#FreeFutures #FTSE Absolutely nothing to do with the markets; anyone who’s ever read ‘Bike’ magazine will doubtless notice a 50th Anniversary edition in newsagents. For years, the first component read of “Bike” was the Ogri cartoon on the back page. This “Anniversary***” edition completely omits any mention of their best bit! Traditionally, we always enjoy a moan at the start of August, thanks to the markets taking a mental holiday in addition to a literal one. This year feels a little different, the FTSE proving well behaved with a trading range, so far this month, of just 80 points.

Some days, there would be a burst of sudden excitement, a mood which quickly waned with the realisation a movement of just 5 points can look pretty major on a chart, when the market had spent a few hours exploring a 10 point range. A five point jump or drop obviously paints a vivid 50% picture until you zoom out to view the entire day. The now familiar reality of nothing actually happening once again hits home… Sometimes, we suspect the markets do this, just to lull folk into a sense of false security, perhaps encouraging us all to turn our backs and miss some real excitement?

We’re pretty comfortable something interesting is due with the FTSE. The only problem is, will the market take all of August to make the movement or shall it occur when a fit of boredom has driven us all outdoors to count the wheels on the car! Perhaps it shall be the case the US Payrolls Numbers, due on Friday 6th August, will be sufficient to force an irrational movement from the FTSE, making it essential we watch Bloomberg or CNN at 1.30pm.

Regardless, the immediate situation is pretty straightforward. Above just 7143 points should harbour ambitions of a visit to 7198 points. If bettered, we’d hope for a visit to 7235 points which will represent a new “high” for the index, following the market being trashed at the start of 2020. If triggered, the tightest stop is suspiciously attractive at just 7100 points.

What are the threats, if 7100 points breaks?

Initially, we suspect reversal to a pretty tame 7077 points with secondary, if broken, our secondary is at 7055. This represents a level we’d suspect a bounce, doubtless due to the FTSE intending remain within its soporific journey through the month.

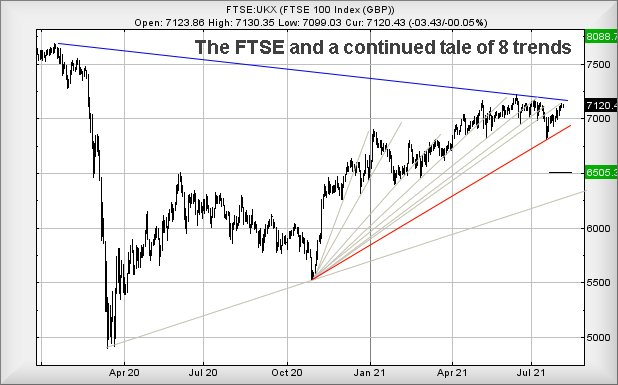

Yet again, we’ve published a ‘trends’ chart for the FTSE below, dealing with the curious period since October last year. The market displays lots of uptrends which proved false when, despite the uptrend being broken, the index goes on to exceed the point of trend break, proving the uptrend wasn’t actually a trend. It is truly amazing to be able to paint 8 lines, anchored to a single point. Traditionally, when a trend line fails, there’s a reasonable expectation for coming reversals but in this instance, the converse appears true. If the market is failing to fall despite lots of trend failures, we can only embrace an assumption growth is coming. Just, goodness knows when!

***Needless to say, the only reason this edition was bought was curiosity, just to see if Ogri would again appear. Alas, £5 was wasted.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:02:59PM | BRENT | 71.09 | 69.63 | 69.07 | 70.93 | 71.36 | 71.57 | 70.3 | |||

| 10:06:44PM | GOLD | 1804.54 | 1803 | 1801 | 1810 | 1814 | 1819.5 | 1808 | ‘cess | ||

| 10:17:11PM | FTSE | 7122.76 | 7094 | 7085 | 7127 | 7131 | 7148 | 7104 | Shambles | ||

| 10:19:13PM | FRANCE | 6775.5 | 6748 | 6739 | 6782 | 6787 | 6797 | 6766 | ‘cess | ||

| 10:21:03PM | GERMANY | 15751 | 15658 | 15642 | 15728 | 15756 | 15761 | 15735 | Success | ||

| 10:24:16PM | US500 | 4429.82 | 4400 | 4394 | 4414 | 4430 | 4434 | 4408 | ‘cess | ||

| 10:30:05PM | DOW | 35048 | 34804 | 34739 | 34900 | 35060 | 35121 | 34947 | Success | ||

| 10:31:53PM | NASDAQ | 15180.59 | 15082 | 15034 | 15130 | 15184 | 15214.25 | 15115 | Success | ||

| 10:35:13PM | JAPAN | 27849 | 27760 | 27733 | 27828 | 27868 | 27883 | 27760 | Success |

