#FTSE #SP500

It’s easy to wonder if internet streaming services are feeling a little pain currently, due to the level of real world entertainment presently available. From the ongoing lurches into a banking crisis, stock markets being all over the place, or if in Scotland, the discovery their empress was actually a false construct, surviving only on the achievements on who went before her.

Obviously, living in Argyll, we’re closer to the unseemly Scottish shambles but it’s already causing popcorn shortages everywhere.

As for the markets, we shall not be surprised if Friday ends with some reversals, if only due to concern over potential bad news breaking over the weekend. While the Swiss Central Bank has “saved” Credit Suisse and First Republic Bank saved by a coalition of major banks, considerable effort is obviously going in to inhibit a domino effect in the banking sector. However, will we indeed see many traders opting to close positions on Friday rather than risk a wipe-out on Monday, due to a new cause for panic.

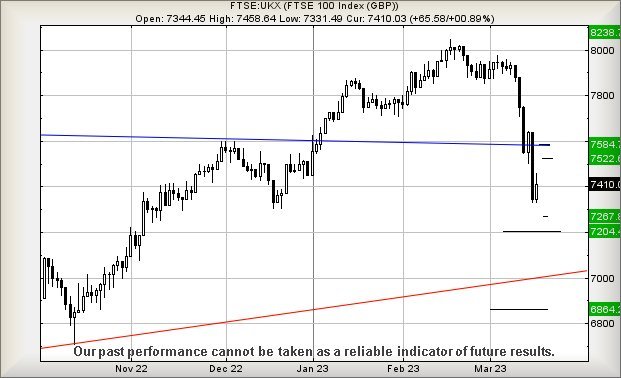

We’ve some doubts for Friday as it feels like the FTSE may again experience some recovery.

Closing Thursday at 7410 points, it need only lurch above 7460 to hopefully trigger recovery to 7522 points with secondary, if bettered, a more encouraging 7584 points. This secondary ambition is quite a big deal, giving the FTSE the impetus to potentially regain the Blue downtrend and point at happy days ahead. Perhaps Louis Hamilton shall even do well in the Saudi Formula 1 race on Sunday, cementing the feel good factor! The required stop loss is rather wide, calculating at 7377 points.

If everything intends go wrong, below 7330 points looks more catastrophic than putting Nicola Sturgeon in charge of anything, as this risks triggering reversal to 7267 points with secondary, if broken, at 7204 points and a limp bounce, maybe…

Have a good weekend.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:38:01PM | BRENT | 74.48 | 71.44 | 69.79 | 73.97 | 75.31 | 75.93 | 73 | |||

| 10:40:30PM | GOLD | 1919.82 | 1907 | 1886 | 1920 | 1934 | 1937 | 1917 | |||

| 10:43:12PM | FTSE | 7452.73 | 7380 | 7273 | 7430 | 7474 | 7528 | 7427 | |||

| 10:45:13PM | STOX50 | 4151.7 | 4109 | 4099 | 4137 | 4154 | 4176 | 4124 | ‘cess | ||

| 10:48:10PM | GERMANY | 15045.95 | 14882 | 14868 | 15003 | 15072 | 15174 | 14970 | ‘cess | ||

| 10:51:05PM | US500 | 3958.87 | 3924 | 3910 | 3945 | 3966 | 3978 | 3936 | Success | ||

| 10:53:36PM | DOW | 32224.5 | 31876 | 31804 | 32114 | 32297 | 32374 | 32095 | Shambles | ||

| 11:02:50PM | NASDAQ | 12580.72 | 12185 | 12060 | 12330 | 12596 | 12670 | 12494 | Success | ||

| 11:05:17PM | JAPAN | 27270 | 27004 | 26922 | 27189 | 27276 | 27345.5 | 27136 | Success |

16/03/2023 FTSE Closed at 7410 points. Change of 0.9%. Total value traded through LSE was: £ 7,906,260,016 a change of -5.19%

15/03/2023 FTSE Closed at 7344 points. Change of -3.84%. Total value traded through LSE was: £ 8,338,790,623 a change of 43.77%

