#Gold #WallSt Living by the sea here in Argyll, we’ve a quite ambiguous relationship with fishing. An outdoors shed is almost entirely given over to the pass-time, containing a bewildering range of rods, reels, lures, nets, waterproofs, all the paraphernalia a proper fisherman needs. Aside from our little boat, we’ve not spent a penny on this homage to the sport, friends preferring to leave their equipment as it’s always here for their next visit.

Some years, we become utterly fed up eating mackerel, other years it’s trout, and everything always punctuated by the occasional dozy Pollock.

Folk tend to cling to an assumption I enjoy wishing, due to the oft repeated tale of the time I caught a salmon. Sitting beside a local river estuary at low tide, salmon could be often seen battling their way upstream through the shallows and rocks exposed by the reduced sea level. In a fit of madness, I had jumped in after one, eventually catching it in a bear hug, making my way to shore, and giving it to one of the local lads who haunted the river with something called ‘A Gaff’, essentially a big steel hook at the end of a stick.

Arriving home, soaked, no-one believed the story until he turned up later with £10, payment from the local hotel. The actual value may have been quite a bit higher as this event took place before farmed fish became commonplace, with a commensurate reduction in the price of fresh salmon. And from memory, the fish was almost too heavy for 8 year old me to lift.

However, catching a fish by hand didn’t set me up to become fanatical about the sport, probably quite the opposite. But I’m always impressed at quite how much money folk are prepared to spend in following the sport, going through life ignorant of the truism; it’s called “Fishing” and not “Catching”…

Angling Direct, both online and with a chain of store in England, appear to be covering all bases and even ensuring prospective fishermen have the correct clothing for the sport, less they disappoint their target audience by wearing the wrong hat or incorrect sunglasses. Few people would enjoy going through life, knowing they had failed to impress a fish.

All joking aside, one item of clothing in the countryside which always proves useful is a body warmer (a gilet), something with a decent selection of pockets. And experience has taught, the only reliable place to purchase useful body warmers are angling stores, presumably manufactured with the assumption buyers want more than a pocket for a mobile phone and some shotgun cartridges.

Prompting this visit to Angling Direct share price was the news a chum is visiting for the weekend, intending to get some fishing in. He has apparently bought a new rod, an item which should prove capable of casting lures further than ever before. My usual contribution to proceedings will be aiming the boat, sometimes tying up are moorings, more often opening a bottle of cider. It makes for a very relaxed day, usually unsullied by the unpleasant duty of netting any fish.

Currently trading around 31p, Angling Direct (LSE:ANG) only need exceed this level to make an attempt at 36 next with our secondary, if exceeded at a visually sane 40p and some probable hesitation, due to a little historical plateau at this level. But for the longer term, closure above 40p becomes a crucial ambition, dropping the share price into an area where it could easily lure a long term visit to 79p and hopefully beyond.

The share price looks like it’s now capable of some recovery and we suspect the important task shall be to aim to exceed the pre-pandemic high again.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:50:46PM | BRENT | 71.89 | Success | ||||||||

| 9:52:43PM | GOLD | 1957.33 | 1949 | 1938 | 1923 | 1959 | 1967 | 1973 | 1981 | 1954 | ‘cess |

| 9:54:51PM | FTSE | 7585.8 | |||||||||

| 9:56:39PM | STOX50 | 4335.9 | ‘cess | ||||||||

| 9:58:54PM | GERMANY | 16156 | Success | ||||||||

| 10:21:29PM | US500 | 4343.57 | Success | ||||||||

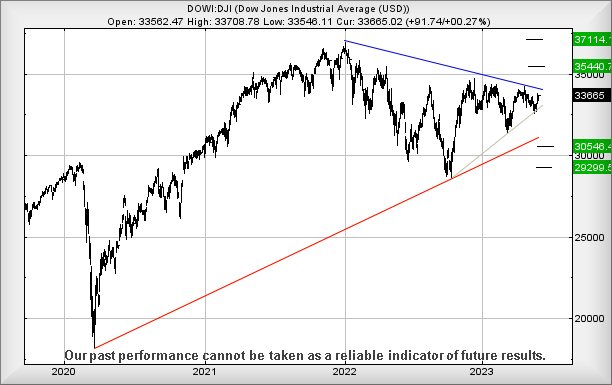

| 10:24:12PM | DOW | 34069 | 33867 | 33795 | 33700 | 33974 | 34080 | 34180 | 34291 | 33933 | ‘cess |