5/08/2021 FTSE Closed at 7120 points. Change of -0.04%. Total value traded through LSE was: £ 5,576,456,686 a change of -7.06%

4/08/2021 FTSE Closed at 7123 points. Change of 0.25%. Total value traded through LSE was: £ 6,000,336,002 a change of 33.33%

3/08/2021 FTSE Closed at 7105 points. Change of 0.34%. Total value traded through LSE was: £ 4,500,441,860 a change of 3.51%

2/08/2021 FTSE Closed at 7081 points. Change of 0.7%. Total value traded through LSE was: £ 4,347,850,496 a change of -16.5%

30/07/2021 FTSE Closed at 7032 points. Change of -0.65%. Total value traded through LSE was: £ 5,206,905,420 a change of -14.32%

29/07/2021 FTSE Closed at 7078 points. Change of 0.88%. Total value traded through LSE was: £ 6,077,251,516 a change of 24.02%

28/07/2021 FTSE Closed at 7016 points. Change of 0.29%. Total value traded through LSE was: £ 4,900,403,964 a change of 0.43%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AVCT Avacta** **LSE:DDDD 4D Pharma** **LSE:ECO ECO (Atlantic) O & G** **LSE:EMG MAN** **LSE:GLEN Glencore Xstra** **LSE:IGAS Igas Energy** **LSE:ITM ITM Power** **LSE:NWG Natwest** **LSE:RMG Royal Mail** **LSE:RR. Rolls Royce** **LSE:SPX Spirax** **LSE:SRP Serco** **

********

Updated charts published on : Avacta, 4D Pharma, ECO (Atlantic) O & G, MAN, Glencore Xstra, Igas Energy, ITM Power, Natwest, Royal Mail, Rolls Royce, Serco,

LSE:AVCT Avacta. Close Mid-Price: 128 Percentage Change: + 0.00% Day High: 131.5 Day Low: 126

Now below 121 looks troubling, presenting an initial reversal target of 11 ……..

</p

View Previous Avacta & Big Picture ***

LSE:DDDD 4D Pharma Close Mid-Price: 82.3 Percentage Change: -2.49% Day High: 88.4 Day Low: 81.7

If 4D Pharma experiences continued weakness below 81.7, it will invariabl ……..

</p

View Previous 4D Pharma & Big Picture ***

LSE:ECO ECO (Atlantic) O & G. Close Mid-Price: 28 Percentage Change: + 9.80% Day High: 30.75 Day Low: 25.75

Continued trades against ECO with a mid-price ABOVE 30.75 should improve ……..

</p

View Previous ECO (Atlantic) O & G & Big Picture ***

LSE:EMG MAN Close Mid-Price: 209.4 Percentage Change: -0.38% Day High: 211.5 Day Low: 207.1

Target met. Further movement against MAN ABOVE 211.5 should improve accel ……..

</p

View Previous MAN & Big Picture ***

LSE:GLEN Glencore Xstra Close Mid-Price: 324 Percentage Change: -1.61% Day High: 334 Day Low: 319.55

Target met. In the event of Glencore Xstra enjoying further trades beyond ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:IGAS Igas Energy Close Mid-Price: 15.75 Percentage Change: -3.67% Day High: 15.9 Day Low: 15.9

Continued weakness against IGAS taking the price below 15.9 calculates as ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:ITM ITM Power Close Mid-Price: 380.4 Percentage Change: -4.80% Day High: 397.2 Day Low: 373.6

In the event ITM Power experiences weakness below 373.6 it calculates wit ……..

</p

View Previous ITM Power & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 211 Percentage Change: + 0.29% Day High: 211.5 Day Low: 205.7

Target met. Further movement against Natwest ABOVE 211.5 should improve a ……..

</p

View Previous Natwest & Big Picture ***

LSE:RMG Royal Mail Close Mid-Price: 499.8 Percentage Change: -0.75% Day High: 506.2 Day Low: 492.6

In the event Royal Mail experiences weakness below 492.6 it calculates wi ……..

</p

View Previous Royal Mail & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 110.68 Percentage Change: + 5.87% Day High: 110.1 Day Low: 104

Target met. All Rolls Royce needs are mid-price trades ABOVE ^111 to impr ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SPX Spirax. Close Mid-Price: 15410 Percentage Change: + 0.52% Day High: 15555 Day Low: 15330

Continued trades against SPX with a mid-price ABOVE 15520 should improve t ……..

</p

View Previous Spirax & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 140.9 Percentage Change: + 0.21% Day High: 146.1 Day Low: 138.7

Continued trades against SRP with a mid-price ABOVE 146.1 should improve ……..

</p

View Previous Serco & Big Picture ***