#GOLD #SP500 Now the free world actually has a leader with President Trump, it’s going to be interesting how quickly the free world falls apart. With the UK perceived by the new US government as a failed state, we’re certainly living in interesting times. Inchcape must be fascinated at the implications for their own business, due to the “cunning plan” by certain motor vehicle manufacturers falling apart with Chinese firms shipping components for vehicle assembly to Mexico for assembly, then transferred to the USA under preferential export rates. It appears safe to say it’s not now going to happen.

Inchcape, one of the largest vehicle distributors with operations in 37 countries, are one of the few members of the motor trade we’re unable to produce a joke about. But once upon a time, there was another distributor who essentially had a conveyor belt of transporters heading to our family business yards in Scotland, big fields filled with drab cars covered in shipping wax. As a child under 10 years old, it was quite a big deal to be pressed into service driving brand new cars around the field, parking and running fast back to the delivery vehicle. Inevitably, as the day progressed and the parking area filled up, the brand new vehicles were treated as go-carts by the 10, 12, and 14 year old boys who were having the time of their life. It’s safe to say myself and my cousins loved car transporter deliveries at the weekend, though we did catch hell when caught racing vehicles around the compound.

One funny thing about vehicle distribution was mentioned, extremely quietly, when our parents discussed the annual accounts. The distributor has delivered 7 transports of cars, perhaps around 70 vehicles, which had never been invoiced for. Back in the day, the appropriate paperwork, import and registration documents for each vehicle delivered were kept inside the glove compartment. After we race tested each vehicle, we’d attach an identifier tag to each set of keys and attach a magnetic identifier to the vehicle roof, clipping keys onto the paperwork and dropping everything into a cardboard box which was invariably stored in the first vehicle delivered. Once a transport driver announced “that’s it”, we’d climb onto our bicycles and ride back to the company head office. (Obviously, not true, the oldest 14 year old cousin would attach magical ‘trade plates’ to the vehicle with all the records and drive the few miles back to the offices. We’d strict instructions to play dumb and pretend we all thought trade plates allowed anyone to drive a car!) But as the years went by, somehow the manufacturer and distributor lost 70 cars, giving our family company a surprise financial windfall.

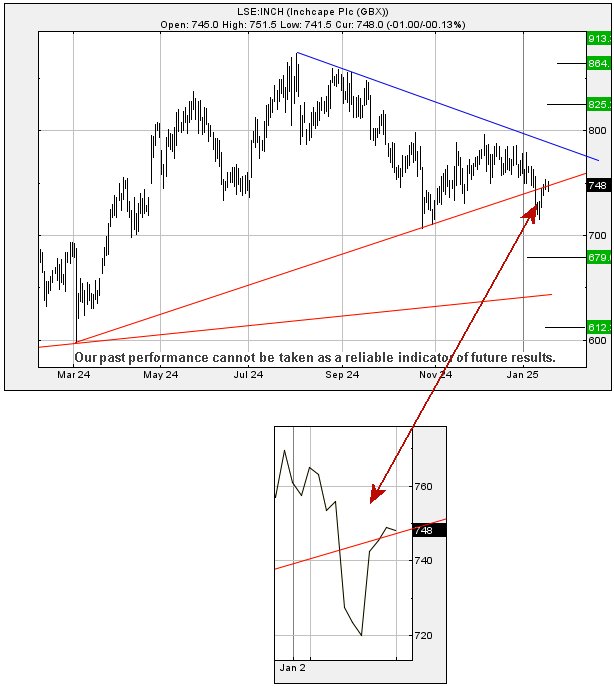

Returning to Inchcape, their share price is, according to the charty fans, supposed to be on the verge of sharp reductions, potentially to an eventual bottom around 612p. The share, quite successfully, achieved our gain targets, even exceeding our secondary target of 813p for a while in 2024 but now, “poised for failure” appears to be an easy conclusion.

From a visual perspective, we’re now supposed to believe reversals below 735p threatens a drop to an initial 679 with our secondary, if broken, at an eventual 612p and hopefully a rebound/. BUT we have our doubts, due to share price behaviour during the last few sessions.

Our doubts are growing, due to share price behaviour during the last few days. The chart inset shows something candles don’t reveal as despite intraday movements, the price has remained above the Red uptrend, creating a situation where we suspect the market doesn’t want Inchcape to drop, yet will be quite happy if traders fall for a “fake” play. When a share price breaks below an uptrend, yet “walks” up the trend in the period thereafter, is generally a pretty reliable signal for continued gains.

