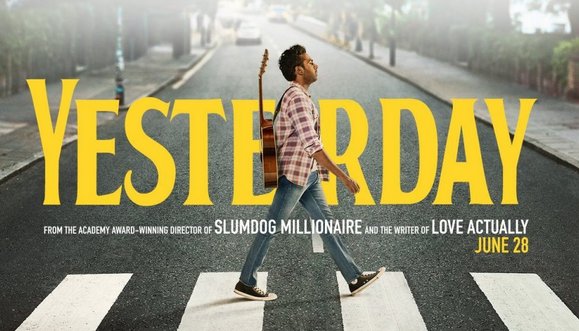

Barclays, Lloyds, Kingfisher and the Movie: Yesterday thoughts. We’re opting to start the week with an update on items reviewed last week and anything else which takes our fancy. Being “dragged” to watch “Yesterday” proved a pleasant surprise, a good film and tempted to go AGAIN! As for the important things, Bitcoin comes first.

To deal with Bitcoin, what happened proved quite fascinating from our nerdy perspective. At 5:30pm on Wed 26th, it achieved our 13,286 dollars. Better still, the phony currency exceeded target on the first surge, hitting 13,292 before sharply falling back to target level. This (thankfully) confirmed we’d been monitoring the correct trend but such was the pace of Bitcoin acceleration that next time it exceeded our target level, the price powered on upward to 13,880. And then, it dropped like a stone, almost feeling like the market “knew” it had gone to high and needed stuffed back under its rock.

The immediate problem is fairly straightforward. At present, it’s trading around the 11k level, needing below 10,200 to enter a cycle down to 9,300 and ideally a proper rebound.

It now requires – according to our criteria anyway – to trade above 12,925 as this calculates as entering a cycle to an initial 13,980 dollars. If bettered, secondary is at 14,550 and a new high since it broke an important downtrend. This sort of thing takes the price firmly into a region where a “long term – or later that day” target of 16,560 looks pretty certain to provoke some hesitation in any further upward surge.

Kingfisher appear to be doing something worthwhile. Our report (link here) mentioned the importance of the price bettering 222p anytime soon as it takes the share into a region with an initial 235p and beyond. From the point at which it closed last week, it should prove worth watching in the days ahead.

Barclays theoretically does not need discussed, the share price continuing to wobble around in a Zombie state. While our report (link here) demands in better 162p to be taken seriously, it will probably be worth watching for trades exceeding 152p in the week ahead, due to an initial 157 looking possible with secondary 160p. While neither is sufficient to remove the share from Big Picture trouble, it will illustrate rather neatly the reality of prices rarely going straight UP or DOWN.

Lloyds assiduously avoided breaking below our 56p trigger level (Report link here) but to be honest, we’ve little confidence in the price. However, Friday’s session commenced with a peculiar price movement, one which apparently calculates with near term movement above the days high of 57.43 being capable of some growth to a pretty tame looking 59.12p. If exceeded, secondary is at 60.3p. As explained with Barclays above, neither target proves sufficient to extract the share price from danger.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

12:01:42PM |

BRENT |

64.43 |

64.02 |

63.88 |

63.54 |

65.55 |

66.08 |

66.64 |

67.51 |

65.14 |

‘cess |

|

12:03:32PM |

GOLD |

1409.9 |

‘cess | ||||||||

|

12:05:32PM |

FTSE |

7450.77 |

‘cess | ||||||||

|

12:07:17PM |

FRANCE |

5531 |

‘cess | ||||||||

|

12:09:27PM |

GERMANY |

12449.37 |

12314 |

12267 |

12206 |

12409 |

12450 |

12470.5 |

12514 |

12370 |

Success |

|

12:11:10PM |

US500 |

2950.17 |

Success | ||||||||

|

12:12:40PM |

DOW |

26654.4 | |||||||||

|

3:11:46PM |

NASDAQ |

7696.99 | |||||||||

|

3:14:19PM |

JAPAN |

21375 |

‘cess |

One Reply to “Bitcoin etc for 1/07/2019”