#DOW #DAX While used to diverse visitors worldwide to our #FTSE Friday missive, last week saw a strange surge of visitors from Argentina, sufficient to nudge Reunion Island to the bottom of the international Top 20 sources. The surprise; Argentina has never featured previously but suddenly we’d 15 unique readers in Buenos Aires. Suspect we’d featured in a chatroom!

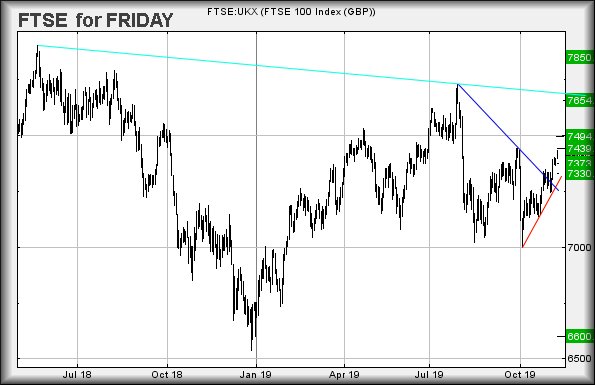

Optimism for the future of the FTSE is gradually subsiding as the market threatens a dodgy moment, one which gives us an excuse to explain some basic rules we apply to price movements. The chart below is used to highlight something we attach importance to, what happens when a downtrend is exceeded?

Against this particular share, the price bettered 57.34 and immediately surged upward. We’ve circled the movement, one which even shows a little jiggle at the point of trend break, showing the market appeared attach some importance to it. This sort of thing is generally a “safe” signal something useful is about to happen. In this particular instance, it had an initial target of 59.5p, achieved and slightly bettered.

In theory, this gives hope for the future but we’ve circled the trend break of 57.34 to highlight something else. If a share (or index) manages below the point of trend break, following an initial surge, the implication for any immediate growth is really not great. Instead, there’s a strong probability a price is about to mess around, usually between the high achieved following the trend break and the low achieved before the trend break. We’ve absolutely no idea why this should happen but in the case of this particular share, it suggests anything now below 57.34 will doubtless witness the share price oscillate between 55.5 and 59.5 for a while. Obviously, a useful trading range and only when this range is either exceeded or broken dare we believe a new trend is forming.

With the looming general election, we suspect quite a few shares shall be placed in a parking zone until it becomes clear the UK knows what isn’t going to happen next…

The reason we explained the foregoing is twofold. Firstly, ‘cos we’ve nothing interesting to write about the FTSE and secondly, ‘cos the FTSE is in danger of doing exactly the thing we’re warning about. If the market closes below 7280 points, it shall exhibit a very real risk of becoming rangebound for a while until the UK political shambles is resolved. This will mean the market being trapped in the 7140 to 7400 zone for a while.

Near term, the suggestion is of weakness now below 7288 bringing reversal down to an initial 7266 points. If broken, our secondary calculation comes in at a less likely (near term) 7216 points.

There is a surprising, alternate potential for Friday. In the event the index makes it above 7331 points, some recovery to an initial 7359 is possible. If bettered, secondary calculates at 7383 points.

We suspect reversal but on the bright side, despite Brazil not appearing on our list of countries visiting our website, Sao Paulo hosts this weekends Formula 1 race.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:47:04PM |

BRENT |

61.95 |

61.71 |

61.46 |

62.78 |

63.32 |

‘cess | ||||

|

9:48:41PM |

GOLD |

1471.37 |

1463 |

1458.5 |

1475 |

1477 |

‘cess | ||||

|

9:51:23PM |

FTSE |

7312.39 |

7282 |

7255 |

7343 |

7354 | |||||

|

9:53:57PM |

FRANCE |

5910.7 |

5889 |

5882 |

5917 |

5925 |

Shambles | ||||

|

9:57:04PM |

GERMANY |

13211.07 |

13157 |

13109 |

13273 |

13292 | |||||

|

10:13:57PM |

US500 |

3098.52 |

3082 |

3076 |

3099 |

3103 | |||||

|

10:29:04PM |

DOW |

27788 |

27669 |

27625.5 |

27840 |

27874 | |||||

|

10:31:00PM |

NASDAQ |

8263.5 |

8226 |

8206 |

8266 |

8279.5 |

Shambles | ||||

|

10:32:45PM |

JAPAN |

23152 |

23004 |

22940 |

23199 |

23248.5 |

‘cess |

14/11/2019 FTSE Closed at 7292 points. Change of -0.8%. Total value traded through LSE was: £ 5,234,690,954 a change of -2.01%

13/11/2019 FTSE Closed at 7351 points. Change of -0.19%. Total value traded through LSE was: £ 5,342,219,099 a change of -6.91%

12/11/2019 FTSE Closed at 7365 points. Change of 0.5%. Total value traded through LSE was: £ 5,738,598,465 a change of -2.15%

11/11/2019 FTSE Closed at 7328 points. Change of -0.42%. Total value traded through LSE was: £ 5,864,681,253 a change of 22.23%

8/11/2019 FTSE Closed at 7359 points. Change of -0.63%. Total value traded through LSE was: £ 4,798,106,379 a change of -22.57%

7/11/2019 FTSE Closed at 7406 points. Change of 0.14%. Total value traded through LSE was: £ 6,196,615,818 a change of 30.74%

6/11/2019 FTSE Closed at 7396 points. Change of 0.11%. Total value traded through LSE was: £ 4,739,678,595 a change of -23.11%

12/11/2019 FTSE Closed at 7365 points. Change of 0.5%. Total value traded through LSE was: £ 5,738,598,465 a change of -2.15%

11/11/2019 FTSE Closed at 7328 points. Change of -0.42%. Total value traded through LSE was: £ 5,864,681,253 a change of 22.23%

8/11/2019 FTSE Closed at 7359 points. Change of -0.63%. Total value traded through LSE was: £ 4,798,106,379 a change of -22.57%

7/11/2019 FTSE Closed at 7406 points. Change of 0.14%. Total value traded through LSE was: £ 6,196,615,818 a change of 30.74%

6/11/2019 FTSE Closed at 7396 points. Change of 0.11%. Total value traded through LSE was: £ 4,739,678,595 a change of -23.11%

8/11/2019 FTSE Closed at 7359 points. Change of -0.63%. Total value traded through LSE was: £ 4,798,106,379 a change of -22.57%

7/11/2019 FTSE Closed at 7406 points. Change of 0.14%. Total value traded through LSE was: £ 6,196,615,818 a change of 30.74%

6/11/2019 FTSE Closed at 7396 points. Change of 0.11%. Total value traded through LSE was: £ 4,739,678,595 a change of -23.11%

6/11/2019 FTSE Closed at 7396 points. Change of 0.11%. Total value traded through LSE was: £ 4,739,678,595 a change of -23.11%