FTSE for FRIDAY (FTSE:UKX) When I look to my right, on the bookshelf there’s a series of titles called “How S**t Works”, bought from a charity shop for a fiver. Alas, nowhere in the books is there a section on the UK FTSE which is a pity, because it urgently needs a repairman to visit! Thursday proved a strange day, worldwide, but of all the markets we cover, only the FTSE made our jaw drop.

By any standards, Thursday was weird with 5 of the 6 index we cover for clients hitting targets, all targets. Firstly, they started the day by successfully hitting all our Short position targets, then bounced and triggered movements to our Long position targets. Once again, all targets were successfully achieved. Except for the UK index which pouted, refusing the play the game. In fairness, this sort of thing in quite rare with individual index’ but when it occured with virtually all markets, we didn’t know what to make of things. Perhaps it shall be the case the FTSE was just “slow” and maybe Friday shall surprise everyone…

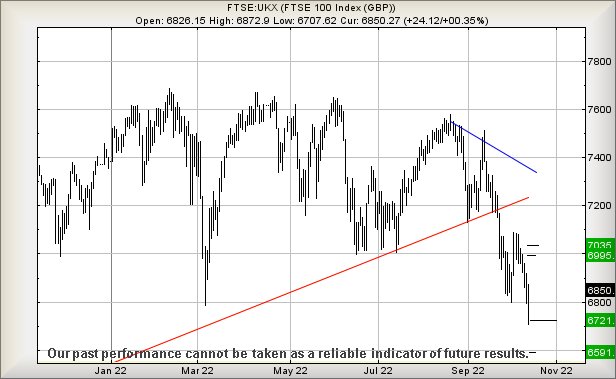

There’s very little positive to be said about the UK index and currently, we must conclude the FTSE is heading down to around 6450. But it may be about 6350 points or even 6240 points. The absurd thing, when we collate this series of numbers, we could even believe the UK index really intends an a visit to around 5200 points eventually, ‘cos it makes sense numerically. From a Big Picture perspective, the UK index needs above 7200 points to give an indication it’s climbing out of the gutter. The index is running low on nails to hammer into its coffin, closing Wednesday this week at a new “lower low”, achieving a price level not witnessed since April last year.

From a near term perspective, if the FTSE intends follow the rest of the world in making an upward lunge, above just 6902 points (it closed Thursday at 6852) should prove capable of triggering party time as a movement to 6995 calculates as possible. If exceeded, our secondary works out at an improbable looking 7035 points. If triggered, the tightest stop loss level looks like 6826 points.

Our alternate scenario looks harder to trigger, requiring the index below 6770 points to push the potential of a drop to 6721 points. If broken, our secondary calculates down at 6591 points.

A glance at the chart below reveals sometime important. Despite our positive scenario above giving a suggestion of an impressive 130 point gain, there’s very little about the visual picture which inspires confidence. Instead, the words “shuffling deckchairs on the Titanic” spring to mind as the FTSE must exceed 7100 points to give the very first indication some recovery of strength is possible. Even in Friday proves to be a happy day for the FTSE, the index needs recover quite firmly to remove the odor of dead cats around an immediate bounce.

Time Issued

Market

Price At Issue

Short Entry

Fast Exit

Slow Exit

Stop

Long Entry

Fast Exit

Slow Exit

Stop

PriorFUTURES

11:33:35PM

BRENT

93.89

91

90.47

92.34

94.1

94.33

93.3

Success

11:35:37PM

GOLD

1665.49

1661

1657

1671

1682

1687

1661

Success

11:38:15PM

FTSE

6891

6802

6769

6861

6905

6957

6853

Shambles

11:40:46PM

STOX50

3401.7

3354

3335

3378

3404

3427

3381

Success

11:44:17PM

GERMANY

12471

12350

12313

12465

12498

12554

12374

Success

11:47:13PM

US500

3671.17

3618

3609

3649

3686

3708

3635

Success

11:50:30PM

DOW

30063

29660

29514

29906

30184

30346

29920

Success

11:53:13PM

NASDAQ

11026

10841

10757

10994

11093

11196

10950

Success

11:55:58PM

JAPAN

26799

26533

26465

26713

26820

26877

26670

Success

13/10/2022 FTSE Closed at 6850 points. Change of 0.35%. Total value traded through LSE was: £ 5,933,139,923 a change of 16.34%

12/10/2022 FTSE Closed at 6826 points. Change of -0.86%. Total value traded through LSE was: £ 5,099,638,855 a change of -0.72%

11/10/2022 FTSE Closed at 6885 points. Change of -1.06%. Total value traded through LSE was: £ 5,136,859,995 a change of 18.36%

10/10/2022 FTSE Closed at 6959 points. Change of -0.46%. Total value traded through LSE was: £ 4,340,006,444 a change of -6.55%

