#Gold #WallSt

With idle curiosity and a touch of sardonic humour, news of a budget airline called Wizz Air coming bottom in customer ratings for short-haul flights in Europe, actually worse than Ryanair and British Airways, prompted a look at the table of customer service results. It was a surprise to note Jet2 Plc topped the vote with a 5 star rating. We’d incorrectly assumed the UK’s second largest travel operator would be found in the mid-range, suffering from an inevitable malaise of size. But instead, the company appear to one customers return to, again and again.

There are early signs the share price is poised to become interesting.

The share price has exceeded the downtrend since 2021, laying the foundations for some positive movement as it looks like it only need exceed 1292p to hopefully trigger movement to an initial 1429p, an ambition which makes a lot of visual sense. With closure above 1429p, we’re able to calculate a longer term 1757p, a new high since the company rebranded from Dart to Jet2 back in 2020.

For everything to go wrong, perhaps conceding pandemic fears remain, the share price needs close a session below 1245p as this risks triggering reversals to an initial 1083p with our secondary, if broken, at a probable bottom of 915p. Visually, such an event seems unlikely as we’re fairly optimistic about this share price future.

But will also admit, entering a petri dish such as an airline cabin, remains an abhorrent idea for the writer, personally. It’s going to be likely many folk remain with such a sheltered and paranoid viewpoint, making recovery for airline shares liable to be a long term process.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:18:06PM | BRENT | 80.37 | Success | ||||||||

| 10:21:16PM | GOLD | 1824.86 | 1823 | 1819 | 1812 | 1833 | 1842 | 1847 | 1855 | 1834 | ‘cess |

| 10:23:47PM | FTSE | 7909 | Success | ||||||||

| 10:26:07PM | STOX50 | 4248.5 | |||||||||

| 10:28:15PM | GERMANY | 15419.99 | |||||||||

| 10:30:34PM | US500 | 4001.12 | ‘cess | ||||||||

| 10:44:44PM | DOW | 33082.2 | 32927 | 32858 | 32455 | 33217 | 33260 | 33332 | 33467 | 33080 | ‘cess |

| 10:46:42PM | NASDAQ | 12142 | |||||||||

| 10:49:32PM | JAPAN | 27050 | Success |

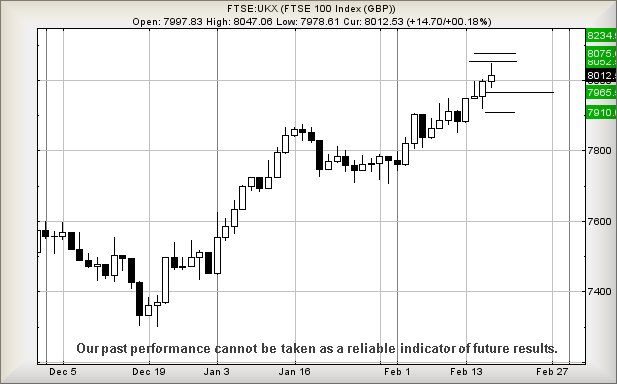

22/02/2023 FTSE Closed at 7930 points. Change of -0.59%. Total value traded through LSE was: £ 5,775,714,264 a change of -17.45%

21/02/2023 FTSE Closed at 7977 points. Change of -0.46%. Total value traded through LSE was: £ 6,996,845,952 a change of 263.69%

20/02/2023 FTSE Closed at 8014 points. Change of 0.12%. Total value traded through LSE was: £ 1,923,863,385 a change of -74.93%

17/02/2023 FTSE Closed at 8004 points. Change of -0.1%. Total value traded through LSE was: £ 7,672,519,841 a change of 57.8%

16/02/2023 FTSE Closed at 8012 points. Change of 0.19%. Total value traded through LSE was: £ 4,862,026,417 a change of -10.79%

15/02/2023 FTSE Closed at 7997 points. Change of 0.55%. Total value traded through LSE was: £ 5,450,342,646 a change of -0.23%

14/02/2023 FTSE Closed at 7953 points. Change of 0.08%. Total value traded through LSE was: £ 5,463,158,317 a change of 17.15%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:BBY BALFOUR BEATTY** **LSE:CASP Caspian** **LSE:FRES Fresnillo** **LSE:TERN Tern Plc** **LSE:TLW Tullow** **LSE:TRN The Trainline** **

********

Updated charts published on : Asos, BALFOUR BEATTY, Caspian, Fresnillo, Tern Plc, Tullow, The Trainline,

LSE:ASC Asos Close Mid-Price: 810 Percentage Change: -0.98% Day High: 825.5 Day Low: 794.5

If Asos experiences continued weakness below 794.5, it will invariably le ……..

</p

View Previous Asos & Big Picture ***

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 360.6 Percentage Change: + 0.17% Day High: 361 Day Low: 357

Now above 368 calculates with the potential of a lift to 395 next with sec ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:CASP Caspian Close Mid-Price: 7.9 Percentage Change: -2.47% Day High: 8.55 Day Low: 7.85

Target met. Further movement against Caspian ABOVE 8.55 should improve ac ……..

</p

View Previous Caspian & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 779.4 Percentage Change: -1.72% Day High: 787 Day Low: 768.4

Continued weakness against FRES taking the price below 768.4 calculates a ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:TERN Tern Plc Close Mid-Price: 6.88 Percentage Change: -5.17% Day High: 7.25 Day Low: 6.75

In the event Tern Plc experiences weakness below 6.75 it calculates with ……..

</p

View Previous Tern Plc & Big Picture ***

LSE:TLW Tullow Close Mid-Price: 32.94 Percentage Change: -3.12% Day High: 33.56 Day Low: 32.86

If Tullow experiences continued weakness below 32.86, it will invariably ……..

</p

View Previous Tullow & Big Picture ***

LSE:TRN The Trainline Close Mid-Price: 240.4 Percentage Change: -1.76% Day High: 249.6 Day Low: 238.5

Target met. Weakness on The Trainline below 238.5 will invariably lead to ……..

</p

View Previous The Trainline & Big Picture ***