#FTSE #GOLD

We looked at the AIM a few weeks ago, confidently giving a trigger level above which “things” should start happening. Unfortunately, the junior UK market is behaving with the resilience of a bird dropping on a car windscreen, refusing to move significantly.

Since the AIM hit its trigger level, it moved upward by around 20 points before slight retreats, not exactly the song and dance we’d been hoping for. Presently trading around 870 points, above just 876 should now promote the concept of movement to an initial 899 with secondary, if bettered, at 943 points. Achieving such a level should hopefully provoke longer term movement of strength and emulate the FTSE, a market which has grown by 1,000 points since Liz Truss decided the UK would be better off without her interference.

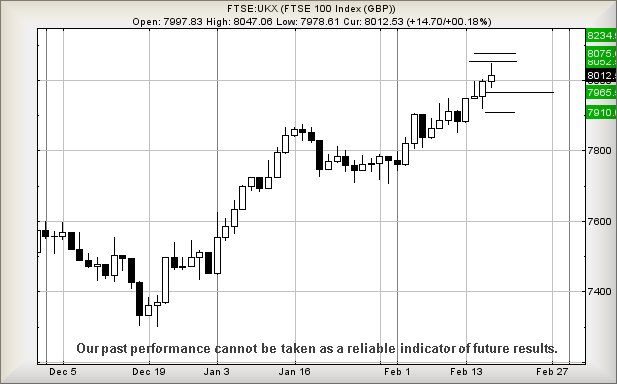

FTSE for FRIDAY It’s going to be interesting if the FTSE experiences yet another day of gains on Friday, a relatively unusual 5 straight Blue days for the market. Unusual, except for the first week of this year, where 5 sessions saw growth of 400 points. This week has witnessed 300 points of movement and while the jumps are not proving spectacular, they’ve been steady.

Near term, above 8027 points hints at the potential of a lift to an initial 8052 points. Our secondary, if it’s party time, works out at 8075 points. If triggered, the tightest stop loss looks like a reasonable 7998 points and overall, we still suspect our longer term ambition around 8234 shall prove capable of hesitation.

Our converse scenario allows weakness below 7998 to promote reversal to a useless 7988 points. If broken, our secondary works out at 7965 points.

Have a good weekend.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:24:16PM | BRENT | 84.49 | 84.33 | 83.81 | 85.04 | 85.97 | 86.53 | 84.97 | ‘cess | ||

| 10:26:19PM | GOLD | 1836.45 | 1827 | 1821 | 1840 | 1845 | 1852 | 1835 | ‘cess | ||

| 10:29:19PM | FTSE | 8006 | 7980 | 7966 | 8018 | 8036 | 8058 | 8009 | ‘cess | ||

| 10:32:02PM | STOX50 | 4286.2 | 4259 | 4241 | 4306 | 4314 | 4328 | 4292 | |||

| 10:35:04PM | GERMANY | 15508 | 15409 | 15352 | 15517 | 15634 | 15654 | 15540 | |||

| 10:38:22PM | US500 | 4087.12 | 4085 | 4068 | 4111 | 4148 | 4163 | 4118 | Shambles | ||

| 10:41:47PM | DOW | 33687 | 33657 | 33636 | 33863 | 34179 | 34239 | 34010 | |||

| 10:45:54PM | NASDAQ | 12422.99 | 12414 | 12344 | 12512 | 12518 | 12528 | 12438 | ‘cess | ||

| 10:50:34PM | JAPAN | 27511 | 27487 | 27436 | 27563 | 27680 | 27713 | 27579 | ‘cess |

16/02/2023 FTSE Closed at 8012 points. Change of 0.19%. Total value traded through LSE was: £ 4,862,026,417 a change of -10.79%

15/02/2023 FTSE Closed at 7997 points. Change of 0.55%. Total value traded through LSE was: £ 5,450,342,646 a change of -0.23%

14/02/2023 FTSE Closed at 7953 points. Change of 0.08%. Total value traded through LSE was: £ 5,463,158,317 a change of 17.15%

13/02/2023 FTSE Closed at 7947 points. Change of 0.82%. Total value traded through LSE was: £ 4,663,265,889 a change of -40.31%

11/02/2023 FTSE Closed at 7882 points. Change of 0%. Total value traded through LSE was: £ 7,812,457,009 a change of 15.14%

10/02/2023 FTSE Closed at 7882 points. Change of -0.37%. Total value traded through LSE was: £ 6,785,335,053 a change of -4.85%

9/02/2023 FTSE Closed at 7911 points. Change of 0.33%. Total value traded through LSE was: £ 7,130,980,933 a change of 23.74%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AZN Astrazeneca** **LSE:BT.A British Telecom** **LSE:CNA Centrica** **LSE:GENL Genel** **LSE:HSBA HSBC** **LSE:ITRK Intertek** **LSE:OPG OPG Power Ventures** **LSE:RR. Rolls Royce** **

********

Updated charts published on : Astrazeneca, British Telecom, Centrica, Genel, HSBC, Intertek, OPG Power Ventures, Rolls Royce,

LSE:AZN Astrazeneca Close Mid-Price: 11362 Percentage Change: -1.78% Day High: 11626 Day Low: 11298

Continued trades against AZN with a mid-price ABOVE 11626 should improve ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BT.A British Telecom. Close Mid-Price: 142.25 Percentage Change: + 2.86% Day High: 143.4 Day Low: 139.15

Target met. Further movement against British Telecom ABOVE 143.4 should i ……..

</p

View Previous British Telecom & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 104.2 Percentage Change: + 5.72% Day High: 105 Day Low: 102

All Centrica needs are mid-price trades ABOVE 105 to improve acceleration ……..

</p

View Previous Centrica & Big Picture ***

LSE:GENL Genel Close Mid-Price: 124.6 Percentage Change: -0.48% Day High: 126.6 Day Low: 123.6

This is on the edge of drama as below 123 now indicates the potential of w ……..

</p

View Previous Genel & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 618.4 Percentage Change: + 1.00% Day High: 620.9 Day Low: 612.8

Continued trades against HSBA with a mid-price ABOVE 621 should improve th ……..

</p

View Previous HSBC & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 4497 Percentage Change: -0.20% Day High: 4549 Day Low: 4467

It still looks like movement next above 4549 should attempt an initial 465 ……..

</p

View Previous Intertek & Big Picture ***

LSE:OPG OPG Power Ventures. Close Mid-Price: 8.3 Percentage Change: + 11.41% Day High: 8.4 Day Low: 7.45

Target Met. Now above 8.4 calculates with the potential of a lift to 9.1 n ……..

</p

View Previous OPG Power Ventures & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 113.8 Percentage Change: + 1.61% Day High: 114.8 Day Low: 112.56

Continued trades against RR. with a mid-price ABOVE 115 should improve the ……..

</p

View Previous Rolls Royce & Big Picture ***