| 10:26:53PM | NASDAQ | 14816.72 | Success | ||||||||

| 10:29:55PM | JAPAN | 32700 | ‘cess |

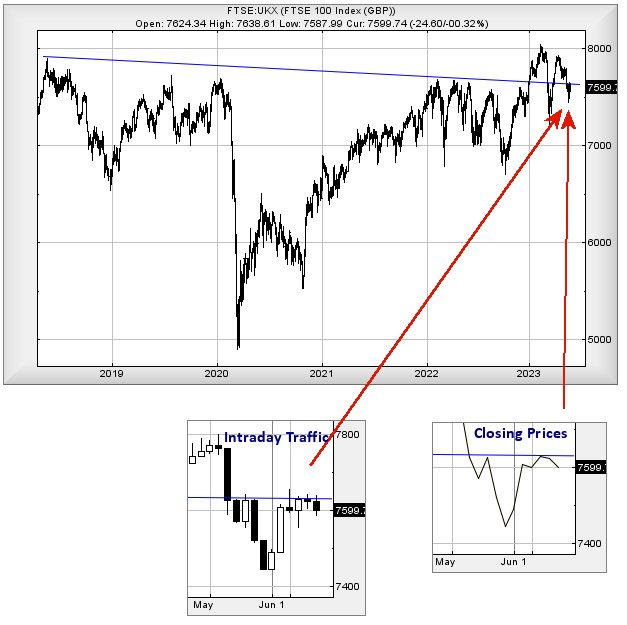

12/06/2023 FTSE Closed at 7470 points. Change of -1.22%. Total value traded through LSE was: £ 4,496,360,714 a change of 0.19%

9/06/2023 FTSE Closed at 7562 points. Change of -0.49%. Total value traded through LSE was: £ 4,487,952,425 a change of -12.07%

8/06/2023 FTSE Closed at 7599 points. Change of -0.33%. Total value traded through LSE was: £ 5,104,102,479 a change of 3.08%

7/06/2023 FTSE Closed at 7624 points. Change of -0.05%. Total value traded through LSE was: £ 4,951,636,659 a change of 0.85%

6/06/2023 FTSE Closed at 7628 points. Change of 0.38%. Total value traded through LSE was: £ 4,909,723,355 a change of 21.93%

5/06/2023 FTSE Closed at 7599 points. Change of -0.11%. Total value traded through LSE was: £ 4,026,661,677 a change of -31.04%

2/06/2023 FTSE Closed at 7607 points. Change of 1.56%. Total value traded through LSE was: £ 5,839,256,981 a change of 14.36%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:CASP Caspian** **LSE:CBX Cellular Goods** **LSE:CCL Carnival** **LSE:HL. Hargreaves Lansdown** **LSE:QED Quadrise** **LSE:VOD Vodafone** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Asos, Caspian, Cellular Goods, Carnival, Hargreaves Lansdown, Quadrise, Vodafone, Zoo Digital,

LSE:ASC Asos. Close Mid-Price: 329.3 Percentage Change: + 1.29% Day High: 330.7 Day Low: 322.3

If Asos experiences continued weakness below 322, it will invariably lead ……..

</p

View Previous Asos & Big Picture ***

LSE:CASP Caspian Close Mid-Price: 5.05 Percentage Change: -8.18% Day High: 5.3 Day Low: 5.05

Weakness on Caspian below 5.05 will invariably lead to 4.5 with secondary ……..

</p

View Previous Caspian & Big Picture ***

LSE:CBX Cellular Goods Close Mid-Price: 0.85 Percentage Change: -2.86% Day High: 0.88 Day Low: 0.85

Continued weakness against CBX taking the price below 0.85 calculates as ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 1024.5 Percentage Change: + 12.66% Day High: 1045 Day Low: 907.8

Target met. Continued trades against CCL with a mid-price ABOVE 1045 shou ……..

</p

View Previous Carnival & Big Picture ***

LSE:HL. Hargreaves Lansdown Close Mid-Price: 859.2 Percentage Change: -0.28% Day High: 872.6 Day Low: 855.2

In the event of Hargreaves Lansdown enjoying further trades beyond 872.6, ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:QED Quadrise. Close Mid-Price: 1.47 Percentage Change: + 15.72% Day High: 1.65 Day Low: 1.5

Target met. All Quadrise needs are mid-price trades ABOVE 1.65 to improve ……..

</p

View Previous Quadrise & Big Picture ***

LSE:VOD Vodafone Close Mid-Price: 72.85 Percentage Change: -2.71% Day High: 74.85 Day Low: 72.91

In the event Vodafone experiences weakness below 72.91 it calculates with ……..

</p

View Previous Vodafone & Big Picture ***

LSE:ZOO Zoo Digital Close Mid-Price: 115.5 Percentage Change: -1.70% Day High: 117.5 Day Low: 115.5

In the event Zoo Digital experiences weakness below 115.5 it calculates w ……..

</p

View Previous Zoo Digital & Big Picture ***