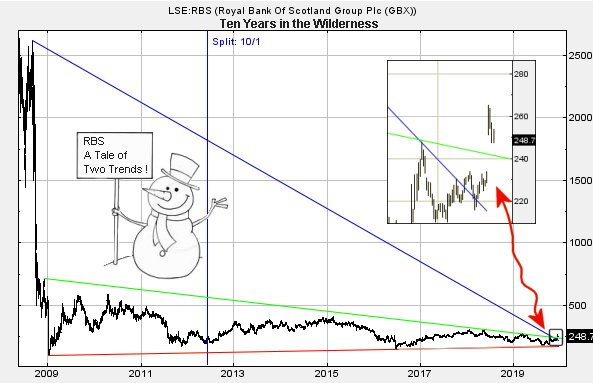

#DAX #DOW It took the Conservatives win in the General Election to “prove” we’ve been studiously following the wrong trend against #RBS. Often, a market Gap such as occurred after the election will do three useful things. First, if confirms the prior trend position and secondly, it confirms a new trend commencing. And third, perhaps the most important detail, we’ve now got an early warning danger level, if the price intends serious reversal.

In the grand scheme of things, the trend in Blue on the chart inset has turned out to be a load of tosh, the price movement signalling we should really have been watching the Green trend line! Both trends commenced from 2008, the Blue one from an adjusted high of 26 quid, the Green one from an adjusted high of just 7 quid. The implication behind this difference is foul, suggesting we must dilute long term big picture ambitions.

To look at the positive side of things, should RBS now manage to stagger above 265p, we’re looking for ongoing recovery to an initial 282p. If exceeded, our secondary calculation works out at 310p. As it’s the festive season, we decided to run the numbers on the basis 310p is somehow exceeded. Apparently 431p becomes a major point of interest, a price level where some real volatility could be expected. Curiously, this level virtually matches the high of 2015, along with a funny period in 2011 when something strange was going on with the share.

In plain English, in the (unlikely at present) event 431p makes an appearance, we’d expect trouble.

The immediate future does not look like miracle recovery is planned. Instead, we’ll be interested if the share staggers below 246p as reversal down to 234p makes a lot of sense. If broken, secondary comes in at 229p. Despite these calculations bringing the share price below Green again, we shall not be terribly alarmed unless the market opts to Gap the price down below the trend. We keep banging on about this sort of thing as it’s a prime indication the market feels the recent breakout was erroneous.

In the case of RBS, were the price now to be gapped down below 242p, the big picture allows reversal to 160p, perhaps even a bottom of 114p.

We need to stress, if the share trades downward without market manipulation gaps, we shall not be alarmed and suggest patience while awaiting a future break upward.

Thankfully, this should be the final time we cover RBS this decade. But shall revisit toward end of January next year.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:28:32PM |

BRENT |

65.5 | |||||||||

|

10:30:22PM |

GOLD |

1475.89 | |||||||||

|

10:32:25PM |

FTSE |

7554 | |||||||||

|

10:34:44PM |

FRANCE |

5962.7 | |||||||||

|

10:36:36PM |

GERMANY |

13233 |

13203 |

13147.5 |

13044 |

13285 |

13285 |

13309.5 |

13345 |

13230 |

‘cess |

|

10:38:37PM |

US500 |

3195.4 | |||||||||

|

10:43:04PM |

DOW |

28268 |

28215 |

28142 |

28026 |

28318 |

28323 |

28350.5 |

28378 |

28236 | |

|

10:51:53PM |

NASDAQ |

8592.05 |

‘cess | ||||||||

|

10:54:01PM |

JAPAN |

23919 |

Success |

18/12/2019 FTSE Closed at 7540 points. Change of 0.2%. Total value traded through LSE was: £ 6,288,425,252 a change of -24.93%

17/12/2019 FTSE Closed at 7525 points. Change of 0.08%. Total value traded through LSE was: £ 8,377,255,941 a change of -3.48%

16/12/2019 FTSE Closed at 7519 points. Change of 2.26%. Total value traded through LSE was: £ 8,678,908,281 a change of -19.58%

13/12/2019 FTSE Closed at 7353 points. Change of 1.1%. Total value traded through LSE was: £ 10,792,434,555 a change of 97.15%

12/12/2019 FTSE Closed at 7273 points. Change of 0.79%. Total value traded through LSE was: £ 5,474,098,560 a change of -29.24%

11/12/2019 FTSE Closed at 7216 points. Change of 0.04%. Total value traded through LSE was: £ 7,735,942,999 a change of 44.42%

10/12/2019 FTSE Closed at 7213 points. Change of -0.28%. Total value traded through LSE was: £ 5,356,569,029 a change of 11.8%

16/12/2019 FTSE Closed at 7519 points. Change of 2.26%. Total value traded through LSE was: £ 8,678,908,281 a change of -19.58%

13/12/2019 FTSE Closed at 7353 points. Change of 1.1%. Total value traded through LSE was: £ 10,792,434,555 a change of 97.15%

12/12/2019 FTSE Closed at 7273 points. Change of 0.79%. Total value traded through LSE was: £ 5,474,098,560 a change of -29.24%

11/12/2019 FTSE Closed at 7216 points. Change of 0.04%. Total value traded through LSE was: £ 7,735,942,999 a change of 44.42%

10/12/2019 FTSE Closed at 7213 points. Change of -0.28%. Total value traded through LSE was: £ 5,356,569,029 a change of 11.8%

12/12/2019 FTSE Closed at 7273 points. Change of 0.79%. Total value traded through LSE was: £ 5,474,098,560 a change of -29.24%

11/12/2019 FTSE Closed at 7216 points. Change of 0.04%. Total value traded through LSE was: £ 7,735,942,999 a change of 44.42%

10/12/2019 FTSE Closed at 7213 points. Change of -0.28%. Total value traded through LSE was: £ 5,356,569,029 a change of 11.8%

10/12/2019 FTSE Closed at 7213 points. Change of -0.28%. Total value traded through LSE was: £ 5,356,569,029 a change of 11.8%