#FTSE #WallSt There’s something about Metro Bank we find attractive, perhaps the lack of corporate baggage held by other retail banks. It’s refreshing, when the first retail High St bank in over 100 years describe their outlets as “Stores” or “Shops” in a real attempt to soften perception away from the intimidating facade once propagated in Mary Poppins and Harry Potter. However, other High St banks have long tried to alter public perception, if only with lower counters in their branches.

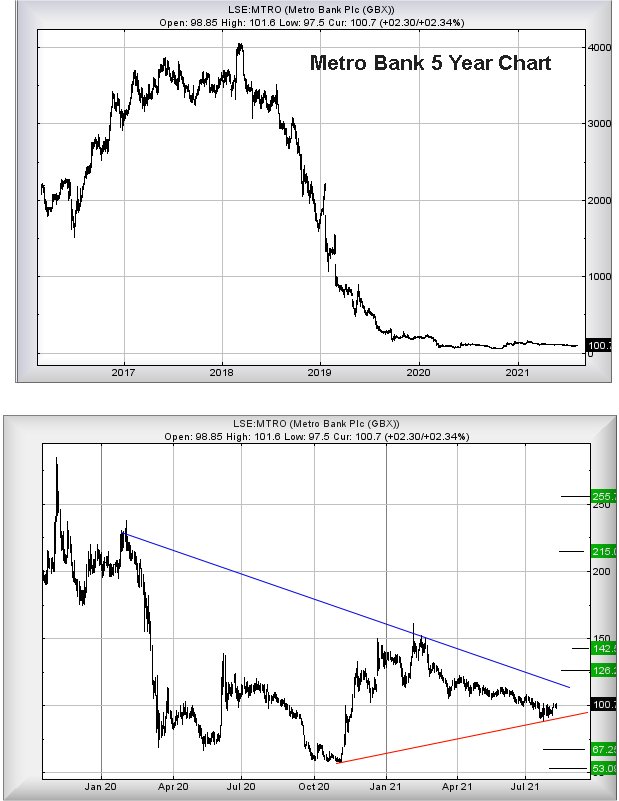

But Metro Bank remain the dog friendly chain of outlets and more recently, appear to be experimenting with hosting childrens craft weeks in a few of their stores. If only the company hadn’t experienced their little whoopsie with an accounting error back in 2019, causing their share price to drop 39% in a single day. This event has overseen a period of rot for the company share price, diminishing from 2200p to a low of 58p toward the end of last year. In 2018, the bank share price had peaked at just over £40!

Such has been the level of drama, we cannot display a meaningful 5 year chart as scaling forces price movements since the start of the pandemic to appear as a virtually flat line.

However, there are early signs something is brewing in the recovery aisle for this retail shop and we’d suggest paying attention, should the price manage above 112p. At time of writing, the share is trading around 100p, so perhaps this isn’t such a distant trigger level. Above 112p calculates as capable of driving price recovery toward an initial 126p with secondary, if bettered, working out at a longer term 142p. At this secondary level, the all important signal for the longer term shall arrive depending on where the price manages to close a session.

In the event the share manages to actually close above 140p, some quite surprising longer term expectations become available as we can project future movement to 215p, along with a possible glass ceiling. This is due to such a calculation also challenging the share price pre-Covid high last year and other shares, when reaching this level, are tending to pause for thought for a while, prior to any further movements northward.

For alarm bells to ring, the share needs below 88p as this risks a very real threat of matching last years lows.

Currently, we’re a little bit optimistic over this lots potentials.

Trends and Targets. Past performance is not a reliable indicator of future results

As always, a big thanks to those who find useful adverts on this page.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:51:10PM | BRENT | 70.61 | |||||||||

| 9:52:54PM | GOLD | 1728.85 | |||||||||

| 9:56:10PM | FTSE | 7178.88 | 7113 | 7093.5 | 7065 | 7148 | 7180 | 7229 | 7273 | 7114 | Success |

| 9:58:10PM | FRANCE | 6834 | |||||||||

| 10:00:59PM | GERMANY | 15789 | Shambles | ||||||||

| 10:04:02PM | US500 | 4436.72 | Success | ||||||||

| 10:06:32PM | DOW | 35265 | |||||||||

| 10:08:58PM | NASDAQ | 15060 | ‘cess | ||||||||

| 10:11:08PM | JAPAN | 27987 | 27792 | 27709 | 27571 | 27900 | 28008 | 28057.5 | 28145 | 27925 | Success |

10/08/2021 FTSE Closed at 7151 points. Change of 0.27%. Total value traded through LSE was: £ 5,561,861,537 a change of 12.31%

9/08/2021 FTSE Closed at 7132 points. Change of 0.14%. Total value traded through LSE was: £ 4,952,268,424 a change of -14.01%

