#FTSE #Gold

When examing price movements with shares, commodities, forex, crypto, index’ etc, we usually start by calling up a chart, drawing a few trend lines, then walk away for a while. Sometimes, returning to the chart will suddenly make sense, sometimes (like currently) we’re left uncomfortably clueless as to the markets intention.

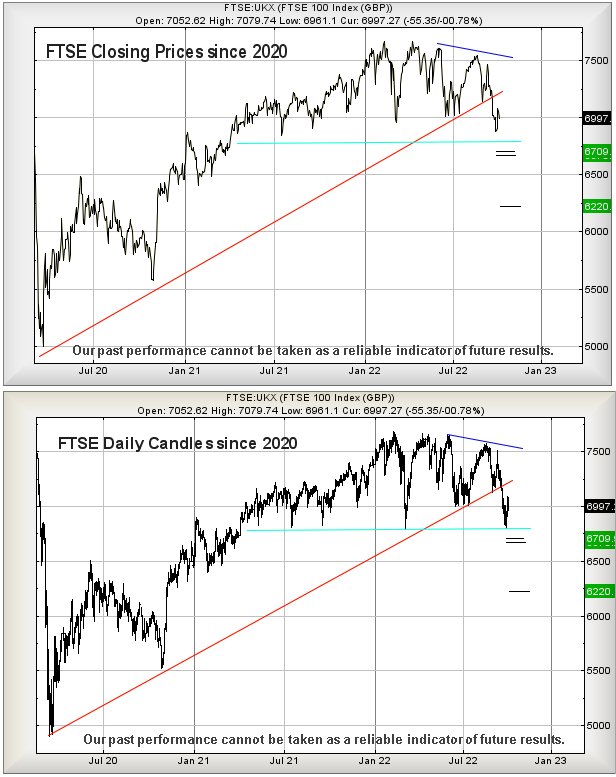

The charts immediately below are a simple representation of FTSE closing prices since March 2020. While the index has clearly broken through Red, the uptrend, the price has not being describing “Lower Lows”, needing to CLOSE a session below 6797 – the most recent intraday low price – to tick the first box in an inevitable tumble to around 6,220 points eventually. Instead, the UK market is performing as if the Light Blue line represents an impenetrable barrier, below which some sort of rule will stop the market falling.

There’s a tiny little problem with this, thanks to the break of Red. Thanks to politics in the UK, the market has already illustrated the pandemic uptrend can fail and appears to be awaiting the next economic gaff from the PM or Chancellor as the FTSE hasn’t made any real effort to clamber above 7200 points, hopefully eradicating the reversal potentials. Instead, with a couple of weeks of fits and starts, London appears to be treading water, doubtless with an expectation British politicians will give in to temptation and continue their efforts to erode confidence in the economy. Additionally, we remain curious at the virtual political & media blackout regarding the price of crude oil, no-one questioning why fuel prices remain high despite the cost of Crude retreating below the level, pre-Ukraine!

Our suspicion is the FTSE shall discover a path down to 6220 points eventually. It just needs the right excuse…

FTSE for FRIDAY From a near term perspective, we strongly suspect the FTSE requires exceed 7,120 points to trigger some “proper” gains, allowing rather tame movement to an initial 7,138 points with secondary, if bettered, a more impressive 7,230 points. Obviously, such movement has the potential of affording the chance for the FTSE to close a session in “safe” territory, effectively undoing the numeric damage from the trend break. If this upward break triggers, the tightest stop is painfully wide around 7,050 points.

However, we’d be remiss if we ignored market behaviour on Thursday 6th October. Ongoing traffic below 6,960 points calculates with the potential of reversal to an initial 6,920 points with secondary, if broken, at 6,862 points. Neither reversal ambition is sufficient to trigger anything from a Big Picture perspective and thus, for this reason alone, they’re probably the ideal series of movements for the FTSE in the absence of negative news.

Of course, it’s also the first Friday of October and this means US Payrolls day!

