#Gold #SP500 Regular readers will be aware we trust #Silver with similar confidence to trusting Scottish politicians. For those unfamiliar with the (possibly) criminal conspiracy against Mr Salmond, the whole mess has blown up with the expectation the Scottish PM, Nicola Sturgeon will resign fairly soon. Deliciously, the threat of her husband facing arrest for refusing to appear before a parliamentary committee, now accused of lying under oath, is making the murky goings on in Scotland slightly more fun than the markets. Except, of course, for the issue of GameStop.

The share price of GameStop accelerated ludicrously, performing in the traditions of a ramped UK AIM share. We’ve a bit of a suspicion this story shall end with the share price down below $10. It closed Monday at $186, down 42% on the day. The social media site, Reddit, was credited with providing the platform to drive private investors into a frenzy, some impressive projections suggesting the price was going to ‘at least’ $1,000.

Various sections of the media, rather than actually checking Reddit, picked up on someone suggesting a similar boiler room scam could be enacted with the price of Silver. Fairly soon thereafter, it became ‘a thing’ private investors on Reddit were intending to aggressively buy Silver, forcing the price up. The problem, aside from it being untrue, dates back to August last year when Silver was already trading around the $30 mark. Presently at $27, the evidence favouring buying hysteria is somewhat lacking. In fact, Silver has been pretty static for the last 6 months.

Surprisingly, quite a few of the Silver miners have share prices doing very nicely, doubtless catching the positive sentiment as the price of Silver accelerated from $16 last June to a high of $30 in August, then 6 months of relative price stability as the commodity successfully remained above the $22 mark. For Silver, this is a really big deal, the product showing a pretty firm track record of giving, then taking it all away again.

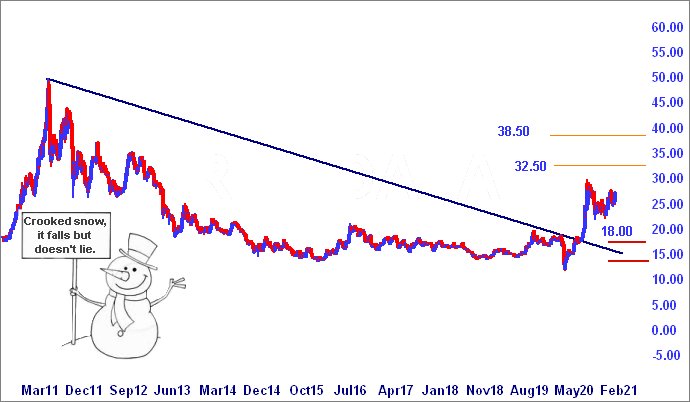

In the event Silver makes another upward twitch, above the $30 mark is liable to be interesting, calculating with an initial ambition at $32.50 with secondary, if exceeded, coming in at $38.50. This behaviour is almost certain to reflect positively on the likes of Fresnillo or Hecla to name just two.

If it all intends melt away for Silver, below the $22 mark would certainly be the first sign of concern, threatening reversals to an initial $18 with secondary, when broken, back around the $12 dollar level, suggesting the last six months were but a dream. Visually, we suspect Silver may finally be performing properly and if this is the case, we’d hope any reversal would arrest at the $18 level.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:59:38PM | BRENT | 56.42 | ‘cess | ||||||||

| 10:01:53PM | GOLD | 1861.09 | 1847 | 1840 | 1837 | 1863 | 1876 | 1887.5 | 1903 | 1856 | |

| 10:04:09PM | FTSE | 6490.59 | |||||||||

| 10:05:59PM | FRANCE | 5484 | |||||||||

| 10:26:40PM | GERMANY | 13660 | |||||||||

| 10:28:37PM | US500 | 3770 | 3722 | 3706 | 3680 | 3770 | 3785 | 3804 | 3851 | 3732 | |

| 10:31:14PM | DOW | 30216 | |||||||||

| 10:52:07PM | NASDAQ | 13259 | ‘cess | ||||||||

| 10:57:03PM | JAPAN | 28278 |