6/08/2021 FTSE Closed at 7122 points. Change of 0.03%. Total value traded through LSE was: £ 5,759,335,075 a change of 3.28%

5/08/2021 FTSE Closed at 7120 points. Change of -0.04%. Total value traded through LSE was: £ 5,576,456,686 a change of -7.06%

4/08/2021 FTSE Closed at 7123 points. Change of 0.25%. Total value traded through LSE was: £ 6,000,336,002 a change of 33.33%

3/08/2021 FTSE Closed at 7105 points. Change of 0.34%. Total value traded through LSE was: £ 4,500,441,860 a change of 3.51%

2/08/2021 FTSE Closed at 7081 points. Change of 0.7%. Total value traded through LSE was: £ 4,347,850,496 a change of -16.5%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:CPI Capita** **LSE:EMG MAN** **LSE:FGP Firstgroup** **LSE:MRW Morrisons** **LSE:NG. National Glib** **LSE:ODX Omega Diags** **LSE:POLY Polymetal** **LSE:QFI Quadrise** **LSE:SBRY Sainsbury** **LSE:VEC Vectura** **LSE:VOG VICTORIA** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Aviva, Capita, MAN, Firstgroup, Morrisons, National Glib, Omega Diags, Polymetal, Quadrise, Sainsbury, Vectura, VICTORIA, Zoo Digital,

LSE:AV. Aviva. Close Mid-Price: 403 Percentage Change: + 0.67% Day High: 403.6 Day Low: 396.8

In the event of Aviva enjoying further trades beyond 403.6, the share sho ……..

</p

View Previous Aviva & Big Picture ***

LSE:CPI Capita. Close Mid-Price: 45.9 Percentage Change: + 6.74% Day High: 46.27 Day Low: 42.6

Continued trades against CPI with a mid-price ABOVE 46.27 should improve ……..

</p

View Previous Capita & Big Picture ***

LSE:EMG MAN. Close Mid-Price: 214.3 Percentage Change: + 2.39% Day High: 215.6 Day Low: 209.5

Target met. Continued trades against EMG with a mid-price ABOVE 215.6 sho ……..

</p

View Previous MAN & Big Picture ***

LSE:FGP Firstgroup. Close Mid-Price: 91.6 Percentage Change: + 0.33% Day High: 92.3 Day Low: 89.7

Further movement against Firstgroup ABOVE 92.3 should improve acceleratio ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:MRW Morrisons. Close Mid-Price: 281.3 Percentage Change: + 0.90% Day High: 283.3 Day Low: 280.1

In the event of Morrisons enjoying further trades beyond 283.3, the share ……..

</p

View Previous Morrisons & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 951.5 Percentage Change: + 0.68% Day High: 952 Day Low: 943

Continued trades against NG. with a mid-price ABOVE 952 should improve th ……..

</p

View Previous National Glib & Big Picture ***

LSE:ODX Omega Diags Close Mid-Price: 48 Percentage Change: -1.03% Day High: 49 Day Low: 31.5

Target met. If Omega Diags experiences continued weakness below 31.5, it ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:POLY Polymetal Close Mid-Price: 1467.5 Percentage Change: -1.01% Day High: 1499 Day Low: 1462.5

Target met. Weakness on Polymetal below 1462.5 will invariably lead to 14 ……..

</p

View Previous Polymetal & Big Picture ***

LSE:QFI Quadrise. Close Mid-Price: 3.35 Percentage Change: + 9.84% Day High: 3.35 Day Low: 3

It’s interesting to note a near term move above 3.35 points at 3.75, along ……..

</p

View Previous Quadrise & Big Picture ***

LSE:SBRY Sainsbury. Close Mid-Price: 293.9 Percentage Change: + 1.07% Day High: 294 Day Low: 290

All Sainsbury needs are mid-price trades ABOVE 294 to improve acceleratio ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:VEC Vectura Close Mid-Price: 163.4 Percentage Change: -5.55% Day High: 175 Day Low: 173

In the event of Vectura enjoying further trades beyond 175, the share sho ……..

</p

View Previous Vectura & Big Picture ***

LSE:VOG VICTORIA Close Mid-Price: 3.6 Percentage Change: -6.49% Day High: 3.94 Day Low: 3.47

Continued weakness against VOG taking the price below 3.47 calculates as ……..

</p

View Previous VICTORIA & Big Picture ***

LSE:ZOO Zoo Digital Close Mid-Price: 149 Percentage Change: -0.67% Day High: 152.5 Day Low: 149

Target met. Further movement against Zoo Digital ABOVE 152.5 should impro ……..

</p

View Previous Zoo Digital & Big Picture ***