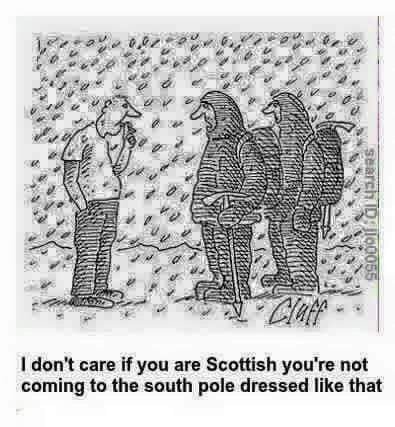

#DAX #CAC40 As we ‘enjoy’ the first snows of winter here in Argyll, thoughts turn to the building industry and a share which is supposed to be going up. Since 2015, Taylor Wimpey has stagnated, albeit sometimes with a useful trading range. Unlike my wifes conversation last night, price moves are about as interesting as a discussion about roof trusses.

Like most couples who’ve been married too long, we’ve absurd games to irritate the other. One is ‘The Word’, when hearing a word not commonly used and spending the rest of the day taking turns to fit it into conversation, regardless how mangled the original word gets. (Hey, we follow share prices, did you think we’ve an interesting life?)

Yesterdays unexpected word was ‘Karma’, prompting conversations about Chicken Karma, VW KarmaGhia, that Boy George song about a lizard, etc. Finally, a new low was achieved with mention of Frances spectacular La Camargue, neatly mispronounced as The Karmargue.

Once Asian markets had opened, it was bedtime. A sleepy voice said “Karma Sutra, I win.”

It’s worth taking a step back to visually ascertain “the problem” and in the case of Taylor Wimpey, there’s clearly an issue around the 2 quid level, 212p to be precise. Whether we call it a Glass Ceiling or a Horizontal Trend, the market appears to find something really offensive about the 212p level. Bizarrely, this chain of events started in December 2007 and creates a situation where “the Big Picture” suggests closure above 212p should trigger a longer term cycle which leads to an initial 308p. If bettered, our secondary calculation is at 410p.

Perhaps the strength of this potential is also why the market is refusing to let the share close in “safe” territory!

Near term, we shall be interested if TW manages above 178p as growth to an initial 188p looks possible. If bettered, secondary is at 198p. Importantly, above 198p will tend suggest another stab at the Glass Ceiling of 212p.

Unfortunately, that’s the end of the good news. More likely, we should fear weakness below 143p as this is liable to trigger reversal to an initial 134p. This, unfortunately, breaks the uptrend since 2011 and as a result, if 134p breaks, “bottom” is liable to make itself known by 93p hopefully.

We also need to mention 18p as “ultimate bottom” if politicians get their way and trash the countries economy.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:50:27PM |

BRENT |

61.72 | |||||||||

|

9:51:42PM |

GOLD |

1457.04 | |||||||||

|

9:53:48PM |

FTSE |

7357.56 |

‘cess | ||||||||

|

10:15:40PM |

FRANCE |

5915.5 |

5897 |

5888.5 |

5874 |

5924 |

5933 |

5942 |

5969 |

5905 |

Success |

|

10:18:34PM |

GERMANY |

13272 |

13185 |

13163 |

13115 |

13254 |

13288 |

13316 |

13384 |

13211 |

Success |

|

10:20:39PM |

US500 |

3091.57 |

Success | ||||||||

|

10:22:29PM |

DOW |

27694 |

‘cess | ||||||||

|

10:24:29PM |

NASDAQ |

8265.27 |

Success | ||||||||

|

10:27:06PM |

JAPAN |

23478 |

Success |

12/11/2019 FTSE Closed at 7365 points. Change of 0.5%. Total value traded through LSE was: £ 5,738,598,465 a change of -2.15%

11/11/2019 FTSE Closed at 7328 points. Change of -0.42%. Total value traded through LSE was: £ 5,864,681,253 a change of 22.23%

8/11/2019 FTSE Closed at 7359 points. Change of -0.63%. Total value traded through LSE was: £ 4,798,106,379 a change of -22.57%

7/11/2019 FTSE Closed at 7406 points. Change of 0.14%. Total value traded through LSE was: £ 6,196,615,818 a change of 30.74%

6/11/2019 FTSE Closed at 7396 points. Change of 0.11%. Total value traded through LSE was: £ 4,739,678,595 a change of -23.11%

5/11/2019 FTSE Closed at 7388 points. Change of 0.26%. Total value traded through LSE was: £ 6,164,114,046 a change of 25.79%

4/11/2019 FTSE Closed at 7369 points. Change of 0.92%. Total value traded through LSE was: £ 4,900,286,853 a change of -8.27%

8/11/2019 FTSE Closed at 7359 points. Change of -0.63%. Total value traded through LSE was: £ 4,798,106,379 a change of -22.57%

7/11/2019 FTSE Closed at 7406 points. Change of 0.14%. Total value traded through LSE was: £ 6,196,615,818 a change of 30.74%

6/11/2019 FTSE Closed at 7396 points. Change of 0.11%. Total value traded through LSE was: £ 4,739,678,595 a change of -23.11%

5/11/2019 FTSE Closed at 7388 points. Change of 0.26%. Total value traded through LSE was: £ 6,164,114,046 a change of 25.79%

4/11/2019 FTSE Closed at 7369 points. Change of 0.92%. Total value traded through LSE was: £ 4,900,286,853 a change of -8.27%

6/11/2019 FTSE Closed at 7396 points. Change of 0.11%. Total value traded through LSE was: £ 4,739,678,595 a change of -23.11%

5/11/2019 FTSE Closed at 7388 points. Change of 0.26%. Total value traded through LSE was: £ 6,164,114,046 a change of 25.79%

4/11/2019 FTSE Closed at 7369 points. Change of 0.92%. Total value traded through LSE was: £ 4,900,286,853 a change of -8.27%

4/11/2019 FTSE Closed at 7369 points. Change of 0.92%. Total value traded through LSE was: £ 4,900,286,853 a change of -8.27%