#Gold #Stoxx

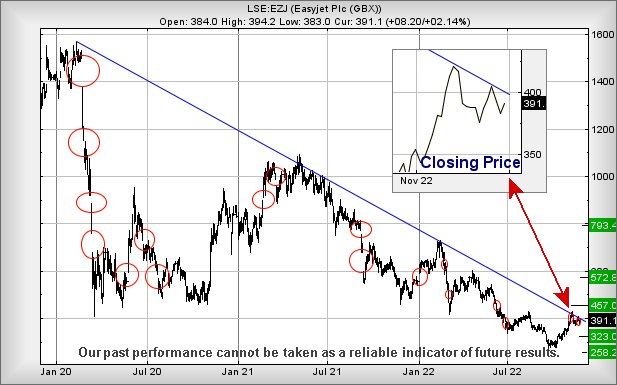

We quite cruelly refer to market price gaps at the open of trade as “manipulation”. Our reasoning is quite basic, if no-one was able to trade, how else can the market justify the price movement? But if manipulation is your thing, few shares prove quite as fascinating as Easyjet, a share where we’ve been painting little red circles since 2020 on inexplicable price movements.

There are a lot, an awful lot, roughly 10 per year.

From our perspective, it’s a sodding nuisance as software likes data which makes sense. When gaps in the trading value of shares appear, they provoke a degree of confusion and led us to introduce a little piggy bank of gap values against shares. These accumulating values essentially allow for Plus or Minus parameters in any major price movement. To be fair, we’ve as little confidence in this logic proving correct or having any hope the reader will understand the point being made.

With Easyjet, the confusion is strong with this one. We reviewed the share a couple of months ago, promising we’d revisit if the price closed above our 355p target level.

Trading around 390p at time of writing, the share price needs exceed just 415p to give considerable hope for an ascent to an initial 457p with secondary, if bettered, at a longer term 572p. So far, so good, unless we throw a spanner in the works and take account of manipulation gaps. Above our secondary hovers a third level calculation at 793p, a number which visually even looks sane! Our confidence always increases, when target values match historic highs or lows. In the case of the 800p level, the share price has tended to pivot above and below for quite a while.

Unfortunately, this is Easyjet and we’re a little worried at the effort employed to stop the share price from closing above Blue, the downtrend since pre-pandemic 2020. If this avoidance of the trend proves correct, below 370p risks promoting reversal to an initial 323p with secondary, if broken, down at 258p.

We think Easyjet shall offer a surprise and head to 572p next.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:00:22PM | BRENT | 86.78 | |||||||||

| 10:03:43PM | GOLD | 1770.08 | 1757 | 1754 | 1749 | 1765 | 1771 | 1776 | 1780 | 1757 | ‘cess |

| 10:07:01PM | FTSE | 7615.89 | Success | ||||||||

| 10:19:35PM | STOX50 | 4019.2 | 3941 | 3912 | 3876 | 3971 | 4020 | 4037 | 4031 | 3988 | ditto |

| 10:26:50PM | GERMANY | 14588 | |||||||||

| 10:28:41PM | US500 | 4086 | Success | ||||||||

| 10:30:59PM | DOW | 34565 | ditto | ||||||||

| 10:33:31PM | NASDAQ | 12048.8 | ditto | ||||||||

| 10:35:45PM | JAPAN | 28361 | ditto |

30/11/2022 FTSE Closed at 7573 points. Change of 0.81%. Total value traded through LSE was: £ 8,552,950,993 a change of 45.26%

29/11/2022 FTSE Closed at 7512 points. Change of 0.51%. Total value traded through LSE was: £ 5,887,947,739 a change of 42.84%

28/11/2022 FTSE Closed at 7474 points. Change of -0.16%. Total value traded through LSE was: £ 4,121,947,461 a change of -6.58%

25/11/2022 FTSE Closed at 7486 points. Change of 0.27%. Total value traded through LSE was: £ 4,412,047,721 a change of 36.26%

24/11/2022 FTSE Closed at 7466 points. Change of 0.01%. Total value traded through LSE was: £ 3,237,992,179 a change of -28.67%

23/11/2022 FTSE Closed at 7465 points. Change of 0.17%. Total value traded through LSE was: £ 4,539,480,951 a change of 32.52%

22/11/2022 FTSE Closed at 7452 points. Change of 1.03%. Total value traded through LSE was: £ 3,425,428,256 a change of -30.51%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:BARC Barclays** **LSE:CAR Carclo** **LSE:CBX Cellular Goods** **LSE:DGE Diageo** **LSE:GLEN Glencore Xstra** **LSE:IGAS Igas Energy** **LSE:NWG Natwest** **LSE:OCDO Ocado Plc** **LSE:STAN Standard Chartered** **

********

Updated charts published on : Asos, Barclays, Carclo, Cellular Goods, Diageo, Glencore Xstra, Igas Energy, Natwest, Ocado Plc, Standard Chartered,

LSE:ASC Asos. Close Mid-Price: 631.5 Percentage Change: + 3.36% Day High: 628.5 Day Low: 585

If Asos experiences continued weakness below 585, it will invariably lead ……..

</p

View Previous Asos & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 161.24 Percentage Change: + 0.15% Day High: 162.8 Day Low: 160.38

Continued trades against BARC with a mid-price ABOVE 162.8 should improve ……..

</p

View Previous Barclays & Big Picture ***

LSE:CAR Carclo Close Mid-Price: 14 Percentage Change: -11.11% Day High: 14.95 Day Low: 10.6

Target met. If Carclo experiences continued weakness below 10.6, it will ……..

</p

View Previous Carclo & Big Picture ***

LSE:CBX Cellular Goods Close Mid-Price: 1.25 Percentage Change: -7.41% Day High: 1.35 Day Low: 1.25

In the event Cellular Goods experiences weakness below 1.25 it calculates ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:DGE Diageo. Close Mid-Price: 3808 Percentage Change: + 1.06% Day High: 3833 Day Low: 3774.5

Further movement against Diageo ABOVE 3833 should improve acceleration to ……..

</p

View Previous Diageo & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 563.5 Percentage Change: + 2.31% Day High: 566.4 Day Low: 549

Target met. Continued trades against GLEN with a mid-price ABOVE 566.4 sh ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:IGAS Igas Energy. Close Mid-Price: 22 Percentage Change: + 3.29% Day High: 21.4 Day Low: 20.4

Target met. If Igas Energy experiences continued weakness below 20.4, it ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 261.9 Percentage Change: + 0.54% Day High: 264.4 Day Low: 260.3

Continued trades against NWG with a mid-price ABOVE 264.4 should improve ……..

</p

View Previous Natwest & Big Picture ***

LSE:OCDO Ocado Plc. Close Mid-Price: 622.6 Percentage Change: + 0.91% Day High: 634.2 Day Low: 613

Continued trades against OCDO with a mid-price ABOVE 750 should improve th ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 617.4 Percentage Change: + 1.38% Day High: 617.8 Day Low: 608.2

Further movement against Standard Chartered ABOVE 617.8 should improve ac ……..

</p

View Previous Standard Chartered & Big Picture ***