Inchcape are living in interesting times.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:40:26PM | BRENT | 7909.2 | ‘cess | ||||||||

| 11:01:50PM | GOLD | 2703.57 | 2689 | 2678 | 2662 | 2705 | 2714 | 2732 | 2745 | 2689 | ‘cess |

| 11:29:51PM | FTSE | 8500.5 | ‘cess | ||||||||

| 11:33:21PM | STOX50 | 5152.3 | |||||||||

| 11:45:18PM | GERMANY | 20943.7 | ‘cess | ||||||||

| 11:49:26PM | US500 | 5998.8 | 5961 | 5952 | 5921 | 6009 | 6045 | 6062 | 6104 | 5984 | ‘cess |

| 12:16:35AM | DOW | 43536 | Success | ||||||||

| 12:22:39AM | NASDAQ | 21432.9 | |||||||||

| 12:30:22AM | JAPAN | 38961 | Shambles |

20/01/2025 FTSE Closed at 8520 points. Change of 0.18%. Total value traded through LSE was: £ 4,317,400,042 a change of -38.76%

17/01/2025 FTSE Closed at 8505 points. Change of 1.36%. Total value traded through LSE was: £ 7,049,507,611 a change of 39.47%

16/01/2025 FTSE Closed at 8391 points. Change of 1.08%. Total value traded through LSE was: £ 5,054,366,255 a change of -17.27%

15/01/2025 FTSE Closed at 8301 points. Change of 1.22%. Total value traded through LSE was: £ 6,109,137,300 a change of -9.61%

14/01/2025 FTSE Closed at 8201 points. Change of -0.28%. Total value traded through LSE was: £ 6,758,270,581 a change of 5.88%

13/01/2025 FTSE Closed at 8224 points. Change of -0.3%. Total value traded through LSE was: £ 6,383,033,146 a change of 23.46%

10/01/2025 FTSE Closed at 8249 points. Change of -0.84%. Total value traded through LSE was: £ 5,170,108,064 a change of -6.19%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AAL Anglo American** **LSE:BARC Barclays** **LSE:CPI Capita** **LSE:HIK Hikma** **LSE:IAG British Airways** **LSE:IGG IG Group** **LSE:IHG Intercontinental Hotels Group** **LSE:RKH Rockhopper** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:STAN Standard Chartered** **

********

Updated charts published on : Anglo American, Barclays, Capita, Hikma, British Airways, IG Group, Intercontinental Hotels Group, Rockhopper, Scottish Mortgage Investment Trust, Standard Chartered,

LSE:AAL Anglo American. Close Mid-Price: 2620.5 Percentage Change: + 2.85% Day High: 2642 Day Low: 2540.5

Target met. Further movement against Anglo American ABOVE 2642 should imp ……..

</p

View Previous Anglo American & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 291.85 Percentage Change: + 0.86% Day High: 293.6 Day Low: 290.05

Further movement against Barclays ABOVE 293.6 should improve acceleration ……..

</p

View Previous Barclays & Big Picture ***

LSE:CPI Capita Close Mid-Price: 13.62 Percentage Change: -3.54% Day High: 14.04 Day Low: 13.14

In the event Capita experiences weakness below 13.14 it calculates with a ……..

</p

View Previous Capita & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 2084 Percentage Change: -0.10% Day High: 2104 Day Low: 2074

All Hikma needs are mid-price trades ABOVE 2104 to improve acceleration t ……..

</p

View Previous Hikma & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 322.7 Percentage Change: + 1.64% Day High: 325.7 Day Low: 317

Continued trades against IAG with a mid-price ABOVE 325.7 should improve ……..

</p

View Previous British Airways & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 1049 Percentage Change: -0.47% Day High: 1059 Day Low: 1046

Continued trades against IGG with a mid-price ABOVE 1059 should improve t ……..

</p

View Previous IG Group & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 10375 Percentage Change: + 0.10% Day High: 10450 Day Low: 10350

All Intercontinental Hotels Group needs are mid-price trades ABOVE 10450 t ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:RKH Rockhopper. Close Mid-Price: 40.1 Percentage Change: + 1.26% Day High: 42 Day Low: 39.5

Further movement against Rockhopper ABOVE 42 should improve acceleration ……..

</p

View Previous Rockhopper & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust Close Mid-Price: 1042.5 Percentage Change: -0.33% Day High: 1048 Day Low: 1032.5

All Scottish Mortgage Investment Trust needs are mid-price trades ABOVE 1 ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 1078.5 Percentage Change: + 0.19% Day High: 1083 Day Low: 1075

In the event of Standard Chartered enjoying further trades beyond 1083, t ……..

</p

View Previous Standard Chartered & Big Picture ***