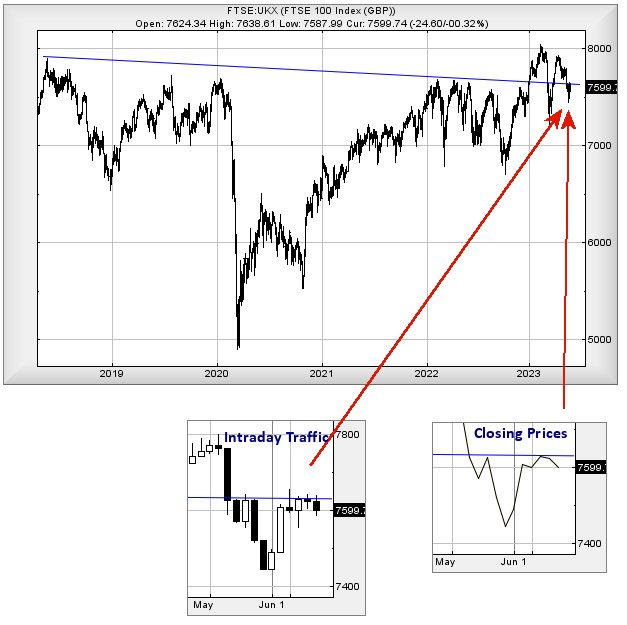

#FTSE #GOLD The downtrend on the FTSE which dates back to May 2018 appears to be still exerting influence across the market. As the chart and extracts below highlight quite clearly, extraordinary care has been taken to ensure the UK market has failed to close a session above the Blue line, something which may prove important if searching for a “safe” trade.

As always, we must remind readers there’s absolutely no such thing as a safe trade (stuff happens) but there’s a balance of probabilities. If the market decides it has sufficient excuse to allow the UK index to again close above the long term downtrend, we shall be inclined to take it as a strong signal yet another attempt to break upwards is once again about to occur. Then again, perhaps it’s also the case where the market has a case of nerves and what we’re seeing is the risk of imminent reversal due to this fear of closing above the trend.

Who knows?

Our inclination is to firstly present our positive scenario for the FTSE as the index needs very little work which should ideally trigger some near term gains. Near term, above 7639 points should prove capable of a lift to an initial 7699 points with secondary, if this initial is exceeded, calculating at 7747 points. Perhaps, with the US due to experience a Payrolls day on Friday, it shall be revealed mass employment has been discovered in an industry which involves geese and lots of golden eggs! If triggered, the tightest stop looks quite wide at 7582 points.

The alternate, reversal scenario, needs the index to wander below 7582 as this risks triggering reversal down to an initial 7564. Our secondary, should this modest level fail, calculates down at 7496 points.

Despite the lack of a grand-prix, have a good weekend. Perhaps there will be decent live music at Le Mans for the 24 hour race, not that we’re going. Live commentary tends become tedious, after the first few minutes.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:43:15PM | BRENT | 75.57 | 73.52 | 72.41 | 75.49 | 76.77 | 77.49 | 75.74 | Shambles | ||

| 10:45:13PM | GOLD | 1965.75 | 1953 | 1941 | 1967 | 1970 | 1978 | 1961 | Success | ||

| 10:47:40PM | FTSE | 7619 | 7585 | 7581 | 7605 | 7627 | 7640 | 7607 | |||

| 10:49:09PM | STOX50 | 4310.9 | 4270 | 4253 | 4294 | 4311 | 4324 | 4287 | |||

| 10:51:00PM | GERMANY | 16012.72 | 15886 | 15821 | 15961 | 16027 | 16075 | 15936 | |||

| 10:52:44PM | US500 | 4294.52 | 4259 | 4242 | 4276 | 4300 | 4313 | 4279 | |||

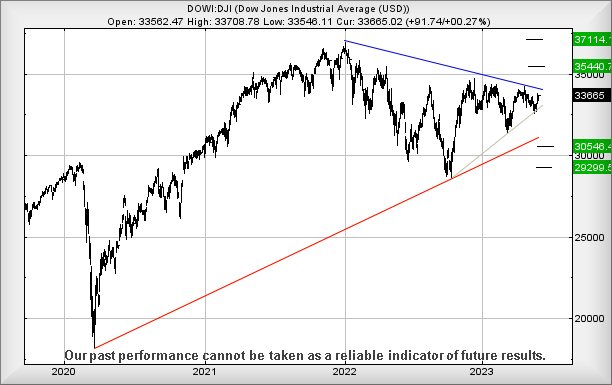

| 11:01:16PM | DOW | 33815.9 | 33588 | 33496 | 33680 | 33868 | 33893 | 33756 | ‘cess | ||

