#FTSE #NASDAQ It’s funny but after nearly 30 years of marriage, stumbling into stupid mistakes remains easy. A simple sentence, “the tree looks nice but do you know it’s leaning to the left” provoked a surprising degree of vitriol. It’s easy to forget, a Christmas tree diva does not take criticism well when hours of work are honestly assessed.

The lack of anything resembling a “chill pill” was highlighted, as usual bringing thoughts of cannabis to the fore. Not because of a need to smoke it, just a sad reminder of how virtually impossible it is to not buy genuine CBD oil in the UK. Personal experience, using the stuff to manage pain from an illness, taught of its amazing effects. Now, sadly, due to a tweak to UK Customs controls, real CBD is no longer on the market. Instead, we have products using the moniker but a glance at the ingredient list invariably reveals the weasel words, “made from hemp”, ensuring it has no real value medicinally.

However, we live in hope for change and keep an eye on cannabis share prices also, suspecting the UK shall follow where Canada and the US lead.

We must stress, this legendary product “CBD Oil” has absolutely no psychotropic effect. It just (for the writer anyway) removed the need for potentially addictive opioid based painkillers.

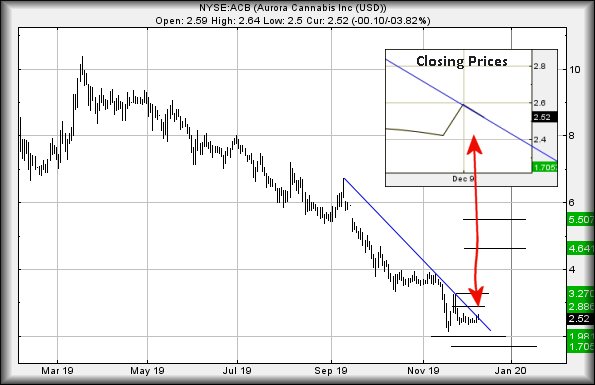

The inset on the chart highlights something fascinating with recent price movements for Aurora. At time of writing, the share price is at 2.52 dollars and the downtrend is at 2.40 dollars. For the last couple of sessions, the price has mirrored the Blue downtrend and, despite the visuals, has closed above the immediate trend. This gives slight hope “something” is due to happen.

We’d regard movement now above 2.64 as capable of provoking an initial 2.88 dollars. If exceeded, secondary calculates at 3.27.

The important detail about the secondary is it risks being fairly game changing. In the event the price manages above 3.27 on an initial surge, ongoing recovery to 4.64 and beyond is expected.

All this hope is based on the price visually managing to avoid our big picture bottom target of 1.98. The share bounced, just above this target level and implies some hope for the future. The detail of it actually trading above the immediate trend, again implies some hope.

Perhaps worth watching in the days ahead.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:40:25PM |

BRENT |

63.85 | |||||||||

|

9:47:32PM |

GOLD |

1464.57 | |||||||||

|

9:49:56PM |

FTSE |

7215.63 |

7157 |

7134 |

7104 |

7194 |

7225 |

7255.5 |

7296 |

7187 |

Success |

|

10:13:39PM |

FRANCE |

5842.7 |

Success | ||||||||

|

10:15:58PM |

GERMANY |

13086.46 |

Success | ||||||||

|

10:20:34PM |

US500 |

3137.27 |

Success | ||||||||

|

10:22:21PM |

DOW |

27919.6 |

Success | ||||||||

|

10:36:11PM |

NASDAQ |

8366.7 |

8293 |

8268 |

8216 |

8366 |

8396 |

8409 |

8447 |

8312 |

Success |

|

10:38:22PM |

JAPAN |

23438 |

‘cess |