Have a good weekend.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:37:46PM | BRENT | 94.48 | 92.28 | 91.37 | 93.47 | 94.58 | 94.86 | 93 | |||

| 9:39:14PM | GOLD | 1713.3 | 1706 | 1699 | 1715 | 1722 | 1728 | 1709 | |||

| 9:41:07PM | FTSE | 6980.09 | 6959 | 6918 | 7011 | 7024 | 7034 | 6997 | ‘cess | ||

| 9:43:00PM | STOX50 | 3420 | 3414 | 3396 | 3444 | 3458 | 3471 | 3427 | Shambles | ||

| 9:44:50PM | GERMANY | 12434 | 12412 | 12326 | 12534 | 12556 | 12600 | 12444 | |||

| 9:47:33PM | US500 | 3739 | 3733 | 3696 | 3764 | 3781 | 3801 | 3743 | |||

| 9:49:27PM | DOW | 29924 | 29840 | 29773 | 30060 | 30424 | 30575 | 30226 | |||

| 9:51:34PM | NASDAQ | 11452 | 11446 | 11379 | 11530 | 11608 | 11648 | 11524 | |||

| 9:57:24PM | JAPAN | 27002 | 26981 | 26892 | 27093 | 27216 | 27290 | 27060 | Success |

6/10/2022 FTSE Closed at 6997 points. Change of -0.78%. Total value traded through LSE was: £ 6,440,759,247 a change of 17.34%

5/10/2022 FTSE Closed at 7052 points. Change of -0.48%. Total value traded through LSE was: £ 5,488,765,319 a change of -9.96%

4/10/2022 FTSE Closed at 7086 points. Change of 2.58%. Total value traded through LSE was: £ 6,096,244,319 a change of 12.65%

3/10/2022 FTSE Closed at 6908 points. Change of 0.22%. Total value traded through LSE was: £ 5,411,543,289 a change of -20.03%

30/09/2022 FTSE Closed at 6893 points. Change of 0.17%. Total value traded through LSE was: £ 6,766,933,974 a change of -4.67%

29/09/2022 FTSE Closed at 6881 points. Change of -1.77%. Total value traded through LSE was: £ 7,098,757,750 a change of -12.95%

28/09/2022 FTSE Closed at 7005 points. Change of 0.3%. Total value traded through LSE was: £ 8,154,391,132 a change of 17.78%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AGM Applied Graphene** **LSE:CNA Centrica** **LSE:IGG IG Group** **LSE:NG. National Glib** **LSE:SBRY Sainsbury** **LSE:TERN Tern Plc** **

********

Updated charts published on : Applied Graphene, Centrica, IG Group, National Glib, Sainsbury, Tern Plc,

LSE:AGM Applied Graphene Close Mid-Price: 12.5 Percentage Change: -3.85% Day High: 13 Day Low: 12.5

Continued weakness against AGM taking the price below 12.5 calculates as ……..

</p

View Previous Applied Graphene & Big Picture ***

LSE:CNA Centrica Close Mid-Price: 68.44 Percentage Change: -4.44% Day High: 71.28 Day Low: 67.88

Weakness on Centrica below 67.88 will invariably lead to 60 with secondar ……..

</p

View Previous Centrica & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 784.5 Percentage Change: + 0.45% Day High: 788.5 Day Low: 780

All IG Group needs are mid-price trades ABOVE 788.5 to improve accelerati ……..

</p

View Previous IG Group & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 909.6 Percentage Change: -1.64% Day High: 927.6 Day Low: 905.8

Weakness on National Glib below 905.8 will invariably lead to 889 with se ……..

</p

View Previous National Glib & Big Picture ***

LSE:SBRY Sainsbury Close Mid-Price: 169.95 Percentage Change: -1.31% Day High: 174.9 Day Low: 169.8

Target met. Continued weakness against SBRY taking the price below 169.8 ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:TERN Tern Plc Close Mid-Price: 7.25 Percentage Change: -12.12% Day High: 7.6 Day Low: 7.25

Target met. If Tern Plc experiences continued weakness below 7.25, it wil ……..

</p

View Previous Tern Plc & Big Picture ***