#France #Nasdaq Our throwaway comment yesterday regarding the #GameStop frenzy certainly attracted emails, perhaps due to mentioning a share price reversal target below US $10. Once again, the share price received a thrashing with the low of the day at $74, a rather horrible level for a share challenging $485 a few days ago. Price movements certainly reinforce the expensive lesson, avoid becoming caught up in the excess enthusiasm often displayed by three or four people in public discussion groups on the internet.

We’re now able to calculate an “ultimate” bottom of $10.24 against this, a probable return to the price level of November last year before it all went crazy. Near term weakness below 74 should prove capable of travel down to an initial $39 with secondary, when broken, at $10.24. We cannot calculate anything below such a level. It now needs a miracle to get out of trouble, visually unlikely.

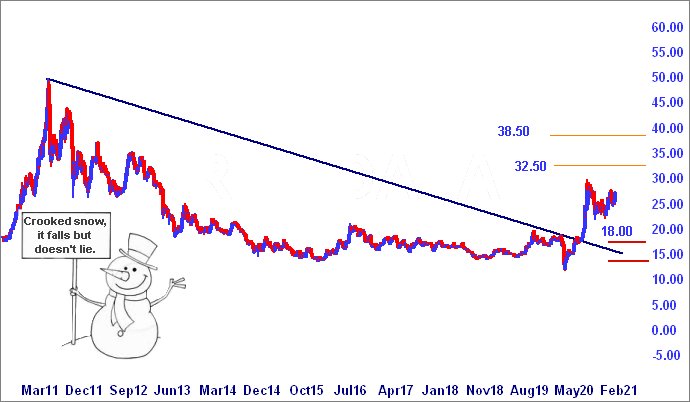

Legal & General certainly can rarely be accused of an excess of flamboyance. Plodding and reliable, only the Covid crash of last March providing a similar sized blip to that from the financial crash of 2009. At present, LGEN requires exceed 280p to give hope for a slight change of pace, this trigger working out with a pretty tame ambition of 308p. Secondary is a longer term 366p. The important detail comes, if Legal & General ever find an excuse to close a session above 313p at any time in the future.

This is quite a big deal. While the immediate suggestion allows travel to 308p with secondary, if bettered, at 366p, closure above 313p is something we’d regard as pretty game changing. This is one of these all important “Big Picture” things, launching the price into a zone where a distant 498p is supposed be be irresistibly attractive sometime in the distant future.

For now, the price is viewed as bumbling around, requiring below 203p before we’d be alarmed.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:34:05PM | BRENT | 57.83 | Success | ||||||||

| 10:36:16PM | GOLD | 1838.55 | Success | ||||||||

| 10:38:31PM | FTSE | 6542 | ‘cess | ||||||||

| 10:43:50PM | FRANCE | 5583 | 5517 | 5502.5 | 5474 | 5547 | 5588 | 5607.25 | 5642 | 5547 | Success |

| 10:46:18PM | GERMANY | 13884 | Success | ||||||||

| 10:57:21PM | US500 | 3836.17 | ‘cess | ||||||||

| 10:59:17PM | DOW | 30730 | Success | ||||||||

| 11:01:16PM | NASDAQ | 13517 | 13304 | 13244.5 | 13154 | 13401 | 13518 | 13562 | 13840 | 13300 | Success |

| 11:03:54PM | JAPAN | 28466 | ‘cess |