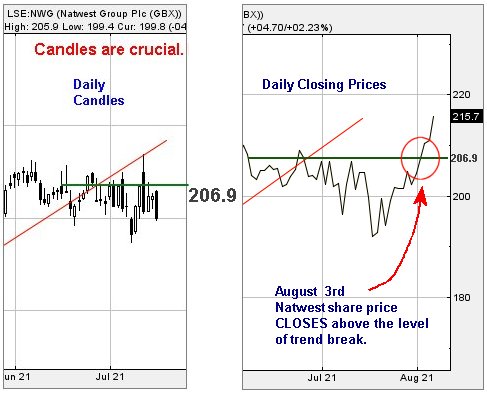

#Brent #SP500 When we last reviewed #Natwest three weeks ago, we made a point of showing how important it can be to study a shares closing price, in addition to viewing a screen full of pretty candles. Amazingly, for a UK retail bank, everything started to make sense within days, a target was met, and yet another potential candle catastrophe is upon us.

Firstly, the chart extracts below. The Red uptrend since September 2020 was broken in June, the trend break level being at 206.9p. We’d made a point, should the share price manage to close above the level of trend break, we could no longer regard the Red uptrend as being viable. On August 3rd, Natwest share price closed the session at 207.4p, suggesting the historical break of the uptrend was no longer valid and instead, price growth was expected. Our initial target of 215p was successfully achieved in Friday 6th August.

However, staying with our lesson on managing candles – and when to turn them off – it’s very possible something more important occurred on Friday, given the point at which Natwest share price closed the session. Shown below, there’s a long term Blue downtrend and with the share price closing at 215.7p, the day was quite solidly above the historical downtrend, ticking a pretty important box which is the first sign of optimism for the future. The share now needs close a session below 213.6p to give cause for concern.

Finally, even from a near term viewpoint, reasonable levels of hope appear posssible. Above 216p now calculates with the potential of gains in the direction of an initial 226p with secondary, if exceeded, working out at a very possible 251p. In fact, from a Big Picture perspective, thanks to the share closing a session above the Blue downtrend, we can now regard a long term 324p as allegedly exerting a distant influence.

If it all intends go horribly wrong, the share price needs close a session below 193p, thus threatening a reversal cycle commencing down to 167p eventually.

As ever, thanks to those folk who find adverts on this page worth a visit. It buys an essential daily coffee & bun.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 8:24:59PM | BRENT | 70.25 | 70.13 | 69.465 | 68.52 | 71.4 | 71.81 | 72.385 | 73.3 | 70.88 | Success |

| 9:23:37PM | GOLD | 1764.41 | Success | ||||||||

| 9:25:44PM | FTSE | 7126.72 | |||||||||

| 9:30:21PM | FRANCE | 6825 | Success | ||||||||

| 9:32:51PM | GERMANY | 15780 | Success | ||||||||

| 9:35:09PM | US500 | 4436 | 4423 | 4416 | 4408 | 4431 | 4440 | 4448.5 | 4474 | 4423 | ‘cess |

| 9:37:51PM | DOW | 35206 | Success | ||||||||

| 9:39:41PM | NASDAQ | 15106 | |||||||||

| 9:41:37PM | JAPAN | 27890 | Success |

6/08/2021 FTSE Closed at 7122 points. Change of 0.03%. Total value traded through LSE was: £ 5,759,335,075 a change of 3.28%

5/08/2021 FTSE Closed at 7120 points. Change of -0.04%. Total value traded through LSE was: £ 5,576,456,686 a change of -7.06%

4/08/2021 FTSE Closed at 7123 points. Change of 0.25%. Total value traded through LSE was: £ 6,000,336,002 a change of 33.33%

3/08/2021 FTSE Closed at 7105 points. Change of 0.34%. Total value traded through LSE was: £ 4,500,441,860 a change of 3.51%

2/08/2021 FTSE Closed at 7081 points. Change of 0.7%. Total value traded through LSE was: £ 4,347,850,496 a change of -16.5%

30/07/2021 FTSE Closed at 7032 points. Change of -0.65%. Total value traded through LSE was: £ 5,206,905,420 a change of -14.32%

29/07/2021 FTSE Closed at 7078 points. Change of 0.88%. Total value traded through LSE was: £ 6,077,251,516 a change of 24.02%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:BARC Barclays** **LSE:CASP Caspian** **LSE:FGP Firstgroup** **LSE:MRW Morrisons** **LSE:NWG Natwest** **LSE:OXIG Oxford Instruments** **LSE:RR. Rolls Royce** **LSE:VEC Vectura** **

********

Updated charts published on : Aviva, Barclays, Caspian, Firstgroup, Morrisons, Natwest, Oxford Instruments, Rolls Royce, Vectura,

LSE:AV. Aviva. Close Mid-Price: 399.1 Percentage Change: + 1.94% Day High: 400.9 Day Low: 389.6

Further movement against Aviva ABOVE 400.9 should improve acceleration to ……..

</p

View Previous Aviva & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 182.66 Percentage Change: + 1.64% Day High: 183.4 Day Low: 178.94

Target met. All Barclays needs are mid-price trades ABOVE 183.4 to improv ……..

</p

View Previous Barclays & Big Picture ***

LSE:CASP Caspian. Close Mid-Price: 3 Percentage Change: + 5.26% Day High: 3.15 Day Low: 2.9

Further movement against Caspian ABOVE 3.15 should improve acceleration t ……..

</p

View Previous Caspian & Big Picture ***

LSE:FGP Firstgroup. Close Mid-Price: 90.05 Percentage Change: + 1.35% Day High: 90.65 Day Low: 88.35

In the event of Firstgroup enjoying further trades beyond 90.65 should im ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:MRW Morrisons. Close Mid-Price: 278.8 Percentage Change: + 2.50% Day High: 279.6 Day Low: 269.5

All Morrisons needs are mid-price trades ABOVE 279.6 to improve accelerat ……..

</p

View Previous Morrisons & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 215.7 Percentage Change: + 2.23% Day High: 215.7 Day Low: 209.7

Target met. In the event of Natwest enjoying further trades beyond 215.7, ……..

</p

View Previous Natwest & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 2550 Percentage Change: -0.97% Day High: 2600 Day Low: 2520

In the event of Oxford Instruments enjoying further trades beyond 2600, t ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 112.42 Percentage Change: + 1.57% Day High: 112.8 Day Low: 109.42

Continued trades against RR. with a mid-price ABOVE 112.8 should improve ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:VEC Vectura. Close Mid-Price: 164 Percentage Change: + 6.49% Day High: 164.8 Day Low: 153.4

Target met. Further movement against Vectura ABOVE 164.8 should improve a ……..

</p

View Previous Vectura & Big Picture ***