#FTSE #Nasdaq

We’d a couple of interesting “reader requests” today and one immediately caught our eye. Ardmore Shipping. Surely Ardmore must enjoy local roots from Scotland, a local peninsula in Argyll giving terrible views of nothing really. Neither Greenock nor a partially sunken ship justify ever visiting. Perhaps the excellent Ardmore Malt whisky provided the inspiration but visiting their distillery on a wet day is an experience to avoid. And it’s often very wet, windy, and bleak in the Cairngorms.

Thankfully with no visible link to Scotland, Ardmore Shipping commenced 12 years ago, creating a new shipping company carrying chemicals and other products via their own fleet of tankers. Anyone who enjoys looking at pictures of tankers is advised to visit the corporate website. They appear proud of their fleet, described as the most modern in the industry. Their share price appears to justify some confidence as it’s currently trading at an all time high, requiring very little effort to once again climb higher.

We’ve calculates $16.50 as a viable trigger level to hopefully produce further share price gains. Above this level looks capable of promoting gains toward an initial 17.75 with our longer term secondary, should such a tame ambition be exceeded, working out at 22.75 dollars. Perhaps this shall prove worth keeping an eye on, their share price needing below $11 to promote a panic.

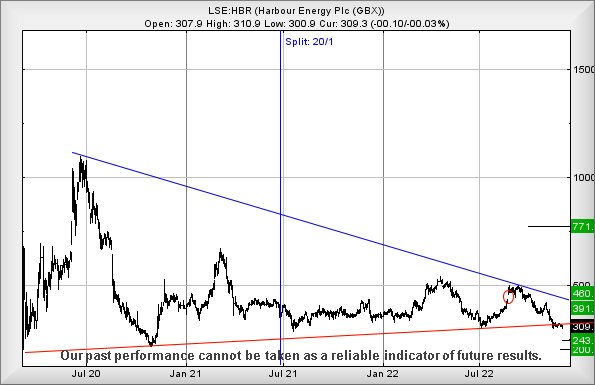

Harbour Energy (LSE:HBR) We’d glanced at this back in September and every appears to be going wrong with their share price. Visually, it’s easy to believe the price is experiencing a “double bottom” as visually, the current trip to the 300p level visually matches the lows from July earlier this year.

Alas, there’s a tiny little problem insofar as while this is indeed the case, their share price has broken below the Red uptrend which dates back to 2020. As the share price has not closed a session below 298.5p yet, the final nail has not been hammered but we’d advocate caution, despite them being proclaimed as the largest London Listed independent oil & gas company.

The immediate situation, their share price trading at 309 at time of writing, calculates with a threat of movement below 298 bringing a visit down to 243 with secondary, if broken, a probable bottom just above the 200p level.

If any miracle recovery is planned, the share price needs exceed 354p to apparently trigger movement to an initial 391p with secondary, if bettered, a longer term 460p.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:03:43PM | BRENT | 79.8 | Success | ||||||||

| 10:06:35PM | GOLD | 1771.7 | |||||||||

| 10:09:12PM | FTSE | 7554.51 | 7500 | 7478 | 7460 | 7536 | 7557 | 7569 | 7592 | 7534 | ‘cess |

| 10:11:31PM | STOX50 | 3940 | ‘cess | ||||||||

| 10:13:59PM | GERMANY | 14302 | ‘cess | ||||||||

| 10:16:22PM | US500 | 3942.27 | ‘cess | ||||||||

| 10:19:02PM | DOW | 33602.8 | ‘cess | ||||||||

| 10:21:40PM | NASDAQ | 11553.1 | 11480 | 11421 | 11324 | 11565 | 11642 | 11698 | 11769 | 11558 | Success |

| 10:23:47PM | JAPAN | 27648 |

6/12/2022 FTSE Closed at 7521 points. Change of -0.61%. Total value traded through LSE was: £ 5,764,980,013 a change of 13.53%

5/12/2022 FTSE Closed at 7567 points. Change of 0.15%. Total value traded through LSE was: £ 5,078,150,606 a change of 13.07%

2/12/2022 FTSE Closed at 7556 points. Change of -0.03%. Total value traded through LSE was: £ 4,491,031,065 a change of -9.42%

1/12/2022 FTSE Closed at 7558 points. Change of -0.2%. Total value traded through LSE was: £ 4,958,235,310 a change of -42.03%

30/11/2022 FTSE Closed at 7573 points. Change of 0.81%. Total value traded through LSE was: £ 8,552,950,993 a change of 45.26%

29/11/2022 FTSE Closed at 7512 points. Change of 0.51%. Total value traded through LSE was: £ 5,887,947,739 a change of 42.84%

28/11/2022 FTSE Closed at 7474 points. Change of -0.16%. Total value traded through LSE was: £ 4,121,947,461 a change of -6.58%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:AZN Astrazeneca** **LSE:FOXT Foxtons** **LSE:OXIG Oxford Instruments** **LSE:POLY Polymetal** **LSE:RR. Rolls Royce** **LSE:SCLP Scancell** **LSE:VOD Vodafone** **

********

Updated charts published on : Aviva, Astrazeneca, Foxtons, Oxford Instruments, Polymetal, Rolls Royce, Scancell, Vodafone,

LSE:AV. Aviva. Close Mid-Price: 444.2 Percentage Change: + 0.18% Day High: 446.9 Day Low: 441.4

Moves now above 467 look capable of provoking a lift to 484 next with seco ……..

</p

View Previous Aviva & Big Picture ***

LSE:AZN Astrazeneca Close Mid-Price: 11150 Percentage Change: -0.98% Day High: 11268 Day Low: 11160

Above just 11352 should now prove significant, triggering a visit to an in ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:FOXT Foxtons Close Mid-Price: 30.85 Percentage Change: -0.64% Day High: 31.4 Day Low: 30.75

Now below 30p looks capable of inducing reversal to an initial 28 with sec ……..

</p

View Previous Foxtons & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 2150 Percentage Change: -4.02% Day High: 2275 Day Low: 2140

All Oxford Instruments needs are mid-price trades ABOVE 2275 to improve a ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:POLY Polymetal Close Mid-Price: 238 Percentage Change: -3.04% Day High: 248 Day Low: 230

Price improvement above 265 now looks capable of providing a lift to an in ……..

</p

View Previous Polymetal & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 93.49 Percentage Change: + 3.20% Day High: 94.45 Day Low: 91.22

Further movement against Rolls Royce ABOVE 94.45 should improve accelerat ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SCLP Scancell. Close Mid-Price: 27 Percentage Change: + 15.38% Day High: 27 Day Low: 23.25

Target met. In the event of Scancell enjoying further trades beyond 27, t ……..

</p

View Previous Scancell & Big Picture ***

LSE:VOD Vodafone Close Mid-Price: 89.27 Percentage Change: -1.92% Day High: 91.11 Day Low: 88.56

Weakness on Vodafone below 88.56 will invariably lead to 87 with secondar ……..

</p

View Previous Vodafone & Big Picture ***