#FTSE #Nasdaq

It’s easy to think of Bae Systems as the company where famous names in manufacture go to fade away and be forgotten. As the ultimate successor to so many famous British manufacturers, the company enjoy a back catalogue of enviable #1’s in the fields of aviation, electronics, and shipping. They are also the largest manufacturer in the UK, despite the efforts of various governments over the years.

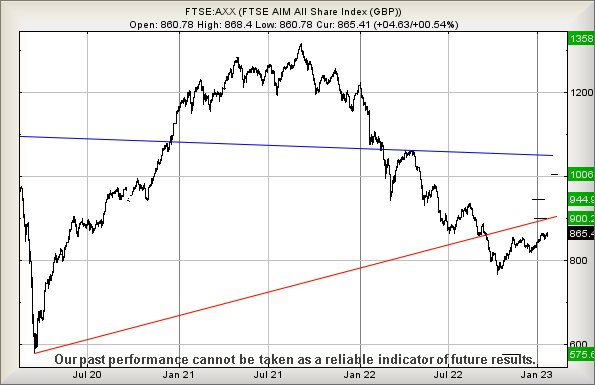

When we reviewed Bae last year, it was with an expectation the war in Ukraine would prove to be a “nice little earner” for the defence contractor, a suspicion which has so far failed to become a reality. There’s nothing pointing to any immediate danger for the company share price, just a glacial pace of movement. For instance, when we ran our analysis in July 2022, the share price was trading at 826p. At time of writing, it’s at 856p, making its way up a hill which visually isn’t very steep. Our expectation remains of gains for the share price but rather than a stop-watch, we’d suggest using a calendar, if attempting to guess when some real movement is coming.

Our “problem” is fairly straightforward.

Share price gains exceeding 880p now point at an initial ambition of 947p, a target level arrived at by two different calculations, based on conventional near term scenario, along with a Big Picture scenario. Normally, we’d suspect a sudden spike upward will occur but, with Bae, our confidence is lacking as it looks like patience shall be key for the future. Our secondary above the 947p level now calculates at a distant 1004p.

If everything intends go wrong, the share price needs below 720p as this looks capable of triggering reversal down to an initial 630p with our secondary, if broken, working out at a potential 550p and hopefully a proper rebound.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:43:20PM | BRENT | 85.58 | ‘cess | ||||||||

| 9:45:59PM | GOLD | 1928.74 | Success | ||||||||

| 10:02:27PM | FTSE | 7784.82 | 7727 | 7714 | 7686 | 7742 | 7797 | 7808 | 7842 | 7770 | Shambles |

| 10:04:47PM | STOX50 | 4183 | ‘cess | ||||||||

| 10:07:14PM | GERMANY | 15179 | Shambles | ||||||||

| 10:17:12PM | US500 | 4071 | ‘cess | ||||||||

| 10:24:08PM | DOW | 34062 | |||||||||

| 10:26:44PM | NASDAQ | 12071.77 | 11868 | 11820 | 11723 | 12048 | 12104 | 12131 | 12238 | 11987 | ‘cess |

| 10:28:35PM | JAPAN | 27495 |

31/01/2023 FTSE Closed at 7771 points. Change of -0.17%. Total value traded through LSE was: £ 6,660,813,951 a change of 20.2%

30/01/2023 FTSE Closed at 7784 points. Change of 0.24%. Total value traded through LSE was: £ 5,541,404,266 a change of 12.58%

27/01/2023 FTSE Closed at 7765 points. Change of 0.05%. Total value traded through LSE was: £ 4,922,369,454 a change of -13.06%

26/01/2023 FTSE Closed at 7761 points. Change of 0.22%. Total value traded through LSE was: £ 5,661,516,595 a change of 15%

25/01/2023 FTSE Closed at 7744 points. Change of -0.17%. Total value traded through LSE was: £ 4,923,070,732 a change of -10.83%

24/01/2023 FTSE Closed at 7757 points. Change of -0.09%. Total value traded through LSE was: £ 5,520,852,512 a change of 27.06%

23/01/2023 FTSE Closed at 7764 points. Change of -0.08%. Total value traded through LSE was: £ 4,345,074,257 a change of -16.34%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CNA Centrica** **LSE:DARK Darktrace Plc** **LSE:FGP Firstgroup** **LSE:GRG Greggs** **LSE:IPF International Personal Finance** **LSE:NWG Natwest** **LSE:PMG Parkmead** **LSE:SBRY Sainsbury** **LSE:SRP Serco** **

********

Updated charts published on : Centrica, Darktrace Plc, Firstgroup, Greggs, International Personal Finance, Natwest, Parkmead, Sainsbury, Serco,

LSE:CNA Centrica. Close Mid-Price: 100.75 Percentage Change: + 0.30% Day High: 101.3 Day Low: 100.1

In the event of Centrica enjoying further trades beyond 102p, the share sh ……..

</p

View Previous Centrica & Big Picture ***

LSE:DARK Darktrace Plc Close Mid-Price: 210.2 Percentage Change: -4.45% Day High: 228.9 Day Low: 198

If Darktrace Plc experiences continued weakness below 198, it will invaria ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:FGP Firstgroup. Close Mid-Price: 108.4 Percentage Change: + 0.37% Day High: 112.2 Day Low: 107.3

Further movement against Firstgroup ABOVE 113 should improve acceleration ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:GRG Greggs Close Mid-Price: 2694 Percentage Change: -0.37% Day High: 2712 Day Low: 2670

In the event of Greggs enjoying further trades beyond 2712, the share shou ……..

</p

View Previous Greggs & Big Picture ***

LSE:IPF International Personal Finance. Close Mid-Price: 84.2 Percentage Change: + 0.84% Day High: 84.9 Day Low: 82

Further movement against International Personal Finance ABOVE 85 should im ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:NWG Natwest Close Mid-Price: 308 Percentage Change: -0.19% Day High: 309.6 Day Low: 306.3

Natwest needs mid-price trades ABOVE 310 to improve acceleration toward a ……..

</p

View Previous Natwest & Big Picture ***

LSE:PMG Parkmead Close Mid-Price: 44.95 Percentage Change: -4.36% Day High: 45.5 Day Low: 44.1

Now a little dodgy, below 44 expects a visit to 41 next with secondary, if ……..

</p

View Previous Parkmead & Big Picture ***

LSE:SBRY Sainsbury Close Mid-Price: 262.6 Percentage Change: -0.08% Day High: 263.1 Day Low: 258.5

In the event of Sainsbury enjoying further trades beyond 264, the share sh ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:SRP Serco Close Mid-Price: 145.9 Percentage Change: -4.64% Day High: 152 Day Low: 145.1

This isn’t playing the game as weakness now below 145 suggests a visit to ……..

</p

View Previous Serco & Big Picture ***