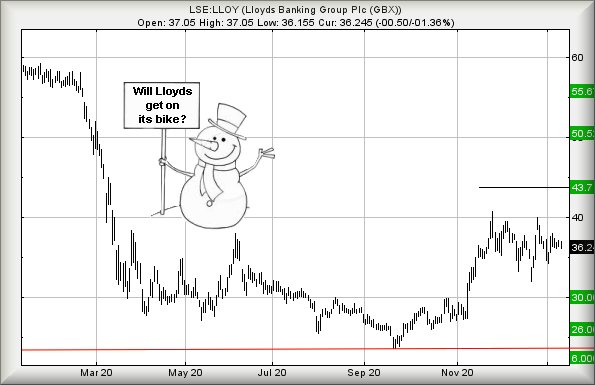

#FTSE #DOWJONES Famously, Emperor Nero fiddled while Rome burned. Whereas, Boris went for a Bike Ride while England suffered. News of Britain recording the highest ever daily death count, taking the country to an unenviable 2nd worst in the world was a shock. Surprisingly, reports of UK fatalities being over 100,000 didn’t appear to panic the markets or futures but we’re interested in Lloyds share price, ‘cos it has effectively stopped moving again.

When we last reviewed Lloyds, we’d a demand the price exceed 41.5p to assure our software it was about to move. Unfortunately, this number has been entirely absent so far in 2020 and we are starting to wonder if it shall prove a forlorn hope. We’d suspected negative news would risk trashing Lloyds but thus far, Boris & Co’s successful efforts at producing a “World Beating Mortality Rate” has failed to shock the FTSE. In-house, we expect a seasoning of poor income level reports shall be required to spook the index.

For Lloyds, the immediate situation looks risky with movement below 34p risking triggering reversal to an initial 30p. If broken, our secondary calculates down at 26p and we’d hope for a bounce, yet again, if such a number makes an appearance.

The other side of the coin is slightly more encouraging, the share price now needing above 40p to trigger a (visually unlikely) movement toward an initial 43.7p with secondary, if exceeded, working out at a slightly more encouraging 50p. The chart confirms Lloyds is a mess but at least, our software isn’t really projecting a further crash, just a scenario where the share remains trapped between a rock and a hard place.

If it all intends go horribly wrong for Lloyds, our ‘ultimate bottom’, the level we cannot calculate below, comes in at 6p. At present, nothing looks capable of provoking this level. Aside from domestic news in the World Beating UK…

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:40:29PM | BRENT | 55.97 | ‘cess | ||||||||

| 10:42:20PM | GOLD | 1845.54 | |||||||||

| 10:44:42PM | FTSE | 6753 | 6733 | 6701 | 6617 | 6776 | 6773 | 6791 | 6815 | 6733 | |

| 10:47:46PM | FRANCE | 5664 | |||||||||

| 10:50:25PM | GERMANY | 13959 | |||||||||

| 10:56:43PM | US500 | 3816.32 | Shambles | ||||||||

| 10:58:42PM | DOW | 31082 | 30973 | 30904 | 30821 | 31111 | 31167 | 31210 | 31289 | 31085 | |

| 11:01:01PM | NASDAQ | 12990 | Shambles | ||||||||

| 11:14:20PM | JAPAN | 28426 | Success |

13/01/2021 FTSE Closed at 6745 points. Change of -0.13%. Total value traded through LSE was: £ 5,892,793,822 a change of 7.6%

12/01/2021 FTSE Closed at 6754 points. Change of -0.65%. Total value traded through LSE was: £ 5,476,413,320 a change of -2.69%

11/01/2021 FTSE Closed at 6798 points. Change of -1.09%. Total value traded through LSE was: £ 5,628,068,721 a change of -23.51%

8/01/2021 FTSE Closed at 6873 points. Change of 0.25%. Total value traded through LSE was: £ 7,358,043,641 a change of -0.17%

7/01/2021 FTSE Closed at 6856 points. Change of 0.22%. Total value traded through LSE was: £ 7,370,774,807 a change of -13.13%

6/01/2021 FTSE Closed at 6841 points. Change of 3.46%. Total value traded through LSE was: £ 8,484,604,926 a change of 72.21%

5/01/2021 FTSE Closed at 6612 points. Change of -100%. Total value traded through LSE was: £ 4,926,938,806 a change of 0%