7/10/2022 FTSE Closed at 6991 points. Change of -0.09%. Total value traded through LSE was: £ 4,644,361,624 a change of -27.89%

6/10/2022 FTSE Closed at 6997 points. Change of -0.78%. Total value traded through LSE was: £ 6,440,759,247 a change of 17.34%

5/10/2022 FTSE Closed at 7052 points. Change of -0.48%. Total value traded through LSE was: £ 5,488,765,319 a change of -9.96%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:AML Aston Martin** **LSE:ASC Asos** **LSE:BDEV Barrett Devs** **LSE:BT.A British Telecom** **LSE:CAR Carclo** **LSE:CEY Centamin** **LSE:DARK Darktrace Plc** **LSE:EMG MAN** **LSE:FOXT Foxtons** **LSE:FRES Fresnillo** **LSE:HL. Hargreaves Lansdown** **LSE:IGAS Igas Energy** **LSE:ITM ITM Power** **LSE:ITRK Intertek** **LSE:JET Just Eat** **LSE:LLOY Lloyds Grp.** **LSE:MKS Marks and Spencer** **LSE:NG. National Glib** **LSE:NWG Natwest** **LSE:OCDO Ocado Plc** **LSE:PHP Primary Health** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:SRP Serco** **LSE:STAN Standard Chartered** **LSE:TLW Tullow** **LSE:TSCO Tesco** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : AFC Energy, Aston Martin, Asos, Barrett Devs, British Telecom, Carclo, Centamin, Darktrace Plc, MAN, Foxtons, Fresnillo, Hargreaves Lansdown, Igas Energy, ITM Power, Intertek, Just Eat, Lloyds Grp., Marks and Spencer, National Glib, Natwest, Ocado Plc, Primary Health, Scottish Mortgage Investment Trust, Serco, Standard Chartered, Tullow, Tesco, Taylor Wimpey,

LSE:AFC AFC Energy. Close Mid-Price: 18 Percentage Change: + 1.07% Day High: 18.32 Day Low: 17.06

Weakness on AFC Energy below 17. will invariably lead to 16.5 with seconda ……..

Subscribe for more

View Previous AFC Energy & Big Picture ***

LSE:AML Aston Martin. Close Mid-Price: 91.36 Percentage Change: + 1.02% Day High: 94.86 Day Low: 86.04

Continued weakness against AML taking the price below 86 calculates as lea ……..

Subscribe for more

View Previous Aston Martin & Big Picture ***

LSE:ASC Asos. Close Mid-Price: 542 Percentage Change: + 6.59% Day High: 560 Day Low: 503

Continued weakness against ASC taking the price below 503 calculates as le ……..

Subscribe for more

View Previous Asos & Big Picture ***

LSE:BDEV Barrett Devs. Close Mid-Price: 341.8 Percentage Change: + 5.04% Day High: 351.5 Day Low: 317.8

Now above 352 should apparently generate a lift to 361 next with secondary ……..

Subscribe for more

View Previous Barrett Devs & Big Picture ***

LSE:BT.A British Telecom. Close Mid-Price: 120.8 Percentage Change: + 1.09% Day High: 123.85 Day Low: 117.05

Target Met. Now below 117 allows for reversal to 114 next with secondary, ……..

Subscribe for more

View Previous British Telecom & Big Picture ***

LSE:CAR Carclo Close Mid-Price: 15.62 Percentage Change: -3.85% Day High: 16 Day Low: 15.5

Target Met. This needs above 19p to give early indications of recovery, al ……..

Subscribe for more

View Previous Carclo & Big Picture ***

LSE:CEY Centamin. Close Mid-Price: 84.86 Percentage Change: + 1.56% Day High: 87.82 Day Low: 83

Above 88 could prove interesting, giving the potential of a lift to an ini ……..

Subscribe for more

View Previous Centamin & Big Picture ***

LSE:DARK Darktrace Plc. Close Mid-Price: 297 Percentage Change: + 3.85% Day High: 299.8 Day Low: 275

Weakness on Darktrace Plc below 275 will invariably lead to 269 with secon ……..

Subscribe for more

View Previous Darktrace Plc & Big Picture ***

LSE:EMG MAN. Close Mid-Price: 217.5 Percentage Change: + 4.62% Day High: 217.9 Day Low: 202.9

Target Met. In the event MAN experiences weakness below 202, it calculates ……..

Subscribe for more

View Previous MAN & Big Picture ***

LSE:FOXT Foxtons Close Mid-Price: 27.8 Percentage Change: -1.42% Day High: 28.95 Day Low: 27.5

In the event Foxtons experiences weakness below 27.5 it calculates with a ……..

