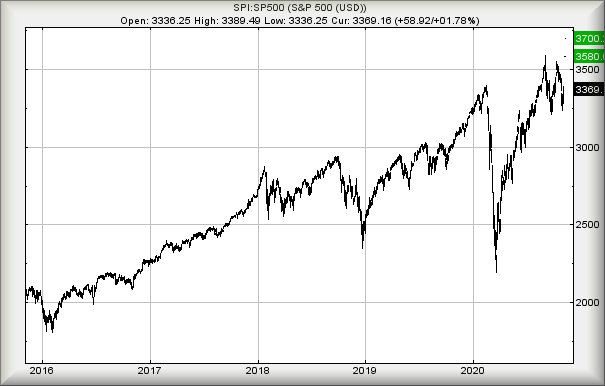

#FTSE #DOW It’s been mentioned several times, a usually reliable “tell” for US election results is the state of the markets. If the markets are doing well, the incumbent president wins. By the times voting closes, it appears the S&P shall be UP 56% during Trumps time in office, the Nasdaq UP 135% and Wall St UP by 49%. In comparison with prior presidential results, this tends suggest Mr Trump should experience a landslide, able to again frustrate virtually an entire media who dislike the bloke.

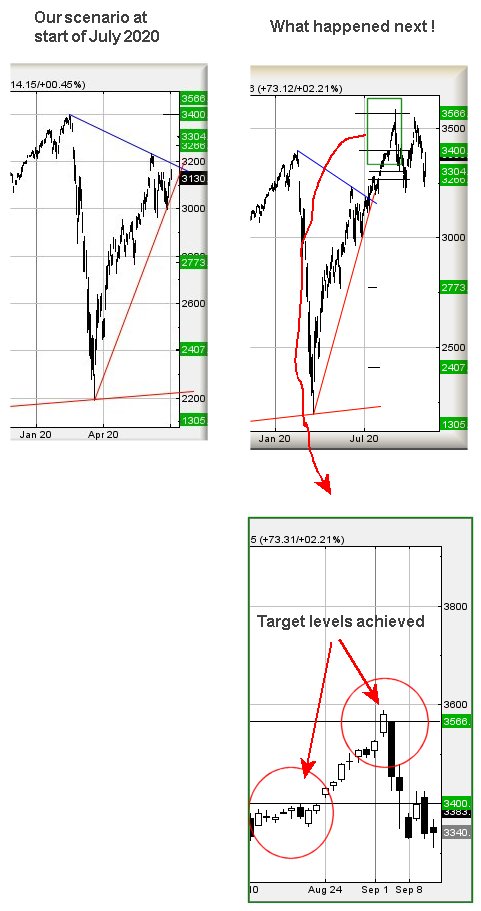

Perhaps this year shall prove to be the election result which turns “normal” on its head. After all, 2020 has utterly failed in providing anything else approaching “normal”. However, our previous analysis against the S&P in July proved pretty concise, the index performing pretty much as expected at each target level.

The last week has seen the S&P execute some fairly interesting movements, ones which almost feel like they attempt to conceal optimism. It’s quite apt, given the singer Lady GaGa has been campaigning for Mr Biden, the S&P performed its own GaGa manouvre, a Gap Down followed by a Gap Up. This sort of nonsense is usually a precursor to solid market gains and in the case of the S&P, we shall be convinced if the market heads above just 3,430 points. This should prove significant, triggering movement toward an initial 3,580 points with secondary, if beaten, a comfortable looking 3,700 points and a brand new, shiny and confident, all time high.

It appears, if the numbers can be trusted, we should anticipate Mr Trump again excelling at issuing incomprehensible Tweets from the bar at the White House, at odd hours.

CRISPR Therapeutics (Nasdaq:CRSP It’s unusual to come across something which sounds like Crisps without seeing Gary Lineker, a former footballer turned full time unhealthy food promoter, involved in the background. Thankfully, this company avoids fattening snack foods, taking their name from a family of DNA sequences founds in gnomes… Okay, that’s a joke, they’re playing with the sequences from the genome of bacteria but it’s a pity David Bowie isn’t around to rework his tune, “The Laughing Genome!”

Recent price moves have felt defensive, the share carefully avoiding closing a session below the Red uptrend since March of this year. Perhaps this indicates some surprise recovery is almost upon us. Price weakness below 84 certainly risks some danger, apparently capable of triggering reversal down to an initial 68 dollars. Visually, we’re not convinced a bounce shall be generated at such a level, especially as any weakness below allows bigger picture reversal to a hopeful bottom of 48 dollars.

If we choose to take hope from the price refusing to close below Red, some surprising gains look pretty certain if the share price manages a miracle recovery above Blue, presently $99. A trigger such as this calculates as capable of an initial $111, matching the previous all time high. If bettered, further traffic to 131 works out as possible. The bad news?

We suspect it intends $48.

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:43:27PM | BRENT | 40.29 | ‘cess | ||||||||

| 10:45:28PM | GOLD | 1909.91 | ‘cess | ||||||||

| 10:47:47PM | FTSE | 5796.64 | 5691 | 5645.5 | 5591 | 5748 | 5809 | 5848 | 5946 | 5700 | Success |

| 10:49:24PM | FRANCE | 4820.2 | Success | ||||||||

| 10:52:00PM | GERMANY | 12165.87 | Success | ||||||||

| 10:54:02PM | US500 | 3367.9 | Success | ||||||||

| 11:07:13PM | DOW | 27541 | 27223 | 27179.5 | 27022 | 27397 | 27652 | 27750 | 28039 | 27350 | ‘cess |

| 11:09:05PM | NASDAQ | 11293 | ‘cess | ||||||||

| 11:11:40PM | JAPAN | 23835 | Success |