COIN:BTCUSD, ETHUSD, XRPGBP #CAC40 #Nikkei Despite UK regulator action on crypto currency trading, there appears plenty who still trade the products, using slightly offshore platforms. On Tues 23th Feb, with considerable horror, traders watched Bitcoin losing $13,000, Ethereum dumping $600 and XRP tossing 11p in the bin! Perhaps percentage terms shall prove more relatable, Bitcoin lost 22%, Ethereum lost 29% and Ripple lost 26%.

It is probably safe to say it was not the finest session for many traders. For legendary Bitcoin miners, it was a nasty cave in and we’re not certain the tragedy is over yet.

But then again, it might be!

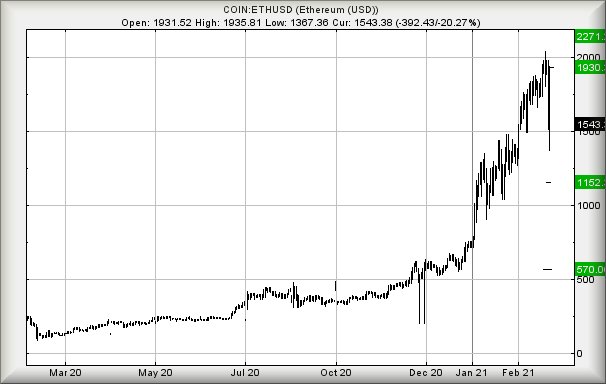

With Bitcoin, the immediate cycle which led to $57,000US had been presenting the threat of reversal to $43,250 but when the price imploded, the value “only” shrunk to $44,888. Perhaps this is an implication of strength as our bottom number was not troubled. Using the same logic, Ethereum has presented the potential of $1300 but on the day, it bounced from $1367. Again, an implication of strength. Finally, XRP hit a low of 0.2950 rather than bother our calculation of 0.27250.

We’ve a (sometimes dodgy) logic which tells us to be cynical, if price drops fail to breach target on the day of the initial correction. Even though our target level may be broken in future days, we’re cautious advocating flat panic in the event prices bounce just above targets. In the case of each of the three crypto cons, we are loathe to suggest they present an immediate short opportunity.

Needless to say, we can give some potentials for the insanely brave.

With Bitcoin, below $43,000 now permits reversal to around £37k with secondary, if broken, at a bottom of $31k. The visuals even make sense. Alternately, we can present a scenario with a trigger level at $51k which calculates with the potential of $54.5 with secondary, if exceeded, $60k and yet another high.

For Ethereum, below $1300 carries the potential of a visit to $1150 and hopefully a bounce. If broken, our secondary is pretty vile at a bottom around $570. The other side of the coin, if we take a positive viewpoint, allows for strength above $1780 to now bring recovery to £1930 with secondary, if exceeded, at $2271, an all time high.

Finally, Ripple XRP. Weakness next below the 0.27 level shall prove troublesome, allowing an initial 0.22 with secondary, if broken, down at 0.14. We cannot calculate below such a level. On a happier note, it need only exceed 0.47 to suggest an initial ambition of 0.60 with secondary, if bettered, a significant 0.74.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:50:40PM | BRENT | 64.25 | Success | ||||||||

| 10:53:09PM | GOLD | 1806.21 | |||||||||

| 10:54:51PM | FTSE | 6627.34 | ‘cess | ||||||||

| 10:57:09PM | FRANCE | 5783 | 5718 | 5691.5 | 5657 | 5761 | 5788 | 5793.5 | 5816 | 5766 | ‘cess |

| 10:59:11PM | GERMANY | 13881.91 | Success | ||||||||

| 11:05:05PM | US500 | 3879 | Success | ||||||||

| 11:07:53PM | DOW | 31539 | |||||||||

| 11:10:57PM | NASDAQ | 13181 | Success | ||||||||

| 11:13:31PM | JAPAN | 29997 | 29920 | 29788.5 | 29565 | 30100 | 30100 | 30155.5 | 30325 | 29918 | Success |