#FTSE #GOLD

Once upon a time, a physics teacher was, almost disturbingly, fascinated in wave patterns. Literally, the guy was incapable of passing a puddle without dropping something in it, just to watch the patterns. The fall out from the 2011 Tsunami is still providing ripples around the word, the chart below being the latest example.

The issue, obviously, is what is referred to as the Fukushima nuclear disaster, currently attributed as being the cause of one radiation related death and with the possibility of several hundred more perhaps in the future. However, the media frenzy, along with plenty of nail biting commentary about the Japanese cooling systems proved sufficient to introduce an anti-nuclear terror with Germany opting to jump on the bandwagon fully, opting to close all their nuclear power plants. The Ukraine affair, along with a nice hot summer, is giving Germany some immediate problems, as Germany has been forced to return to coal-fired power plants, anticipated to kill 1,100 per year due to local air pollution. With the world looking down its nose when Germany opts to buy gas from Russia, the country is being backed into a corner. Unable to ship coal to power stations, due to low river levels, reportedly decommissioning more Wind Generators than it builds, and forced to buy electricity from anyone who will supply, the country is apparently facing a bleak winter. Along with the rest of Europe as it discovers just how Russia formed part of the supply chain.

Even in the years immediately following Fukushima, it was being said in Germany “We estimate the increase in mortality from higher electricity prices outnumbers the mortality from the accident itself” in a quote from a paper by the Deutsche Post Foundation. Somewhere, I’ve an old physics teacher, nodding his head, still talking about ripples.

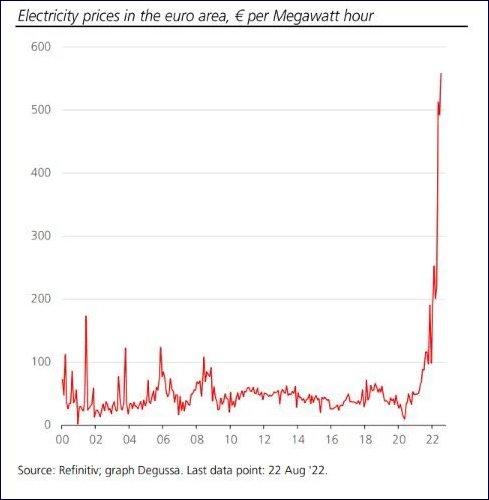

When first noticing this chart, it was easy to assume some internet chatroom had run amok, successfully launching a “Pump & Dump” against an AIM share. Or perhaps Rolls Royce, when they get their nuclear reactors in shop windows!

However, it’s a chart of the price in Euro’s for a Megawatt hour of electricity, a truly unpleasant picture and about the only two slight sources of hope are those of common sense, along with a story about our local Heating Oil supplier.

To deal with the common sense stance, the immediate impression of a Pump & Dump lends some slight hope as generally, something which goes up this sharply will usually founder just as swiftly. Then there’s the story of our Heating Oil supplier.

The conversation went along the lines of;

“Please would you order oil? We’re really missing you and we’ve a tanker in your area this week”

“Go and get stuffed. It’s too expensive, so we’re burning wood this winter.”

“But we can offer Buy Now, Pay Monthly deals!”

“Go and get stuffed.”

“We can offer substantial discounts over existing market prices…”

“Yeah, right. You quoted 159p per litre last month, down to 109p this month. You need do a lot better.”

“How about 82p a litre if you order now. We’ve full storage tanks, tankers sitting unused, and drivers worrying about their jobs.”

Frantically checking current prices on the Internet discovered 99p a litre was as cheap as possible. It appeared the laws of Supply and Demand were kicking in, certainly in my own local part of the economic powerhouse which is the UK.

“Okay, you’ve got a deal,” thankful my huge pile of logs can remain unchopped for yet another weekend, grateful I shall be able to avoid battling the stove to get it lit first thing every morning, and frantically hoping Heating Oil prices don’t entirely crash, making me look a fool with a full tank. But as with motor fuel and foodstuffs, suppliers must be suspecting the dangers of pricing themselves out of the market, once their short term surplus cash advantage dimishes, and while electricity (which surely should be the subject of monopoly protection) is an essential, it’s easy to calculate the usage reduction if people opt to actually turn devices off, rather than leaving them on standby.

FTSE for FRIDAY

Now we’ve vented about fuel costs, we’re almost at the month end and due to be graced by the Belgian Grand Prix, usually a cascade of orange smoke, drunken fans and sometimes biblical rainfall. After an insane week for the FTSE, we’re intending embrace the holiday weekend and try to consign the markets absurd behaviour to August giving traders a final kicking.

Should we take the behaviour of the last 4 days to heart, it immediately appears market weakness below 7468 points should promote reversal to an initial tame 7448 points with our secondary, if broken, at 7417 points and a probable rebound. If triggered, the tightest stop looks like 7500 points though, to be fair, we’d prefer 7522 points. Expecting the UK market to follow the same logic for a 5th day is similar to anticipating a politician discovering integrity.

In the event the market exceeds 7522 points, we can calculate the potential of a lift to 7536 points initially with our secondary working out at 7576 points, almost allowing everyone to believe the last week was simply a bad dream.