Subscribe for more

View Previous Foxtons & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 728.2 Percentage Change: -4.08% Day High: 764.2 Day Low: 698.8

Weakness on Fresnillo below 698 will invariably lead to 655p with secondar ……..

Subscribe for more

View Previous Fresnillo & Big Picture ***

LSE:HL. Hargreaves Lansdown. Close Mid-Price: 797.4 Percentage Change: + 1.24% Day High: 811.8 Day Low: 766.2

Continued weakness against HL. taking the price below 759 calculates as le ……..

Subscribe for more

View Previous Hargreaves Lansdown & Big Picture ***

LSE:IGAS Igas Energy Close Mid-Price: 47 Percentage Change: -1.26% Day High: 48.6 Day Low: 43.3

If Igas Energy experiences continued weakness below 43, it will invariably ……..

Subscribe for more

View Previous Igas Energy & Big Picture ***

LSE:ITM ITM Power. Close Mid-Price: 91.1 Percentage Change: + 0.20% Day High: 94.9 Day Low: 86

In the event ITM Power experiences weakness below 86, it calculates with a ……..

Subscribe for more

View Previous ITM Power & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 3621 Percentage Change: -0.41% Day High: 3624 Day Low: 3485

In the event Intertek experiences weakness below 3484, it calculates with ……..

Subscribe for more

View Previous Intertek & Big Picture ***

LSE:JET Just Eat. Close Mid-Price: 1115.6 Percentage Change: + 1.09% Day High: 1148.6 Day Low: 1054.8

Target Met. Now below 1053 now threatens 996 next with secondary, if broke ……..

Subscribe for more

View Previous Just Eat & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 41.77 Percentage Change: + 6.86% Day High: 41.95 Day Low: 38.51

Continued weakness against LLOY taking the price below 38.5 calculates as ……..

Subscribe for more

View Previous Lloyds Grp. & Big Picture ***

LSE:MKS Marks and Spencer. Close Mid-Price: 98.44 Percentage Change: + 5.62% Day High: 100 Day Low: 91.7

In the event Marks and Spencer experiences weakness below 91.7 it calculat ……..

Subscribe for more

View Previous Marks and Spencer & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 860.6 Percentage Change: + 0.26% Day High: 879.8 Day Low: 844.4

Target Met. If National Grid experiences continued weakness below 844, it ……..

Subscribe for more

View Previous National Glib & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 228.7 Percentage Change: + 7.67% Day High: 230.3 Day Low: 210.9

Weakness on Natwest below 210 will invariably lead to 198 with secondary ( ……..

Subscribe for more

View Previous Natwest & Big Picture ***

LSE:OCDO Ocado Plc. Close Mid-Price: 435.8 Percentage Change: + 10.86% Day High: 440.8 Day Low: 380.3

Continued weakness against OCDO taking the price below 380 calculates as l ……..

Subscribe for more

View Previous Ocado Plc & Big Picture ***

LSE:PHP Primary Health. Close Mid-Price: 98.85 Percentage Change: + 0.15% Day High: 102.1 Day Low: 95.75

If Primary Health experiences continued weakness below 95, it will invaria ……..

Subscribe for more

View Previous Primary Health & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust Close Mid-Price: 729.6 Percentage Change: -0.44% Day High: 740.2 Day Low: 698.4

In the event Scottish Mortgage Investment Trust experiences weakness below ……..

Subscribe for more

View Previous Scottish Mortgage Investment Trust & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 153.4 Percentage Change: + 2.54% Day High: 154.2 Day Low: 148.9

Weakness on Serco below 148 will invariably lead to 139 with secondary, if ……..

Subscribe for more

View Previous Serco & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 551.4 Percentage Change: + 2.38% Day High: 552.8 Day Low: 530.6

Continued weakness against STAN taking the price below 530 calculates as l ……..

Subscribe for more

View Previous Standard Chartered & Big Picture ***

LSE:TLW Tullow. Close Mid-Price: 38.66 Percentage Change: + 0.73% Day High: 39.22 Day Low: 37.1

In the event Tullow experiences weakness below 37.1 it calculates with a d ……..

Subscribe for more

View Previous Tullow & Big Picture ***

LSE:TSCO Tesco. Close Mid-Price: 200.9 Percentage Change: + 0.88% Day High: 203.2 Day Low: 194.35

In the event Tesco experiences weakness below 194, it calculates with a dr ……..

Subscribe for more

View Previous Tesco & Big Picture ***

LSE:TW. Taylor Wimpey. Close Mid-Price: 86.6 Percentage Change: + 0.23% Day High: 89.18 Day Low: 80.8

Continued weakness against TW. taking the price below 80 calculates as lea ……..

Subscribe for more

View Previous Taylor Wimpey & Big Picture ***

*** End of “Updated Today” comments on shares.