14/03/2023 FTSE Closed at 7637 points. Change of 1.18%. Total value traded through LSE was: £ 5,799,952,343 a change of -34.08%

13/03/2023 FTSE Closed at 7548 points. Change of -2.58%. Total value traded through LSE was: £ 8,798,482,438 a change of 25.79%

10/03/2023 FTSE Closed at 7748 points. Change of -1.66%. Total value traded through LSE was: £ 6,994,694,563 a change of 6.35%

9/03/2023 FTSE Closed at 7879 points. Change of -0.63%. Total value traded through LSE was: £ 6,576,891,587 a change of 1.82%

8/03/2023 FTSE Closed at 7929 points. Change of 0.13%. Total value traded through LSE was: £ 6,459,565,037 a change of 19.23%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:CCL Carnival** **LSE:FRES Fresnillo** **LSE:GENL Genel** **LSE:GKP Gulf Keystone** **LSE:HUR Hurrican Energy** **LSE:IGG IG Group** **LSE:NWG Natwest** **LSE:PMG Parkmead** **LSE:SPT Spirent Comms** **LSE:TLW Tullow** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Aston Martin, Carnival, Fresnillo, Genel, Gulf Keystone, Hurrican Energy, IG Group, Natwest, Parkmead, Spirent Comms, Tullow, Zoo Digital,

LSE:AML Aston Martin Close Mid-Price: 239.6 Percentage Change: -0.33% Day High: 256 Day Low: 232.2

If Aston Martin experiences continued weakness below 232, it will invariab ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 657.4 Percentage Change: + 3.30% Day High: 663 Day Low: 628.6

The iceberg remains in front of this share price! Below 628 now allows for ……..

</p

View Previous Carnival & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 697.8 Percentage Change: -5.40% Day High: 737 Day Low: 692.8

In the event Fresnillo experiences weakness below 692, it calculates with ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:GENL Genel Close Mid-Price: 114.2 Percentage Change: -0.35% Day High: 115.2 Day Low: 113

Below 113 indicates reversal potentials to an initial 104 with secondary, ……..

</p

View Previous Genel & Big Picture ***

LSE:GKP Gulf Keystone Close Mid-Price: 170.6 Percentage Change: -0.23% Day High: 175 Day Low: 167.8

Below 167 still suggests a potential for reversal to 151 with secondary, i ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:HUR Hurrican Energy. Close Mid-Price: 6.95 Percentage Change: + 1.16% Day High: 9 Day Low: 6.8

Now above 9 should aim at an initial 9.5 with secondary, if exceeded, comi ……..

</p

View Previous Hurrican Energy & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 693.5 Percentage Change: -0.29% Day High: 707 Day Low: 687.5

Below 687 still risks reversal to around 684 and hopefully a bounce. If br ……..

</p

View Previous IG Group & Big Picture ***

LSE:NWG Natwest Close Mid-Price: 261.6 Percentage Change: -0.08% Day High: 263.5 Day Low: 255.9

Target Met. Weakness next below 255 risks indulging in a path to 237 next ……..

</p

View Previous Natwest & Big Picture ***

LSE:PMG Parkmead Close Mid-Price: 38.2 Percentage Change: -4.14% Day High: 38.6 Day Low: 37.5

Target Met. Now dodgier than an SNP politician, below 37 signals reversal ……..

</p

View Previous Parkmead & Big Picture ***

LSE:SPT Spirent Comms Close Mid-Price: 168.1 Percentage Change: -5.08% Day High: 185.2 Day Low: 167.1

This isn’t looking great as continued traffic below 167 still indicates a ……..

</p

View Previous Spirent Comms & Big Picture ***

LSE:TLW Tullow Close Mid-Price: 29 Percentage Change: -1.29% Day High: 30.1 Day Low: 28.32

Target Met. Now below 28 has the potential for reversal to 22 with seconda ……..

</p

View Previous Tullow & Big Picture ***

LSE:ZOO Zoo Digital. Close Mid-Price: 205 Percentage Change: + 6.49% Day High: 205 Day Low: 192.5

Continued trades against ZOO with a mid-price ABOVE 205 should improve the ……..

</p

View Previous Zoo Digital & Big Picture ***