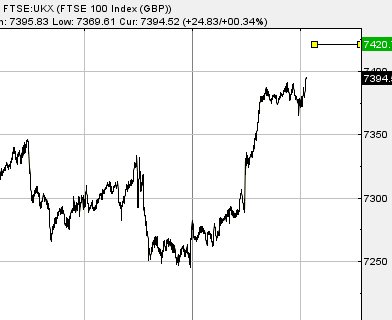

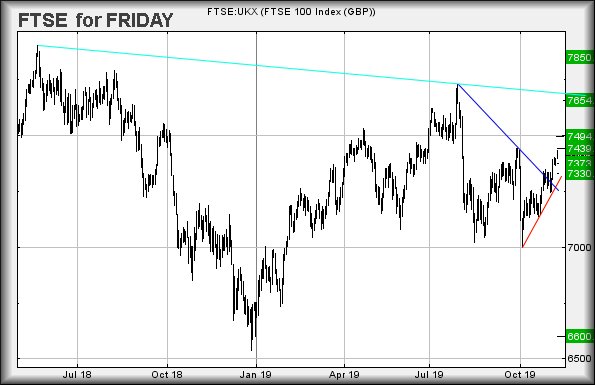

#GOLD #DOW The UK market has spent November limping ever higher, but trailing behind other European and US index’. The slow pace, doubtless, is due to nerves over the Election, Brexit, and what ‘vote greedy’ politicians may say next to enhance their exposure. There are slight signs of an imminent slowdown on the FTSE and we suspect Friday may show some reversal.

At present, the key number on the FTSE is at 7285 points. This is the level the market needs fall below to force us to take reversal seriously. Unless this number is broken, anything soon is liable to be simply part of a trading range. The other key number is at 7440 points.

Above this level, the market betters the highs of July, and enters a cycle where growth to 7494 becomes a near certainty. Secondary calculates at a longer term 7654 points and visually shall challenge the downtrend since the peak achieved in May 2018.

Near term, it looks probable Friday should relax (we’ve a caveat!) and for safety sake, allocating 7384 as a trigger level makes sense. The caveat is quite silly – on far too many occasions recently, when the FTSE illustrates a drop dead argument of direction, the market has toddled off in the opposite direction. To play safe, we’ve opted for a fairly wide trigger level. Below 7384 suggests weakness to an initial 7373 points. If broken, secondary is at 7330 points.

The UK market needs better 7422 before we take any rise seriously as it should permit near term movement up to an initial useless 7429 points. If bettered, secondary calculates at 7439 points – marginally below the Big Picture trigger level of 7440 points.

Have a good weekend.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:18:36PM |

BRENT |

62.09 | |||||||||

|

10:22:31PM |

GOLD |

1469.09 |

1460 |

1456 |

1442.22 |

1476 |

1492 |

1502 |

1516 |

1479 |

Success |

|

10:24:10PM |

FTSE |

7406.91 | |||||||||

|

10:28:40PM |

FRANCE |

5877.9 |

Success | ||||||||

|

10:31:56PM |

GERMANY |

13284 | |||||||||

|

10:34:51PM |

US500 |

3086.77 |

‘cess | ||||||||

|

10:38:21PM |

DOW |

27715 |

27580 |

27474 |

27354 |

27758 |

27780 |

27899 |

28343 |

27406 |

‘cess |

|

10:41:27PM |

NASDAQ |

8223.5 |

Success | ||||||||

|

10:44:12PM |

JAPAN |

23555 |

Success |