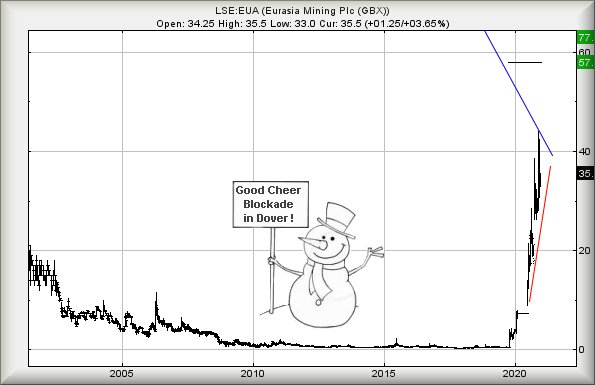

Platinum and gold producer, Eurasia, achieved our initial target level postulated in August and while it came close to our secondary of 45p, it’s a worry the mid-price only achieved 44p before tumbling back to the 30p level. Perhaps it was a calibration error but we doubt it. Unless the company make a faux pas, once it started trading beyond our initial target level, continued travel to 45p was pretty inevitable and we suspect it’s ‘just’ overall market conditions provoking hesitation.

The situation now is pretty useful, movement next above 43p suggesting ongoing travel to an initial 57p with secondary, if bettered, at a longer term 77p.

To finish on an easy note, the price needs fall below 26p to now cause utter panic.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:49:35PM | BRENT | 49.95 | 49.55 | 49.275 | 48.66 | 50.63 | 50.71 | 51.155 | 51.68 | 50.02 | |

| 9:52:06PM | GOLD | 1860.08 | 1858 | 1848.5 | 1829 | 1873 | 1884 | 1892.5 | 1904 | 1866 | ‘cess |

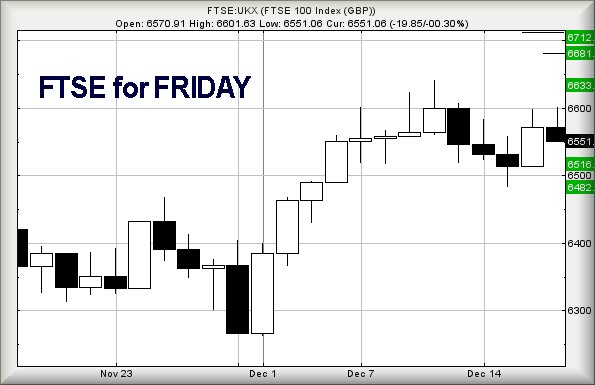

| 10:02:23PM | FTSE | 6458.84 | 6363 | 6316.5 | 6209 | 6438 | 6466 | 6477.5 | 6515 | 6405 | |

| 10:04:36PM | FRANCE | 5468.7 | 5401 | 5394.5 | 5367 | 5453 | 5477 | 5506 | 5536 | 5432 | |

| 10:06:47PM | GERMANY | 13406 | 13337 | 13296.5 | 13248 | 13406 | 13446 | 13566.5 | 13741 | 13347 | |

| 10:08:28PM | US500 | 3683.47 | 3672 | 3659 | 3644 | 3698 | 3704 | 3715 | 3753 | 3673 | |

| 10:10:27PM | DOW | 30016 | 29980 | 29816 | 29652 | 30160 | 30311 | 30384.5 | 30705 | 30070 | |

| 10:33:21PM | NASDAQ | 26531 | 26348 | 26295.5 | 26084 | 26531 | 26632 | 26705.5 | 26825 | 26483 |