#FTSE #GOLD

The FTSE has embraced the spirit of August, doing very little and behaving with little in the way of logic. However, in the last week, the market has closed twice above our suspected ceiling level of 5520 points, leading us to believe some further movement upward shall become possible.

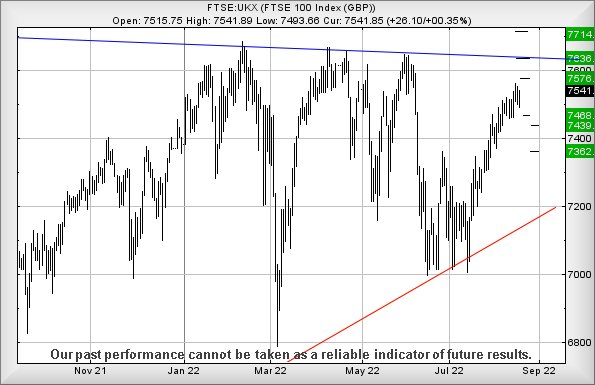

Movement next above 7547 points calculates with the potential of a visit to 7576 points next. While being a fairly useful amble upwards, our secondary is of greater – presumably longer term – interest as it calculates at 7635 points and a probable challenge against Blue on the chart. This downtrend dates back to 2018, a time when life was affordable. Isn’t it funny the only things which appear to be escaping the current inflation cycle are share prices, crypto values, gold, and so on. There’s certainly a “logic disconnect” taking place as the value of the very thing used to literally measure values and worth remains aloof.

If everything intends go pear shaped near term, below 7493 looks capable of triggering reversal to an initial 7468 with secondary, if broken, at 7439 points and hopefully a bounce, due to the underlying trend remaining upward.

Due to the holiday season, we’re attempting to keep our reports short and sharp. Have a good weekend.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:51:19PM | BRENT | 95.97 | 93.54 | 92.88 | 94.97 | 96.96 | 97.775 | 94.92 | Success | ||

| 9:53:23PM | GOLD | 1758.95 | 1755 | 1752 | 1765 | 1772 | 1777 | 1765 | ‘cess | ||

| 9:54:50PM | FTSE | 7563 | 7489 | 7467 | 7519 | 7563 | 7573 | 7531 | Shambles | ||

| 9:56:29PM | STOX50 | 3782 | 3748 | 3735 | 3767 | 3783 | 3796 | 3763 | |||

| 9:58:40PM | GERMANY | 13705 | 13604 | 13521 | 13724 | 13785 | 13810 | 13644 | |||

| 10:00:15PM | US500 | 4286 | 4251 | 4232 | 4278 | 4294 | 4306 | 4262 | |||

| 10:26:45PM | DOW | 34001 | 33833 | 33679 | 33968 | 34067 | 34154 | 33900 | |||

| 10:28:47PM | NASDAQ | 13515 | 13388 | 13317 | 13465 | 13557 | 13612 | 13463 | |||

| 10:30:55PM | JAPAN | 29092 | 28873 | 28763 | 29007 | 29144 | 29214 | 28953 |

18/08/2022 FTSE Closed at 7541 points. Change of 0.35%. Total value traded through LSE was: £ 4,602,765,684 a change of 0.38%

17/08/2022 FTSE Closed at 7515 points. Change of -0.28%. Total value traded through LSE was: £ 4,585,359,451 a change of 5.45%

16/08/2022 FTSE Closed at 7536 points. Change of 0.36%. Total value traded through LSE was: £ 4,348,545,250 a change of 13.62%

15/08/2022 FTSE Closed at 7509 points. Change of 0.12%. Total value traded through LSE was: £ 3,827,179,402 a change of -9.76%

12/08/2022 FTSE Closed at 7500 points. Change of 0.47%. Total value traded through LSE was: £ 4,240,976,226 a change of -17.45%

11/08/2022 FTSE Closed at 7465 points. Change of -0.56%. Total value traded through LSE was: £ 5,137,633,275 a change of -1.15%

10/08/2022 FTSE Closed at 7507 points. Change of 0.25%. Total value traded through LSE was: £ 5,197,338,086 a change of -9.09%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:BBY BALFOUR BEATTY** **LSE:BP. BP PLC** **LSE:GLEN Glencore Xstra** **LSE:HIK Hikma** **LSE:ITM ITM Power** **LSE:QFI Quadrise** **

********

Updated charts published on : Asos, BALFOUR BEATTY, BP PLC, Glencore Xstra, Hikma, ITM Power, Quadrise,

LSE:ASC Asos Close Mid-Price: 810 Percentage Change: -4.93% Day High: 879 Day Low: 800.5

Target Met. Ongoing weakness below 800 now suggests reversal to 787 with s ……..

</p

View Previous Asos & Big Picture ***

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 325 Percentage Change: + 1.69% Day High: 331.8 Day Low: 319.6

Target Met. Traffic now above 332 should built toward an initial 348 with ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 442 Percentage Change: + 2.58% Day High: 443.05 Day Low: 432.6

Target met. All BP PLC needs are mid-price trades ABOVE 444 to improve ac ……..

</p

View Previous BP PLC & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 498.25 Percentage Change: + 2.37% Day High: 498.15 Day Low: 484.3

Target met. Continued trades against GLEN with a mid-price ABOVE 498.15 s ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1441 Percentage Change: -3.32% Day High: 1476 Day Low: 1439.5

If Hikma experiences continued weakness below 1439.5, it will invariably ……..

</p

View Previous Hikma & Big Picture ***

LSE:ITM ITM Power Close Mid-Price: 213.1 Percentage Change: -12.01% Day High: 228.5 Day Low: 208.1

Weakness on ITM Power below 208.1 will invariably lead to 159 with second ……..

</p

View Previous ITM Power & Big Picture ***

LSE:QFI Quadrise. Close Mid-Price: 1.31 Percentage Change: + 1.15% Day High: 1.28 Day Low: 1.28

Continued weakness against QFI taking the price below 1.28 calculates as ……..

</p

View Previous Quadrise & Big Picture ***