| 11:03:15PM | NASDAQ | 14495.47 | 14239 | 14151 | 14353 | 14511 | 14617 | 14400 | ‘cess | ||

| 11:05:13PM | JAPAN | 31877 | 31412 | 31272 | 31700 | 32030 | 32094 | 31715 |

8/06/2023 FTSE Closed at 7599 points. Change of -0.33%. Total value traded through LSE was: £ 5,104,102,479 a change of 3.08%

7/06/2023 FTSE Closed at 7624 points. Change of -0.05%. Total value traded through LSE was: £ 4,951,636,659 a change of 0.85%

6/06/2023 FTSE Closed at 7628 points. Change of 0.38%. Total value traded through LSE was: £ 4,909,723,355 a change of 21.93%

5/06/2023 FTSE Closed at 7599 points. Change of -0.11%. Total value traded through LSE was: £ 4,026,661,677 a change of -31.04%

2/06/2023 FTSE Closed at 7607 points. Change of 1.56%. Total value traded through LSE was: £ 5,839,256,981 a change of 14.36%

1/06/2023 FTSE Closed at 7490 points. Change of 0.59%. Total value traded through LSE was: £ 5,105,968,663 a change of -64.14%

31/05/2023 FTSE Closed at 7446 points. Change of -100%. Total value traded through LSE was: £ 14,237,190,282 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:DGE Diageo** **LSE:FGP Firstgroup** **LSE:HL. Hargreaves Lansdown** **LSE:IPF International Personal Finance** **LSE:JET Just Eat** **LSE:QED Quadrise** **LSE:VOD Vodafone** **

********

Updated charts published on : Diageo, Firstgroup, Hargreaves Lansdown, International Personal Finance, Just Eat, Quadrise, Vodafone,

LSE:DGE Diageo Close Mid-Price: 3326 Percentage Change: -0.22% Day High: 3361 Day Low: 3304.5

Weakness on Diageo below 3304 will invariably lead to 3288 with secondary ……..

</p

View Previous Diageo & Big Picture ***

LSE:FGP Firstgroup. Close Mid-Price: 135.2 Percentage Change: + 13.90% Day High: 143.6 Day Low: 125.9

Target Met. This now shows interesting potentials as above 144 indicates t ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:HL. Hargreaves Lansdown. Close Mid-Price: 857.6 Percentage Change: + 3.10% Day High: 863.2 Day Low: 831.4

Continued trades against HL. with a mid-price ABOVE 864 should improve the ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:IPF International Personal Finance. Close Mid-Price: 117 Percentage Change: + 3.08% Day High: 117.5 Day Low: 112

Continued trades against IPF with a mid-price ABOVE 118 should improve the ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:JET Just Eat Close Mid-Price: 1094 Percentage Change: -4.95% Day High: 1178 Day Low: 1091

Target Met. This is getting potentially very bad as movement below 1091 no ……..

</p

View Previous Just Eat & Big Picture ***

LSE:QED Quadrise. Close Mid-Price: 1.29 Percentage Change: + 28.87% Day High: 1.22 Day Low: 1.2

Something has happened! Above 1.34 now suggests traffic to an initial 1.62 ……..

</p

View Previous Quadrise & Big Picture ***

LSE:VOD Vodafone Close Mid-Price: 74.15 Percentage Change: -5.52% Day High: 75.68 Day Low: 73.96

Target Met. Below 73 now suggests 71 next with our secondary, if broken, a ……..

</p

View Previous Vodafone & Big Picture ***