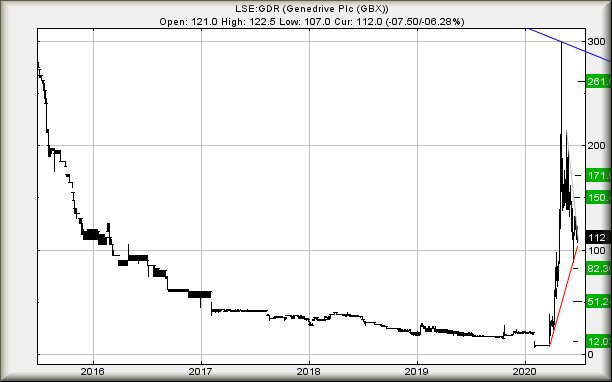

#Gold #Dax As we meander toward the next phase of Covid-19, an unpleasant number of shares which experienced ‘enhanced expectation’ growth are seeing their share price look more vulnerable than a Downing St based Civil Servant. Unfortunately, #Genedrive are on the edge of joining this particular club.

It’s important to stress we’re only seeing early signs of nerves against this share price. It needs to weaken below 90p to provoke serious concern as this is liable to promote reversal to an initial 82p. Should such reversal occur, it will be worth paying attention to any initial drop movement due to the severe risks if 82p breaks on an initial drop. We would expect some sort of rebound anyway, if 82p makes itself known but the danger is fairly simple.

A break below 82p risks further reversal down to 51p or worse.

It’s quite odd, for companies whose share prices have ridden the Covid-19 wave, bad news for their price is liable to be regarded as good news for everyone else. Whether the virus fades away or, ideally, a cure is found, the multitude of companies offering testing will doubtless suffer. This level of suffering is liable to be almost a mirror image of any ‘enhanced expectation’ price movement. In the case of Genedrive, we can currently calculate an ultimate bottom of 12p. This is the point below which all numbers are prefaced with minus signs.

As always, there’s a bit of a “However” and for Genedrive, above 134p should prove capable of trigging movement to an initial 150p with secondary, if exceeded, at 171p. The visuals certainly suggest, if 171p makes itself known, we should expect some hesitation thanks to what looks like a Glass Ceiling. This particular share now needs trade above 261p to suggest the price is entering a brave new world, upwards, for the longer term.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:54:30PM | BRENT | 41.84 | |||||||||

| 9:56:06PM | GOLD | 1773.31 | 1765 | 1763 | 1759 | 1772 | 1775 | 1780 | 1791 | 1765 | ‘cess |

| 10:00:20PM | FTSE | 6244.01 | |||||||||

| 10:04:51PM | FRANCE | 4959 | Success | ||||||||

| 10:07:22PM | GERMANY | 12298 | 12206 | 12185 | 12142 | 12285 | 12305 | 12323.5 | 12447 | 12230 | Success |

| 10:12:00PM | US500 | 3056.7 | ‘cess | ||||||||

| 10:16:04PM | DOW | 25630 | Success | ||||||||

| 10:18:42PM | NASDAQ | 9993.25 | Success | ||||||||

| 10:20:43PM | JAPAN | 22327 | Success |