#GOLD #NASDAQ Our report on Gulf Keystone last October (link here) proved an exercise in futility. The share price has utterly failed to trigger any upward moves, instead is teasing with threats of some coming reversals. As the BLUE downtrend highlights, an impressive effort is taking place to stop it going up!

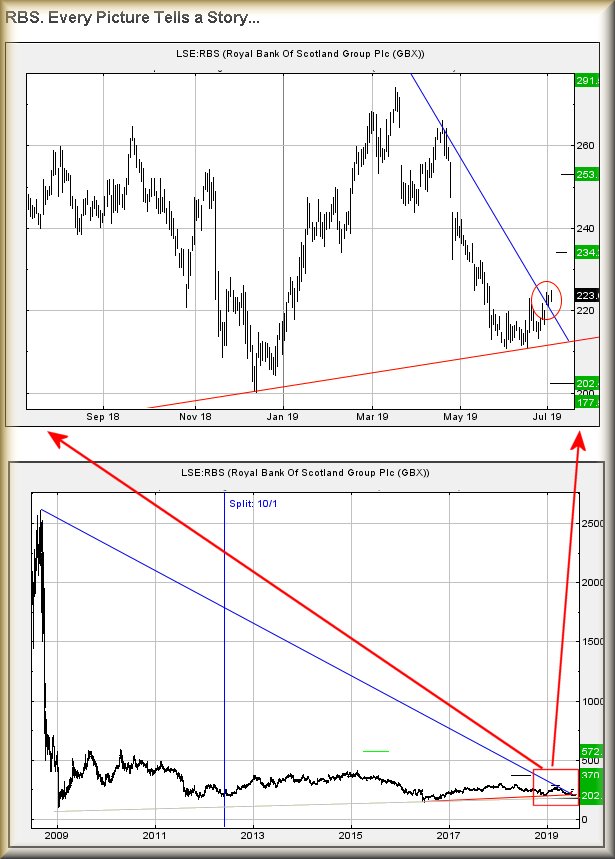

At present, trading around 221p, the price needs actually CLOSE a session above 234p before we dare make an assumption of some price recovery commencing. Such a trigger event should prove capable of an initial 257p. If bettered, secondary calculates at a longer term (and game changing) ambition of 284p. Visually, there’s a pretty firm threat of 284p, if achieved, forming some sort of glass ceiling at some point. There’s little doubt the market has placed some sort of importance at this sort of level and if we place safe, allocating above 300p as a sensible trigger level for long term recovery will make sense.

Unfortunately, more likely appears trades below 215p driving the price down to 203p initially, along with some sort of bounce. It’s critical, if 203p breaks, to remember our secondary calculates at 178p.

There is a really big problem, if the share price makes it below 165p in the future. While we can calculate 125p as a drop target, it would be worth remembering the share has entered a zone with a logical bottom down at 35p.

For now, thanks to its lack of activity in heading upward, we fear the worst for GKP’s future.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:52:19PM |

BRENT |

63.83 |

‘cess | ||||||||

|

9:54:33PM |

GOLD |

1395.78 |

1391 |

1386 |

1379 |

1405 |

1408 |

1411.5 |

1420 |

1391 | |

|

9:56:31PM |

FTSE |

7551.98 | |||||||||

|

10:11:02PM |

FRANCE |

5586 | |||||||||

|

10:12:53PM |

GERMANY |

12503 | |||||||||

|

10:15:22PM |

US500 |

2974.72 | |||||||||

|

10:17:20PM |

DOW |

26794.4 | |||||||||

|

10:27:34PM |

NASDAQ |

7780.15 |

7764 |

7749 |

7714 |

7804 |

7833 |

7855 |

7889 |

7770 |

‘cess |

|

10:29:09PM |

JAPAN |

21594 |

‘cess |