#Japan #France Reports of a rock shaking turn out to be true. Apparently our ex-PM Mrs May is laughing her head off, despite retiring to reside under her rock. Most folk assumed this election could not be managed quite as incompetently as the last one, a belief proving to be hilariously incorrect. Worse, it has totally fouled up the markets as we generally hope the UK index will give a clue. Unfortunately, the FTSE has positioned itself in the Thunderbirds zone – “anything can happen in the next 14 hours!”.

Thoughts of retired PM’s resurrected an excuse to review SAGA, the company who prey on old, miserable, bald, people. Or those who’re over 50.

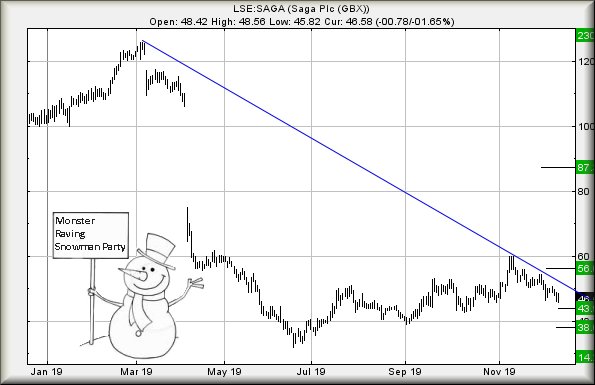

Recent price movements against Saga are not terribly encouraging, though we suspect it shall find some sort of excuse for a bounce anytime soon. As the chart shows, price moves are carefully following the downtrend. This sort of nonsense will generally complete with a sudden spike downward, followed by a rebound. In the case of Saga, weakness now below 45.5 suggests coming travel down to an initial 43p. If such a level breaks, it calculates with a secondary at 38p and hopefully a proper bounce.

In the event the price manages exceed Blue on the chart (presently 52.8) we’re looking at an initial ambition of 56p with secondary, if bettered, a longer term 87. We strongly, very strongly, suggest holding fire on that 87p until such time the price actually closes above 56p. In addition, there’s a very obvious Glass Ceiling awaiting at 60p, one which shall doubtless be employed to create some hesitation.

On the “down side” of things, we’d be quite alarmed if Saga now dropped below 32p as 14p presents the lowest we can calculate.

In summary, we think this shall be worth watching for a spike down at the open in the days ahead. The visuals suggest this should be used to jump start a rising cycle.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:50:44PM |

BRENT |

63.56 | |||||||||

|

10:52:38PM |

GOLD |

1475.5 |

Success | ||||||||

|

10:55:17PM |

FTSE |

7220.85 |

Shambles | ||||||||

|

10:57:03PM |

FRANCE |

5857.2 |

5817 |

5800 |

5778 |

5863 |

5866 |

5878.25 |

5893 |

5822 |

‘cess |

|

10:58:58PM |

GERMANY |

13150.94 |

‘cess | ||||||||

|

11:00:50PM |

US500 |

3143.77 | |||||||||

|

11:02:32PM |

DOW |

27925 | |||||||||

|

11:04:56PM |

NASDAQ |

8403.74 |

‘cess | ||||||||

|

11:07:30PM |

JAPAN |

23450 |

23316 |

23282.5 |

23222 |

23417 |

23464 |

23505 |

23568 |

23386 |