#FTSE #Nasdaq

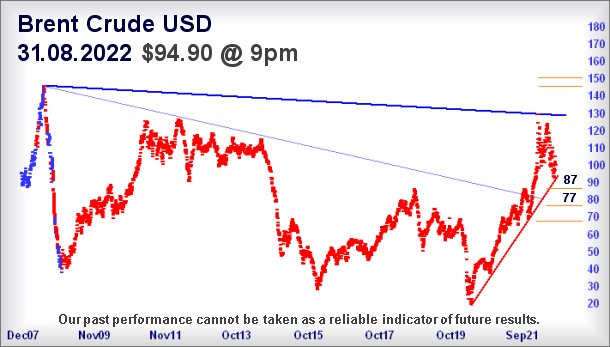

When we previously reviewed Brent Crude back in June, we suggested a break below 101 would potentially provide the first trigger level capable of producing some reversals. Yes, it did and no, it didn’t. The price of the product fell below $101, slumped to $91 in the period since, and has spent the last few months essentially messing around.

We’d already expressed frustration at the seemingly lost nature of Brents movements, rising and falling in a fashion more in tune with the tide rather than any effective basis in reality.

There are now signs things have the potential of further change. Weakness now below just $93 now calculates as capable of triggering further reversals to an initial $87 with secondary, if broken, down at $77. We shall certainly be curious should $77 ever make an appearance as this encompasses quite a surprise potential.

As the visuals on the chart below highlight, hitting the 77 level would reverse the price of Brent below the level of the Big Picture trend break in January this year. From our perspective, dipping below this $81 level is quite important as it calls into question the integrity and strength of the upward surge which has proven so painful for 2022. There are few signals more worrying than when a price breaks from a Big Picture trend, then after some time in the sun, the price opts to dodge below its prior trend. To be honest, it’s a seriously bad signal and often the harbinger of some tough times ahead.

For now, the concern is the immediate proximity of the price of Brent to our $93 trigger level (actually $93.24 at time of writing) as the market is already making shuffling dance steps which indicate a break is imminent. Then again, all this fragile market place needs is a suggestion something is happening in Ukraine or Russia and once again, the price risks being thrown up in the air.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:40:18PM | BRENT | 94.9 | Success | ||||||||

| 9:41:58PM | GOLD | 1711.2 | ‘cess | ||||||||

| 9:45:29PM | FTSE | 7282 | 7270 | 7253 | 7231 | 7321 | 7325 | 7352 | 7384 | 7280 | ‘cess |

| 9:48:21PM | STOX50 | 3510.7 | ‘cess | ||||||||

| 9:51:33PM | GERMANY | 12828.76 | |||||||||

| 9:53:31PM | US500 | 3958.37 | |||||||||

| 9:55:33PM | DOW | 31552 | ‘cess | ||||||||

| 9:57:27PM | NASDAQ | 12292 | 12238 | 12145 | 12027 | 12382 | 12507 | 12573 | 12676 | 12382 | |

| 10:13:22PM | JAPAN | 27845 |

31/08/2022 FTSE Closed at 7284 points. Change of -1.05%. Total value traded through LSE was: £ 8,197,472,854 a change of 27.31%

30/08/2022 FTSE Closed at 7361 points. Change of -0.89%. Total value traded through LSE was: £ 6,438,857,207 a change of 48.05%

26/08/2022 FTSE Closed at 7427 points. Change of -0.7%. Total value traded through LSE was: £ 4,349,079,886 a change of 12.01%

25/08/2022 FTSE Closed at 7479 points. Change of 0.11%. Total value traded through LSE was: £ 3,882,636,574 a change of -18.23%

24/08/2022 FTSE Closed at 7471 points. Change of -0.23%. Total value traded through LSE was: £ 4,748,027,124 a change of -4.63%

23/08/2022 FTSE Closed at 7488 points. Change of -0.6%. Total value traded through LSE was: £ 4,978,434,617 a change of 0.1%

22/08/2022 FTSE Closed at 7533 points. Change of -100%. Total value traded through LSE was: £ 4,973,471,266 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:BT.A British Telecom** **LSE:CNA Centrica** **LSE:HIK Hikma** **LSE:ITRK Intertek** **LSE:ODX Omega Diags** **LSE:QFI Quadrise** **LSE:RR. Rolls Royce** **LSE:SCLP Scancell** **LSE:TW. Taylor Wimpey** **LSE:VOD Vodafone** **

********

Updated charts published on : Aston Martin, British Telecom, Centrica, Hikma, Intertek, Omega Diags, Quadrise, Rolls Royce, Scancell, Taylor Wimpey, Vodafone,

LSE:AML Aston Martin. Close Mid-Price: 445.7 Percentage Change: + 0.16% Day High: 452.4 Day Low: 424

Continued weakness against AML taking the price below 424 calculates as l ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:BT.A British Telecom Close Mid-Price: 150.7 Percentage Change: -0.76% Day High: 152.25 Day Low: 149.6

If British Telecom experiences continued weakness below 149.6, it will in ……..

</p

View Previous British Telecom & Big Picture ***

LSE:CNA Centrica Close Mid-Price: 75.74 Percentage Change: -1.07% Day High: 77.74 Day Low: 74.02

Weakness on Centrica below 74.02 will invariably lead to 60 with secondar ……..

</p

View Previous Centrica & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1313 Percentage Change: -0.49% Day High: 1326.5 Day Low: 1302.5

In the event Hikma experiences weakness below 1302.5 it calculates with a ……..

</p

View Previous Hikma & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 3959 Percentage Change: -1.15% Day High: 4021 Day Low: 3956

If Intertek experiences continued weakness below 3956, it will invariably ……..

</p

View Previous Intertek & Big Picture ***

LSE:ODX Omega Diags Close Mid-Price: 2.75 Percentage Change: -0.90% Day High: 2.8 Day Low: 2.65

Weakness on Omega Diags below 2.65 will invariably lead to 2.5 with secon ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:QFI Quadrise. Close Mid-Price: 1.32 Percentage Change: + 3.94% Day High: 1.26 Day Low: 1.23

Target met. In the event Quadrise experiences weakness below 1.23 it calc ……..

</p

View Previous Quadrise & Big Picture ***

LSE:RR. Rolls Royce Close Mid-Price: 77 Percentage Change: -1.53% Day High: 78.55 Day Low: 76.3

Continued weakness against RR. taking the price below 76.3 calculates as ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SCLP Scancell Close Mid-Price: 11.5 Percentage Change: -1.08% Day High: 11.62 Day Low: 11.25

If Scancell experiences continued weakness below 11.25, it will invariabl ……..

</p

View Previous Scancell & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 108.3 Percentage Change: -1.72% Day High: 111.3 Day Low: 107.6

Weakness on Taylor Wimpey below 107.6 will invariably lead to 106 with se ……..

</p

View Previous Taylor Wimpey & Big Picture ***

LSE:VOD Vodafone Close Mid-Price: 115.68 Percentage Change: -0.03% Day High: 116.8 Day Low: 114.84

If Vodafone experiences continued weakness below 114.84, it will invariab ……..

</p

View Previous Vodafone & Big Picture ***