#DAX #DOW A glance at Hochschild area of operations was surprising, the map looking identical to the route taken by Euan McGregor in the recent TV show, The Long Way Up. Essentially, film actor McGregor rode an electric bike up the left hand side of South America, the trip punctuated by constant searches for a travel plug and cable extensions.

Hochschild (LSE:HOC) , describing themselves as the leading underground precious metals producer, search for gold and silver with some really big recovery numbers quoted on their website. With gold prices messing around between the 1800 and 2000 dollar level presently, the company is doubtless enjoying levels of income not seen for 9 years. This detail shall perhaps prove important when we take a look at the immediate share price potentials.

Currently trading around 237p, we regard 247p with the potential of triggering some further recovery. Above this level, we can calculate an initial ambition of 271p with secondary, if bettered, at 298p. Visually, neither aspiration is particularly interesting, especially as the Big Picture demands the share price CLOSE a session above 298p to provoke a return to some historical share price levels.

Closure above 298p should present 349p as a reasonable hope with secondary, if exceeded, calculating at a more useful 540p and a return to levels the share price has not witnessed for 9 years. If it all intends go wrong, the price needs reverse below 200p as this makes swift reversal to 91p an arithmetic possibility.

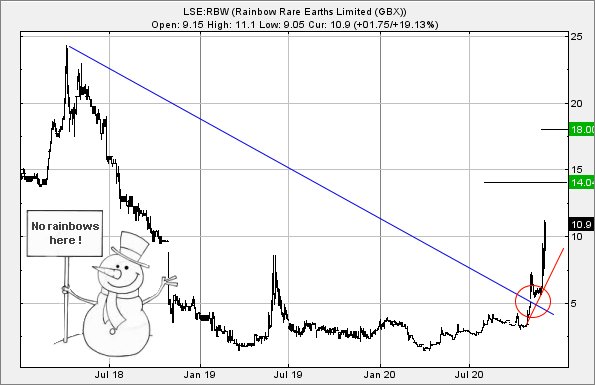

Rainbow Rare Earths (LSE:RBW) The rainbow symbol appears to be hijacked by any organisation wishing to present themselves as “a right-on, politically correct bunch”. It was refreshing to visit Rainbow Rare Earths website and discover they’ve carefully avoiding using the cliché anywhere in their presentations, instead opting for a corporate logo of 4 different coloured pointed hats. Perhaps the little hats are supposed to denote a mountain range?

From the corporate website, their business strategy reads as; “… to become a globally significant producer of rare earth metals, with a particular focus on NdPr, a fundamental building block in the global green technology revolution. As a key component of permanent magnets, required in the construction of motors and turbines, analysts are predicting demand for these rare earth oxides to grow substantially over the coming years, tipping into a supply deficit.”

At time of writing, Rainbow are trading around the 11p mark, needing only trades above 11.2p to suggest coming price recovery to an initial 14p with secondary, if bettered, calculating at 18p. If we chose to accept the closing price as a sensible signal, the share already allows considerable optimism for the future.

Presently, the share price needs sink below 6p to provoke panic for the future but we’re fairly impressed at the strength of movement since the start of November and the forced “gap” up in price. The market clearly has an idea of what it wants.

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:11:59PM | BRENT | 47.96 | ‘cess | ||||||||

| 10:13:47PM | GOLD | 1830.95 | ‘cess | ||||||||

| 10:15:50PM | FTSE | 6452 | ‘cess | ||||||||

| 10:23:01PM | FRANCE | 5577 | ‘cess | ||||||||

| 10:25:36PM | GERMANY | 13308 | 13280 | 13255 | 13195 | 13328 | 13371 | 13406 | 13452 | 13303 | ‘cess |

| 10:27:20PM | US500 | 3670 | Shambles | ||||||||

| 10:30:08PM | DOW | 29910 | 26600 | 29492 | 29386 | 29750 | 29922 | 29966.5 | 30089 | 29755 | ‘cess |

| 10:33:27PM | NASDAQ | 12466 | |||||||||

| 10:48:30PM | JAPAN | 26851 | ‘cess |