#DOW #NK225 Once again, it’s that time of year when TV shows video of 2 towers falling and (for some growing up even by the 1970’s), reminds of the day terrorism stole the mystery and magic of flying. A temptation to cover Boeing today was abandoned (heading up to $411). Instead, we favour VW, famed for the Bentley Continental GT…

Okay, VW make a few other things but enjoying being a passenger in a Bentley GT for an hour or so revived a memory of actually liking cars. Nowadays, it’s tempting to treat them as functional boxes (or if you own a Ford C-Max, non-functional boxes).

Our current transport for the two Golden Retrievers is a Toyota RAV4, a machine which doesn’t seem to break down, is fast, quiet, amazingly economical, handles, and pulls an occasional boat trailer. There’s absolutely nothing “special” about it whereas for ‘just a few pounds‘ more, the dogs could enjoy the rear seats of a Bentley coupe. The more thought given, it’s possible dogs are being abused by NOT being driven around in a Bentley!

The wheels came off this particular dream, when discussing the cost of servicing. Or even tyres and door mirrors, both frequent casualties of the road network here in Argyll. And to get real, a Bentley is not cheap to buy anyway.

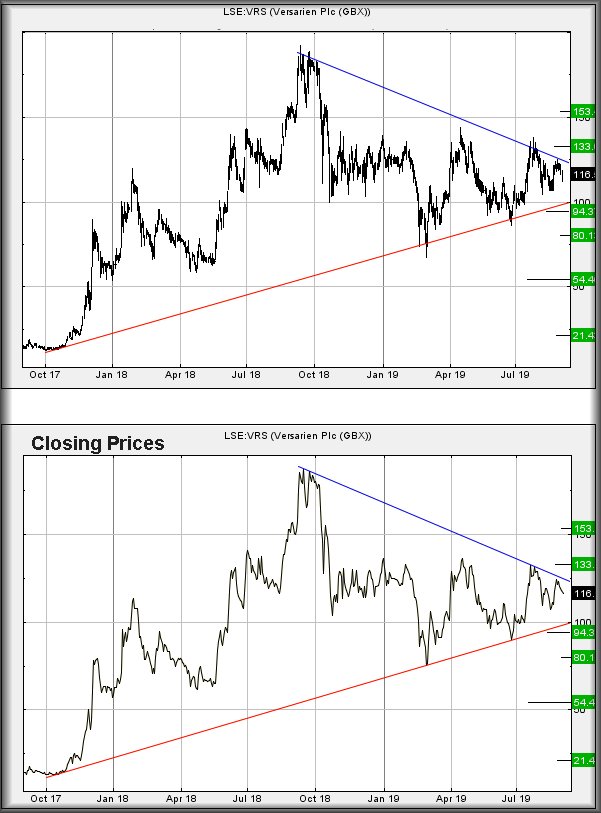

VW’s share price has been languishing since their “Diesel Scandal” but there are some signs recovery may be coming. In the event the share manages to trade above 163 Euro, we calculate an initial ambition up at 177. In the event the price exceeds this level, our secondary comes in at 198 Euro and visually this will prove game changing for the longer term. On the chart below, VW’s downtrend in Blue defines daily closing prices, rather than daily highs as this appears how the share is being mapped. This being the case, we can even allow for optimism should the price of VW actually close a session above 159.75 Euro anytime soon. This will hopefully provide reliable early warning for a period of uphill acceleration.

Of course, there’s a fly in the ointment with this scenario as the price need only slump below 143 to give concern as this shall place the share at risk of 117 and below.

For now, thanks to an hour in a Bentley, we’re feeling kindly toward VW.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:28:29PM |

BRENT |

62.25 |

‘cess | ||||||||

|

9:30:00PM |

GOLD |

1487.02 |

‘cess | ||||||||

|

9:40:05PM |

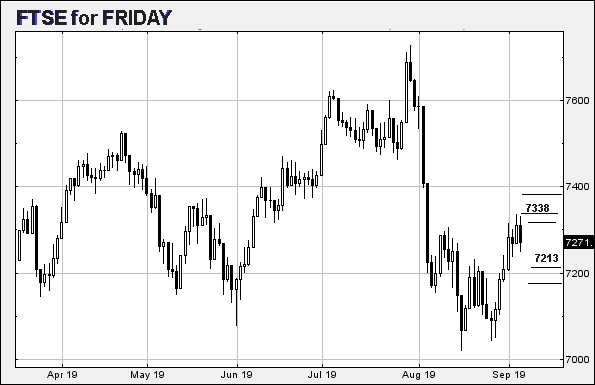

FTSE |

7284.6 |

‘cess | ||||||||

|

9:43:28PM |

FRANCE |

5590 |

‘cess | ||||||||

|

9:46:45PM |

GERMANY |

12297 |

Success | ||||||||

|

9:48:38PM |

US500 |

2978.17 |

‘cess | ||||||||

|

9:52:04PM |

DOW |

26892 |

26711 |

26651.5 |

26565 |

26860 |

26911 |

26938.5 |

26971 |

26770 |

‘cess |

|

9:55:04PM |

NASDAQ |

7814.24 |

Success | ||||||||

|

9:56:24PM |

JAPAN |

21460 |

21289 |

21227 |

21145 |

21377 |

21473 |

21500.5 |

21571 |

21309 |

‘cess |