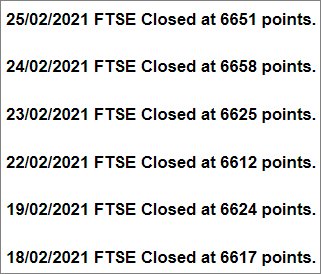

The last six sessions of the #FTSE have been epically boring for us at Trends and Targets, giving a maximum range of 46 points. With all the “stuff” going on in the world, surely the UK market does not need try too hard to find an excuse to actually do something but despite the failure of the FTSE to become interesting, we’re curious about a couple of details which are otherwise unremarked.

Three sectors arouse our immediate interest, the Banking Sector, Major Miners, and Travel & Leisure. All three of these sectors are starting to take a real interest in life, using the time when the FTSE is otherwise asleep to display early signs of considerable hope for the months ahead. For instance, with the banking sector, we already see early suggestions of a justifiable 20% increase across share prices in the weeks ahead. And with the Miners, it’s pretty easy to extrapolate a 12% average rise across sector share prices. With Travel & Leisure we’re slightly less confident, the markets perhaps exercising caution with Covid-19 vaccines but in the event the sector index closes above 9,000 points, we anticipate an initial 15% surge in prices, perhaps over 30% if confidence floods back.

It’s obviously early days, especially as confidence has not yet leaked with sufficient force to nudge the FTSE but perhaps things shall reach a critical mass, moving with enhanced speed once the vaccine program rolls out in early March with under 50’s receiving ‘The Call’ to attend a clinic.

As for our popular FTSE for Friday, we’re inclined to some near term alarm, thanks to whatever scared the pants off America on Thursday. With the S&P down 2.5%, the Nasdaq down 3.6% and the Dow Jones experiencing a 1.8% drop, we suspect a bout of nerves shall leach across the Atlantic for Friday, provoking some reversals. At least, until the USA opens for business!

When the USA closed on Thursday, FTSE Futures were at 6588, substantially below the UK markets closing price of 6651 points. As a result, it’s probable the UK shall open solidly down on Friday morning and this presents some major problems.

In the event the FTSE opens below 6607 points, we suspect continued reversals to an initial 6577 points with secondary, if broken, at 6508 and hopefully a bounce.

The opposite scenario is quite strange as should the FTSE open above 6607, there’s a chance of some insane and unexpected recovery toward 6650 with secondary 6701 points. It can be safely assumed we don’t expect this as it nudges the UK into a region where we can again discuss the possibility of future movements to 7133 points and above.

Have a good weekend, for amusement keep an eye on Scottish Politics (They now have renamed ‘The Crown Office’ to ‘The Clown Office’) and importantly, Formula1 recommences in just 30 days.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:54:48PM | BRENT | 66.1 | 65.59 | 64.825 | 66.45 | 66.57 | 67.025 | 65.64 | ‘cess | ||

| 11:04:56PM | GOLD | 1770.51 | 1768 | 1763 | 1783 | 1801 | 1809.5 | 1785 | ‘cess | ||

| 11:07:02PM | FTSE | 6601.5 | 6567 | 6550 | 6641 | 6653 | 6665.5 | 6599 | |||

| 11:11:33PM | FRANCE | 5727 | 5714 | 5674 | 5767 | 5770 | 5793.5 | 5730 | Success | ||

| 11:14:44PM | GERMANY | 13781 | 13731 | 13668.5 | 13851 | 13860 | 13913.5 | 13765 | Success | ||

| 11:17:35PM | US500 | 3830 | 3824 | 3813 | 3870 | 3874 | 3898.5 | 3834 | Shambles | ||

| 11:23:10PM | DOW | 31420 | 31286 | 31088.5 | 31538 | 31699 | 31865 | 31480 | Success | ||

| 11:25:27PM | NASDAQ | 12803 | 12765 | 12746.5 | 12915 | 13055 | 13151 | 12880 | ‘cess | ||

| 11:27:54PM | JAPAN | 29615 | 29538 | 29471 | 29680 | 29913 | 30032.5 | 29712 | Shambles |