#Brent #Dax

Okay, this feature is a bit weird, essentially questioning just why we sometimes do something. A personal delve into the depths of ridiculous came with an unfortunately successful attempt to build a rock tumbler from the remnants of a microwave. For some reason, the idea of rotating a bunch of rocks until they were smooth and interesting seemed like a good thing.

It wasn’t.

The problem comes when you’ve tumbled a bunch of rocks, discovering in the process your grandchildren have zero interest in collecting the results. Instead, they are liable to be more interested in a feather on the beach. What to do with all the rocks? A simple question in an official “Rock Tumbling” internet forum produced some answers. Among the folk gleefully grinding down rocks, none actually knew what to do with the end product. One person cunningly planted them around the hospital in which he worked, noticing they all vanished within days. Another would leave some while walking his dog, again noticing they quickly vanished. A further person, in a fit of cruelty, gifted them to work colleagues as apparently they make great additions to plant pots. One hoarder even admitted to behaving like a WW2 prison camp inmate trying to conceal tunnel diggings, discretely dropping polished stones among driveway pebbles.

I could discuss the image below but there’s little point. It’s a snapshot of a pile of my tumbled stones, glued together. One of the quartz pieces does have a gold flake embedded!

There is a point behind this tale. Often, folk dive into the markets without a clear idea of what they actually want.

The easy answer is trite, they just want to make money! But the actual answer is more complex, one which few folk satisfactorily reach. Do they want to make money from a single trade? Or do they intend a regular source of income?

This, unfortunately, is the rabbit hole the majority of private investors fall down, as answering YES to both questions kicks open the gates of hell. A single trade will switch to become “a long term hold” when it bites back. And long term holds will sometimes become a quick source of profit, due to panic from money tied up in so called quick trades. Similar to my rock monster above, it’s always a good idea to have a clear aim when doing something or the results can be messy. It’s also the case “a clear aim” can go very wrong, thanks to many folk believing the markets would recover from the 2009 financial crash within just 7 years. Many of ’em are still waiting.

Natwest Group continues to provide a perfect example of a share failing to recover from “the crash”, now trading at 250.9p (25p in real money, once consolidation is factored in). We’re supposed to be ecstatically gushing about the future, the share price finally scrabbling above the downtrend since 2015. However, we’re a little muted in our hoped, due to the share price failing to achieve our initial fairly near term “breakout target” at 268p. Instead, the best achieved was just 264p before the price scared itself with its temerity and fell back a little.

The problem now comes, if the share price opts to close a session below 247p, the level of breakout. Such a movement would now effectively cancel some fairly positive ambitions for the longer term as we can mention – for now – the share is trading in a region with a Big Picture ambition at an initial 336p with secondary, if beaten, a longer term 420p. It’s all very jolly but we’re worried, due to the lack of strength to even reach our 268p ambition. It’s not a case which merits immediate panic, just a horrible feeling of déjà vu as once again, a retail bank lives down to expectations.

Another fear, worthy of comment, deals with the reality of the price being “gapped” up above the Blue downtrend. We need ask, what to expect if it’s now gapped down below 247p?

Initially, reversal to 232p looks possible with secondary, if broken, at 222p. But there’s also the very severe risk of the two Gap movements conspiring together, eventually discovering a bottom around 196p.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 9:54:13PM | BRENT | 102.93 | 97.14 | 96.51 | 94.18 | 102.3 | 103.5 | 104.38 | 108.8 | 97 |

| 9:57:32PM | GOLD | 1738.03 | 1733 | |||||||

| 9:59:52PM | FTSE | 7400.31 | 7372 | |||||||

| 10:08:15PM | STOX50 | 3580 | 3560 | |||||||

| 10:15:56PM | GERMANY | 12921 | 12703 | 12658 | 12562 | 12814 | 12948 | 12994 | 13091 | 12867 |

| 10:17:41PM | US500 | 4034 | 4033 | |||||||

| 10:20:02PM | DOW | 32142 | 32084 | |||||||

| 10:22:18PM | NASDAQ | 12492 | 12438 | |||||||

| 10:24:22PM | JAPAN | 28038 | 27987 |

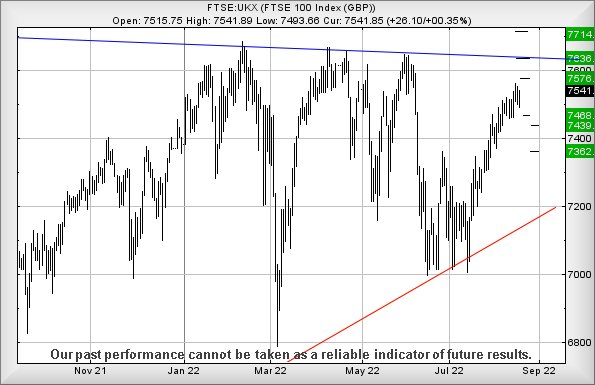

26/08/2022 FTSE Closed at 7427 points. Change of -0.7%. Total value traded through LSE was: £ 4,349,079,886 a change of 12.01%