Have a good weekend, enjoy the GP, and just think, no more holiday Mondays until the festive season.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:37:19PM | BRENT | 98.98 | 93 | 89.85 | 97 | 101.88 | 104.3 | 98.4 | |||

| 9:39:26PM | GOLD | 1757.93 | 1750 | 1745 | 1758 | 1765 | 1768 | 1756 | ‘cess | ||

| 9:42:16PM | FTSE | 7500.81 | 7465 | 7460 | 7497 | 7539 | 7547 | 7489 | ‘cess | ||

| 10:16:42PM | STOX50 | 3696.1 | 3657 | 3640 | 3687 | 3703 | 3710 | 3675 | ‘cess | ||

| 10:18:57PM | GERMANY | 13330 | 13186 | 13127 | 13302 | 13375 | 13413 | 13222 | ‘cess | ||

| 10:24:09PM | US500 | 4197.52 | 4145 | 4127 | 4185 | 4205 | 4222 | 4152 | ‘cess | ||

| 10:26:32PM | DOW | 33267 | 32887 | 32735 | 33145 | 33314 | 33410 | 33046 | Success | ||

| 10:29:41PM | NASDAQ | 13137 | 12912 | 12844 | 13043 | 13150 | 13202 | 12987 | Success | ||

| 10:32:20PM | JAPAN | 28665 | 28440 | 28340 | 28563 | 28691 | 28748 | 28527 | ‘cess |

25/08/2022 FTSE Closed at 7479 points. Change of 0.11%. Total value traded through LSE was: £ 3,882,636,574 a change of -18.23%

24/08/2022 FTSE Closed at 7471 points. Change of -0.23%. Total value traded through LSE was: £ 4,748,027,124 a change of -4.63%

23/08/2022 FTSE Closed at 7488 points. Change of -0.6%. Total value traded through LSE was: £ 4,978,434,617 a change of 0.1%

22/08/2022 FTSE Closed at 7533 points. Change of -0.23%. Total value traded through LSE was: £ 4,973,471,266 a change of -16.58%

19/08/2022 FTSE Closed at 7550 points. Change of 0.12%. Total value traded through LSE was: £ 5,961,629,196 a change of 29.52%

18/08/2022 FTSE Closed at 7541 points. Change of 0.35%. Total value traded through LSE was: £ 4,602,765,684 a change of 0.38%

17/08/2022 FTSE Closed at 7515 points. Change of -0.28%. Total value traded through LSE was: £ 4,585,359,451 a change of 5.45%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:AVCT Avacta** **LSE:AZN Astrazeneca** **LSE:BDEV Barrett Devs** **LSE:BP. BP PLC** **LSE:GKP Gulf Keystone** **LSE:GLEN Glencore Xstra** **LSE:MKS Marks and Spencer** **LSE:SCLP Scancell** **

********

Updated charts published on : Asos, Avacta, Astrazeneca, Barrett Devs, BP PLC, Gulf Keystone, Glencore Xstra, Marks and Spencer, Scancell,

LSE:ASC Asos Close Mid-Price: 722.5 Percentage Change: -0.55% Day High: 741.5 Day Low: 711.5

Continued weakness against ASC taking the price below 711.5 calculates as ……..

</p

View Previous Asos & Big Picture ***

LSE:AVCT Avacta. Close Mid-Price: 137.2 Percentage Change: + 8.20% Day High: 136 Day Low: 124

Target met. Further movement against Avacta ABOVE 136 should improve acce ……..

</p

View Previous Avacta & Big Picture ***

LSE:AZN Astrazeneca. Close Mid-Price: 11422 Percentage Change: + 0.63% Day High: 11540 Day Low: 11370

In the event of Astrazeneca enjoying further trades beyond 11540, the sha ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BDEV Barrett Devs Close Mid-Price: 430.1 Percentage Change: -1.29% Day High: 441.1 Day Low: 425.2

Weakness on Barrett Devs below 425.2 will invariably lead to 418 with sec ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 459.45 Percentage Change: + 1.44% Day High: 463.75 Day Low: 458.65

All BP PLC needs are mid-price trades ABOVE 463.75 to improve acceleratio ……..

</p

View Previous BP PLC & Big Picture ***

LSE:GKP Gulf Keystone. Close Mid-Price: 257.5 Percentage Change: + 2.79% Day High: 263 Day Low: 250.5

Continued trades against GKP with a mid-price ABOVE 263 should improve th ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 505 Percentage Change: + 1.47% Day High: 508.6 Day Low: 502.3

Further movement against Glencore Xstra ABOVE 508.6 should improve accele ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:MKS Marks and Spencer Close Mid-Price: 121.6 Percentage Change: -4.44% Day High: 129.35 Day Low: 121.35

Continued weakness against MKS taking the price below 121.35 calculates a ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:SCLP Scancell Close Mid-Price: 11.5 Percentage Change: -2.13% Day High: 11.75 Day Low: 11.5

In the event Scancell experiences weakness below 11.5 it calculates with ……..

</p

View Previous Scancell & Big Picture ***