25/08/2022 FTSE Closed at 7479 points. Change of 0.11%. Total value traded through LSE was: £ 3,882,636,574 a change of -18.23%

24/08/2022 FTSE Closed at 7471 points. Change of -0.23%. Total value traded through LSE was: £ 4,748,027,124 a change of -4.63%

23/08/2022 FTSE Closed at 7488 points. Change of -0.6%. Total value traded through LSE was: £ 4,978,434,617 a change of 0.1%

22/08/2022 FTSE Closed at 7533 points. Change of -0.23%. Total value traded through LSE was: £ 4,973,471,266 a change of -16.58%

19/08/2022 FTSE Closed at 7550 points. Change of 0.12%. Total value traded through LSE was: £ 5,961,629,196 a change of 29.52%

18/08/2022 FTSE Closed at 7541 points. Change of 0.35%. Total value traded through LSE was: £ 4,602,765,684 a change of 0.38%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:ASC Asos** **LSE:AVCT Avacta** **LSE:BT.A British Telecom** **LSE:ECO ECO (Atlantic) O & G** **LSE:GLEN Glencore Xstra** **LSE:HIK Hikma** **LSE:IGAS Igas Energy** **LSE:ITRK Intertek** **LSE:MKS Marks and Spencer** **

********

Updated charts published on : Aston Martin, Asos, Avacta, British Telecom, ECO (Atlantic) O & G, Glencore Xstra, Hikma, Igas Energy, Intertek, Marks and Spencer,

LSE:AML Aston Martin Close Mid-Price: 428.6 Percentage Change: -1.27% Day High: 461.8 Day Low: 429.1

Weakness on Aston Martin below 429.1 will invariably lead to 407 next. If ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:ASC Asos Close Mid-Price: 697 Percentage Change: -3.53% Day High: 741.5 Day Low: 693.5

In the event Asos experiences weakness below 693.5 it calculates with a d ……..

</p

View Previous Asos & Big Picture ***

LSE:AVCT Avacta. Close Mid-Price: 137.2 Percentage Change: + 0.00% Day High: 141 Day Low: 134.5

Target met. In the event of Avacta enjoying further trades beyond 141, th ……..

</p

View Previous Avacta & Big Picture ***

LSE:BT.A British Telecom Close Mid-Price: 151.45 Percentage Change: -0.82% Day High: 153.55 Day Low: 151.25

Target met. Continued weakness against BT.A taking the price below 151.25 ……..

</p

View Previous British Telecom & Big Picture ***

LSE:ECO ECO (Atlantic) O & G. Close Mid-Price: 35.25 Percentage Change: + 10.16% Day High: 35.25 Day Low: 32

Target met. Further movement against ECO (Atlantic) O & G ABOVE 35.25 sho ……..

</p

View Previous ECO (Atlantic) O & G & Big Picture ***

LSE:GLEN Glencore Xstra Close Mid-Price: 498.9 Percentage Change: -1.21% Day High: 512 Day Low: 498.4

Continued trades against GLEN with a mid-price ABOVE 512 should improve t ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1336 Percentage Change: -1.33% Day High: 1381 Day Low: 1335

If Hikma experiences continued weakness below 1335, it will invariably le ……..

</p

View Previous Hikma & Big Picture ***

LSE:IGAS Igas Energy. Close Mid-Price: 89 Percentage Change: + 7.23% Day High: 92 Day Low: 84.8

Target met. All Igas Energy needs are mid-price trades ABOVE 92 to improv ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 4021 Percentage Change: -2.36% Day High: 4129 Day Low: 4016

In the event Intertek experiences weakness below 4016 it calculates with ……..

</p

View Previous Intertek & Big Picture ***

LSE:MKS Marks and Spencer Close Mid-Price: 120.3 Percentage Change: -1.07% Day High: 124.65 Day Low: 119.2

Weakness on Marks and Spencer below 119.2 will invariably lead to 98 with ……..

</p

View Previous Marks and Spencer & Big Picture ***